South Korea on course to have the world's highest Carbon Prices

In a little over 18 months, South Korea will launch a scheme that will cap around 70% of its greenhouse gas emissions.

In a little over 18 months, South Korea will launch a scheme that will cap around 70% of its greenhouse gas emissions.A White Paper published by research firm Bloomberg New Energy Finance, in cooperation with Ernst & Young, concludes that the design is the most ambitious yet proposed anywhere, and could result in the Korean carbon price reaching the penalty level of $90/tCO2 - exceeding that in any other emissions trading system (ETS) in the world.

The predicted high prices in the Korean scheme reflect a combination of factors: ambitious reduction targets, the relatively high cost of reducing emissions within the country, and restrictions on the use of offset credits from abroad .

Richard Chatterton, lead analyst for carbon markets at Bloomberg New Energy Finance, commented: “If the government implements the scheme without any changes, it will have major implications for Korean companies. A carbon price will lead to higher power prices and impose additional costs on industrial firms. The government is mitigating the impact for covered entities by handing out most allowances for free, but costs could still rise quickly.”

Two other carbon markets will be in existence in 2015 when the Korean programme starts: the linked schemes of Europe and Australia, and the one linking California and Quebec.

Two other carbon markets will be in existence in 2015 when the Korean programme starts: the linked schemes of Europe and Australia, and the one linking California and Quebec.Carbon prices in the European Emission Trading System reached a high of $40/tCO2 in 2008 but are now only around a tenth of that, and not expected to recover substantially until closer to 2020.

The California-Quebec market has started trading and, on Bloomberg New Energy Finance analysis, may trade around $50/tCO2 by 2020.

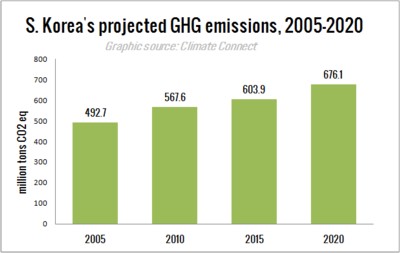

The White Paper’s projections assume that Korea’s national target of 30% below business-as-usual (BAU) emissions in 2020 is applied proportionately to the sectors covered by the Korean ETS. This target is equivalent to a 19% reduction from 2010 levels and compares to a 14% reduction target for Australia and a 5% reduction for the EU in 2010-20.

Under Korea’s proposed programme, demand for emission reductions within the covered sectors would rise to more than 200Mt/yr in 2020. This is almost double the demand projected for the European ETS - though Korea’s programme is only one fifth the size.

The predicted high prices in the Korean scheme reflect a combination of factors: ambitious reduction targets, the relatively high cost of reducing emissions within the country, and restrictions on the use of offset credits from abroad .

Bloomberg New Energy Finance calculates that the Korean scheme would have to cut its emissions by some 836m tonnes relative to BAU between 2015 and 2020. The current design, however, restricts the use of relatively cheap offsets to 28% of this reduction requirement up to 2020. It also proposes that up to 2021, only credits created from projects in South Korea would be eligible.

With the capped scheme covering 70% of Korean emissions, the potential to generate these reductions from within the country but outside the capped scheme will be insufficient to meet this requirement.

The remaining 598Mt of emissions reductions will need to be achieved in the industrial and power sectors. This translates to a reduction of almost 20% from current emission levels. This will be challenging as well as expensive relative to other schemes. Switching power generation from coal to gas tends to be the quickest short-term option and Korea is heavily dependent on expensive imported LNG (liquefied natural gas). At current coal and gas prices this abatement option will, on average, only be viable in South Korea at carbon prices above KRW 150,000/tCO2e ($130/tCO2e). In Europe the figure is currently around $50/tCO2.

The need to reduce emissions will, however, exceed the options available within industrial companies and from the country’s current fleet of gas fired power stations. Further emission reductions will therefore require the replacement of existing coal power stations with new gas plants or renewable technologies, or the implementation of carbon capture and storage technology - the costs of which are significantly above the cost of coal-to-gas fuel switching.

As a result, the proposed penalty of maximum KRW 100,000/tCO2e ($90/tCO2e) is very likely to set the price in the Korean scheme and the government’s emissions reduction target will not be met.

The design of the ETS is yet to be finalised and the Korean government is engaged in an active dialogue with industry. Given the market fundamentals outlined above, the government will need to carefully consider how it refines the scheme’s design - too restrictive and costs could be punitive, too loose and it will have minimal effect.

The good news is several options are available. These include: easing the reduction target, allowing greater use of international offset credits before 2020, raising the overall offset limit, and linking its programme with other carbon markets to provide a wider range of lower cost emissions reduction options.

Milo Sjardin, head of Asia research for Bloomberg New Energy Finance, said: “The challenge is to put in place a carbon price high enough to impact investment decisions, but low enough to transition smoothly towards a carbon-constrained economy.

With the proposed design, demand and supply within the ETS are not well-matched and will lead to unnecessarily high carbon prices. Policy-makers will need to look at cost containment measures closely while not compromising the ambitions of the scheme.”

Yoon Joo-Hoon, senior manager at Ernst & Young, commented: “After the highest GHG emissions increase in 2010, the government asked for efforts to amend the original plan, but the schedule of the new regulation is still unclear.

Despite these political uncertainties, liable entities still need to prepare for the ETS. Main checkpoints include the evaluation of mitigation options, valuation of carbon assets and the development of decision-making for the ETS.”

You can return to the main Market News page, or press the Back button on your browser.