Is the Chevy Volt's payback period really 26 years?

A recent article in the New York Times looks at different types of hybrid and fuel-efficient cars, arguing that many buyers opting for the more efficient models may take years to see any actual savings.

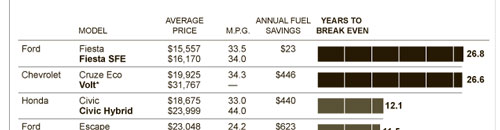

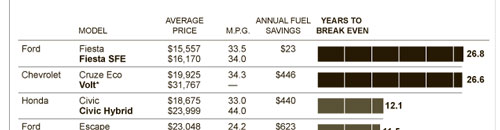

The article comes with a handy chart, using data from TrueCar. The chart compares the price differences between comparable conventional and hybrid cars, and using a figure of $3.85 per gallon and 15,000 miles driver per year, estimates the number of years it would take to recover the cost difference in gas savings (assuming the price of gas never goes up or down).

For most of the cars TrueCar looks at, the break-even point is ten years or less, well within the typical lifespan of most new cars. But there are two outliers - the Ford Fiesta vs. the Fiesta SFE and the Chevy Volt vs. the Chevy Cruze, both with payback periods in excess of - are you ready? - 26 years.

At this point, if you’re Rush Limbaugh, you’ll be rushing off to the microphone to declare the Volt a waste of money. The rest of you may be wondering if that number is really accurate.

The missing mpg figure

The figures for the Fiesta are pretty clear (and trivial, the cost difference is only a few hundred dollars), but for the Volt, we’re left with a mysterious dash where there ought to be a data point - the assumed mpg.

Working backwards using a spreadsheet, I found that the missing number is 46.7 - that would be the mpg equivalent you would have to achieve with a Volt in order to reach a payback period of 26 years. That seems a tad pessimistic, considering the EPA rates the car at 93 mpg equivalent in electric mode and 37 mpg running on gasoline.

The problem with pinning down a mileage figure for the Volt is that it depends entirely on how much you drive in electric mode. A person driving fewer than 35 miles per day (the Volt’s approximate range on battery power) would theoretically never have to buy gas at all. Some Volt owners have reported average mileage in excess of 1,000 mpg, and figures reported by a handful of Volt owners on fuelly.com run from a low of 77 mpg to as high as 168 mpg.

But wait! You can’t just make estimates based on the cost of gasoline burned - electricity costs money, too.

The EPA says the Volt can go 100 miles on 36 kWh, and for simplicity’s sake, lets assume a cost of 10 cents per kWh. So at 37 mpg (in gasoline mode) with gas at $3.85, the Volt costs about 10 cents per mile to drive on gasoline, versus 3.6 cents per mile on electricity.

Still with me?

Your mileage will vary

To get to that 26-year payback figure, we’d have to assume the Volt was driven 11,000 miles in gasoline mode, but only 4,000 miles in electric mode. Assuming the car exhausts its battery on each trip in order for gasoline mode to kick in, that would mean the car was only driven 114 times each year for an average of 131 miles of driving each day. That’s not very typical driving behavior, unless you’re a part-time pizza delivery driver.

So let’s assume the car is charged and driven every single day. Over a year, that works out to 41 miles per day, 35 in electric mode, 6 in gasoline mode. Again using the spreadsheet, that puts our payback at 11.8 years.

Or, we can assume the car is only driven on weekdays. That means 57.7 miles per day (35 in electric mode and 22.7 in gasoline mode). That would put the payback period closer to 15 years.

And, just for kicks, if you drove the car in electric mode 100% of the time, the payback would be around 10 years - more in line with the other cars in the Times’ comparison.

Now, that’s still a long time, but it’s also based on some other unlikely assumptions - such as, the price of gasoline remaining below $4 for the next decade (anyone willing to wager on that?).

A recent analysis by Edmunds pegged the Volt vs. Cruze payback period at 15 years with gas at $3 per gallon, and 9 years with gas at $5 per gallon, though those numbers seem to have been reached simply by comparing EPA mileage figures.

The bottom line is that the Volt is a different beast, whether it’s a smart financial decision will vary dramatically depending on an individual’s driving habits. In fairness, the Times does make this distinction deep in the text of the story, but no such nuance can be found in the accompanying graphic.

The 26-year payback period that the Times is reporting is based on a pretty unlikely scenario, and should be taken with a grain of salt.

The article comes with a handy chart, using data from TrueCar. The chart compares the price differences between comparable conventional and hybrid cars, and using a figure of $3.85 per gallon and 15,000 miles driver per year, estimates the number of years it would take to recover the cost difference in gas savings (assuming the price of gas never goes up or down).

For most of the cars TrueCar looks at, the break-even point is ten years or less, well within the typical lifespan of most new cars. But there are two outliers - the Ford Fiesta vs. the Fiesta SFE and the Chevy Volt vs. the Chevy Cruze, both with payback periods in excess of - are you ready? - 26 years.

At this point, if you’re Rush Limbaugh, you’ll be rushing off to the microphone to declare the Volt a waste of money. The rest of you may be wondering if that number is really accurate.

The missing mpg figure

The figures for the Fiesta are pretty clear (and trivial, the cost difference is only a few hundred dollars), but for the Volt, we’re left with a mysterious dash where there ought to be a data point - the assumed mpg.

Working backwards using a spreadsheet, I found that the missing number is 46.7 - that would be the mpg equivalent you would have to achieve with a Volt in order to reach a payback period of 26 years. That seems a tad pessimistic, considering the EPA rates the car at 93 mpg equivalent in electric mode and 37 mpg running on gasoline.

The problem with pinning down a mileage figure for the Volt is that it depends entirely on how much you drive in electric mode. A person driving fewer than 35 miles per day (the Volt’s approximate range on battery power) would theoretically never have to buy gas at all. Some Volt owners have reported average mileage in excess of 1,000 mpg, and figures reported by a handful of Volt owners on fuelly.com run from a low of 77 mpg to as high as 168 mpg.

But wait! You can’t just make estimates based on the cost of gasoline burned - electricity costs money, too.

The EPA says the Volt can go 100 miles on 36 kWh, and for simplicity’s sake, lets assume a cost of 10 cents per kWh. So at 37 mpg (in gasoline mode) with gas at $3.85, the Volt costs about 10 cents per mile to drive on gasoline, versus 3.6 cents per mile on electricity.

Still with me?

Your mileage will vary

To get to that 26-year payback figure, we’d have to assume the Volt was driven 11,000 miles in gasoline mode, but only 4,000 miles in electric mode. Assuming the car exhausts its battery on each trip in order for gasoline mode to kick in, that would mean the car was only driven 114 times each year for an average of 131 miles of driving each day. That’s not very typical driving behavior, unless you’re a part-time pizza delivery driver.

So let’s assume the car is charged and driven every single day. Over a year, that works out to 41 miles per day, 35 in electric mode, 6 in gasoline mode. Again using the spreadsheet, that puts our payback at 11.8 years.

Or, we can assume the car is only driven on weekdays. That means 57.7 miles per day (35 in electric mode and 22.7 in gasoline mode). That would put the payback period closer to 15 years.

And, just for kicks, if you drove the car in electric mode 100% of the time, the payback would be around 10 years - more in line with the other cars in the Times’ comparison.

Now, that’s still a long time, but it’s also based on some other unlikely assumptions - such as, the price of gasoline remaining below $4 for the next decade (anyone willing to wager on that?).

A recent analysis by Edmunds pegged the Volt vs. Cruze payback period at 15 years with gas at $3 per gallon, and 9 years with gas at $5 per gallon, though those numbers seem to have been reached simply by comparing EPA mileage figures.

The bottom line is that the Volt is a different beast, whether it’s a smart financial decision will vary dramatically depending on an individual’s driving habits. In fairness, the Times does make this distinction deep in the text of the story, but no such nuance can be found in the accompanying graphic.

The 26-year payback period that the Times is reporting is based on a pretty unlikely scenario, and should be taken with a grain of salt.

You can return to the main Market News page, or press the Back button on your browser.