The future of oil prices

Over the past several months, I have detailed the implications of the gradual shift from conventional to unconventional oil production, particularly its upward pressure on the cost of oil production. As it has been a little over three months since I presented my model for oil prices, this week I’d like to review what we know about unconventional oil, and offer an outlook on oil prices for the coming years.

Over the past several months, I have detailed the implications of the gradual shift from conventional to unconventional oil production, particularly its upward pressure on the cost of oil production. As it has been a little over three months since I presented my model for oil prices, this week I’d like to review what we know about unconventional oil, and offer an outlook on oil prices for the coming years.The unconventional non-solution

First, we know that tight oil production, like that in the Bakken Formation of North Dakota, is a treadmill. The constant drumbeat of highly-placed editorials about incipient U.S. energy independence is strictly political fodder, with no sound basis in data. Yes, in theory, it’s possible that we could double the output from the Canadian tar sands and the deepwater Gulf of Mexico, quintuple the number of wells that have been sunk in the Bakken so far, and pull off some biofuel miracles. But local resistance to that drilling program will be fierce in some areas, and its cost will eventually prove prohibitive. And it won’t end there; to maintain that level of output, we’ll have to keep drilling like hell, with increasing risks to the environment and public tranquility.

In reality, despite the technological achievements that have enabled production from these difficult resources, the world is losing the race against the depletion of mature conventional oil fields. And the pace of that depletion is accelerating: it’s now an estimated 5 to 6 percent per year for OPEC, and 8 to 9 percent for non-OPEC. Unconventional oil cannot compensate for a drag of that magnitude for very long.

Further, even if the U.S. were to follow the path to so-called energy independence, it would likely cut the lifespan of our remaining oil in half, leaving us to struggle for decades afterward with greatly diminished domestic production at the very time when global oil exports are declining fastest and becoming intolerably expensive.

We also know that the shift to unconventional oil has moved up the floor of oil prices to around $85 a barrel, which I estimated to be the marginal average cost of profitable production worldwide. A report from Bernstein Research, covered in May by the ever-capable Kate Mackenzie for the Financial Times, suggested that the real floor was even higher at around $92 a barrel in 2011, on its way to $100 a barrel this year. This fits with the stated objective of OPEC members to defend a $100 price target.

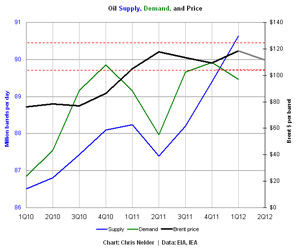

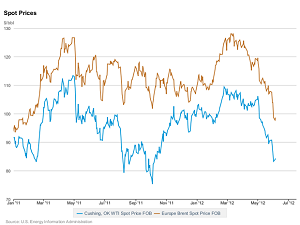

But there is also a ceiling around $125 a barrel for the global Brent benchmark (roughly equivalent to $105 for the U.S. benchmark, West Texas Intermediate). This is why world oil prices have been bouncing around the “narrow ledge” between that floor and ceiling since the beginning of 2011, as shown in the following chart to the right.

In short, unconventional oil doesn’t scale; it’s expensive, and getting more expensive every year; and its risks are increasing.

In short, unconventional oil doesn’t scale; it’s expensive, and getting more expensive every year; and its risks are increasing.Finally, we know that we’re losing the race for vehicle efficiency, and probably will lose it forever. Emerging markets, particularly in Asia, have been outbidding the U.S. and Europe for oil since 2005, exerting a constant upward pressure on oil prices even as demand from the developed world continues to decline. Our response to this has not been a materially significant shift to greater vehicle efficiency, but rather a gradual shift from personal to public transportation, shrinking economic activity, and the “nearshoring” of manufacturing.

All of these factor augur higher oil prices as we move into the future.

Oil prices for the next two years

When oil supply surpassed demand in the first quarter of this year for the first time since 2005 (see chart at top), some observers took it as an indication that peak oil fears had been laid to rest and that we were on our way to a new age of oil abundance.

They are wrong.

The simpler and more obvious explanation is that the narrow ledge of oil prices, shown between $105 and $125 (for Brent) in dotted red lines on the chart, is very much in control. As prices edged toward the ceiling in mid-2011, accompanied by the effects of the Arab Spring, demand and supply fell. But sustained triple-digit prices for the nearly 18 months since the beginning of 2011 gradually brought more supply to market, a trend which continues today. However, those same high prices once again began to kill demand, which has been falling in recent months, and prices are now falling again. As of this writing, Brent spot is trading for $97, and WTI spot is at $83. Spare capacity has continued to decline over the past three months, and is now nearly at the 2.5 percent threshold I discussed in February, but I expect declining demand and growing supply to increase spare capacity again and avert a price spike in the near term.

[A few notes about this chart: I have elected to show this data in quarterly terms for simplicity of presentation, and to highlight the crossover of supply and demand. Supply and demand data is from the IEA Oil Market Report, which includes biofuels and a liberal inclusion of natural gas liquids. Price data is from EIA. On a daily basis, Brent prices were above $120 from the middle of February through the middle of April, and exceeded $125 for 17 days from late February through early April. The second quarter is not yet finished and the most recent monthly Brent price data available from the EIA is for April, so I have averaged the April price with weekly data for May and the first week of June to plot the Q2 price, shown in gray on the chart. Brent stayed steadily above $105 from February of 2011 to the last week of May 2012.]

As oil prices are now below the price floor, the next major move should be upward, as demand rebounds in response to the lower price. Supply will remain above 90 million barrels per day (mbpd) if Brent rises above $105 within the next month or two, but if it does not, then supply will begin to fall back toward 89 (mbpd) again, and the risk of supply destruction will increase. Supply cannot continue to increase without prices remaining perilously close to the ceiling of demand destruction. It is very likely that demand will again exceed supply before the end of the year.

On the fundamentals, I expect this rangebound behavior through roughly the end of 2014. The price will bounce between the floor and ceiling of the narrow ledge, causing supply and demand to vie for the lead. Trading that range will be easy, but not terribly profitable, and speculators may begin to focus their attention elsewhere.

In fact, as reported by John Kemp for CNBC on Monday this week, Goldman Sachs believes the recent selloff was overdone. Speculative traders betting on rising prices left the market in droves last month, and “the market is again primed to rally hard” now, with a tighter balance between supply and demand expected in the second half of the year. This seems reasonable. (Sadly, it appears the Goldman analysts also recommended that their clients buy U.S. oil futures at $107.55 in February, right at the top of the range for WTI. If they had understood the narrow ledge, they would have recommended selling at that point.)

Of course, there is more to the oil trade than fundamentals.

The euro has been an air ball for over nine months, and whether it will break up, or be rescued through some sort of heroic intervention, remains to be seen. My bet is on a rescue.

OPEC could announce production cuts at their meeting later this week, which would be bullish for prices. But, despite conflicting reports this week about what Saudi Arabia’s oil minister, Ali al-Naimi, said or meant to say in recent press interviews, my bet is that the kingdom fears demand destruction more than supply destruction and will maintain output at its current high levels. I don’t believe the rest of the OPEC members will have substantive influence.

A fresh round of tensions over the standoff on Iran’s nuclear ambitions, or any number of other developments in Middle Eastern politics, could also drive prices higher. But I expect those risks to remain relatively muted over the next year. The consequences of letting things get out of hand are simply too great. And no, I don’t think Israel will bomb Iran.

Under the heading “A Foggy Horizon,” the IEA highlighted “the complexities faced by those trying to peer through the murk that shrouds any outlook for the second half of the year” in their May 11 Oil Market Report. I agree that the geopolitical uncertainty is high, and I agree that “there is no room for complacency” at this point. The ledge is narrow indeed, and it wouldn’t take much to push the global supply and balance off it. At the end of that discussion, they wondered rhetorically, “Who’d be a forecaster?” Fair enough; if your job doesn’t depend on seeing through the murk, then there’s little to be gained from taking that risk. Better to leave the bold calls to the energy futurists.

Outlook for 2015 and beyond

I may be right and I may be wrong about these calls, but forecasting a dull trading range for oil prices over the next two years is relatively easy, because it’s supported by recent data and fundamentals. Much harder is forecasting what prices will do after 2014.

As my regular readers know, I expect spare capacity to drop to critically low levels in late 2014/early 2015 as depletion finally overwhelms our efforts to fill the gap with unconventional oil, kicking off a long era of harsh volatility in both oil prices and the global economy as a whole. And I am not alone in this expectation; among others, the IEA official who was responsible for developing their petroleum outlook scenarios from 2006 to 2009, Olivier Rech, also sees a turning point around that time.

An interesting “working paper” prepared for the IMF in May (but expressly identified as representing the views of the authors and not those of the IMF), attempted to empirically quantify the key question of how the battle between geological depletion and technological innovation will play out. The authors concluded that “the future will not be easy,” after their model showed that “small further increases in world oil production comes at the expense of a near doubling, permanently, of real oil prices over the coming decade.” They “suspect that there must be a pain barrier, a level of oil prices above which the effects on GDP becomes nonlinear,” but do not attempt to quantify it.

This conclusion comports with some of the academic research on EROI I reviewed in February. I obtained similar results after playing with a simplified EROI spreadsheet published by fund manager Stephen Johnston last month, which lets you discover the price effects of substituting low-EROI unconventional oil for high-EROI conventional oil. With his default, conservative assumptions, oil prices would rise by 23 percent by 2025, but after plugging in assumptions that I consider more likely, I got from 100 to 150 percent price increases.

The history of oil prices since 2007 suggests that a permanent doubling of oil prices, while possible in theory, are not possible in reality. We have been bumping against the pain barrier since the first oil price spike in 2008. As we substitute more and more unconventional oil for depleting conventional oil, the consequence will not be sustained oil prices at double current levels, but the shrinking of the global economy, or, as I have called it previously, the Great Contraction. Oil prices could actually drift lower, not higher, as we fall into the deflationary vortex.

So enjoy the relative stability of the next two years, and take advantage of the narrow ledge concept to trade oil profitably as it bounces between the price floor and ceiling. Just be aware that a large waterfall awaits at the end of that quiet stretch of river, and be ready to head for shore before you get there.

You can return to the main Market News page, or press the Back button on your browser.