In India, Proving That The Devil's Bargain With Coal Can Be Broken

An uneasy ‘social contract’ has long existed when it comes to building new coal fired power plants in the developing world; country’s receive cheap power to fuel development in exchange for accepting environmental and social destruction. This ‘necessary evil’ has been accepted by policymakers despite often fierce protests because other forms of power are considered too expensive. Now, however, this devil’s bargain has broken as the only justification for polluting, destructive coal plants – that they provide cheap power – is a thing of the past.

An uneasy ‘social contract’ has long existed when it comes to building new coal fired power plants in the developing world; country’s receive cheap power to fuel development in exchange for accepting environmental and social destruction. This ‘necessary evil’ has been accepted by policymakers despite often fierce protests because other forms of power are considered too expensive. Now, however, this devil’s bargain has broken as the only justification for polluting, destructive coal plants – that they provide cheap power – is a thing of the past.The most vivid example of the rupture of ‘coal’s contract’ is the four gigawatt Ultra Mega Power Project Tata Mundra. The plant was built with nearly a billion dollars of public money provided by the IFC and the Asian Development Bank for the ‘cheap and reliable’ power it would provide:

“The project will provide a competitive source of electricity to partly reduce the current power shortages and help meet the growing demand for electricity in the country. Cheap and reliable power from the project will help in improving the competitiveness of Indian manufacturing and services industries which have to often rely on expensive standby diesel generation to fulfill their power needs. Competitively priced power will also improve access to electricity in rural and urban areas of the country while reducing the subsidy burden on state governments. Therefore, the project will have significant impact not only in terms of reducing the prevalent demand supply gap but in reducing the average electricity costs in the country leading to improved access and industrial competitiveness…The project will contribute to enhanced access to electricity through supply of cheap and reliable power.”

The reality is this ‘cheap and reliable’ power is anything but as an Indonesian government decision to raise coal export prices effectively doubled the company’s costs. So great is the effect that the project faces a whopping 270% in annual losses, and the CEO has called it ‘financially unviable’. Add to these woes a mountain of foreign debt that must be paid back in dollars while the rupee is at an all-time low and it’s clear the only way the project can be salvaged is if they are let out of their contract and allowed to significantly raise rates on average citizens.

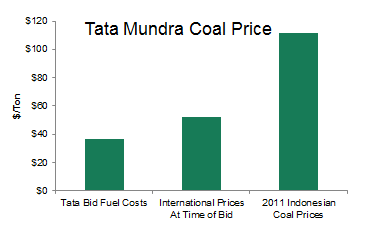

But the problems with Tata Mundra don’t stop there. The truth is they drastically low-balled the underlying fundamentals of the bid they used to win the project which has significantly contributed to their financial woes. Tata Power’s bid was based on fuel (coal) costs that were so out of line with reality that they were literally too good to be true. They were in fact significantly lower than international prices at the time and now thanks to Indonesia they must pay prices triple what they first promised. At the same time the actual cost of construction was premised on costs that were substantially less than bids for other supercritical coal plants in India.

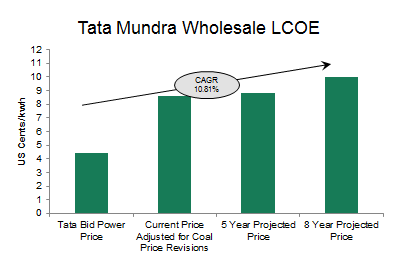

Now, to cover these low-balled estimates and the effect of the Indonesian price hike, they are proposing a tariff revision that will hike rates to nearly 10 US cents per KWHr – double initial estimates. This situation should have been avoided had financiers like the IFC and ADB conducted adequate financial analysis that revealed these ‘too good to be true’ cost estimates.The problem is policymakers and financial institutions systematically underestimate the risks and costs of coal fired power. Accurately assessing these risks would have painted a far more realistic assumption of the price of electricity than the rosy estimates of cheap power IFC promised. That’s because global coal markets are far riskier than you think. Internalizing those risks would have enabled decision makers to better analyze competing sources of power – increasingly cheap wind, solar and energy efficiency – and avoided the potentially serious precedent of enabling private companies to break contractual obligations going forward.

Instead the cost of this failure is being forced upon average Indian citizens as the Tata’s attempt to secure a bail out. It’s “heads I win, tails you lose” because as we all know had coal prices dropped average citizens would not have benefitted by seeing cheaper power bills.

The good news is there is a way to stop this. The IFC and the ADB both have independent accountability mechanisms. Already community groups have filed a complaint at the IFC asking that they conduct a full audit of the project – social, environmental, and financial. They want to ensure that the Tata’s don’t get a bailout at their expense. The groups are now looking at filing a similar complaint with the ADB.

In both cases they are asking a previously unthinkable question – look into the negative developmental impacts of expensive power coming from coal. The answer to this question effectively eliminates the only justification for new coal fired power plants going forward. With the Reserve Bank of India (RBI) suggesting banks freeze lines of credit for the “distressed coal sector”, months of warnings from financial analysts that systemic defaults loom, and lenders hitting the panic button it seems we already have the answer. In the meantime will our public money continue to prop up the financial boondoggle that is Tata Mundra while the people of Gujarat suffer the environmental, social and now financial consequences?

You can return to the main Market News page, or press the Back button on your browser.