Carbon trading would hit 40% of TSX

(by David Parkinson - Globe & Mail) - Companies representing 40 per cent of the Toronto Stock Exchange’s total market capitalization would be directly affected by a legislated system of greenhouse gas (GHG) emissions caps and trading, and that impact will be negative for most of them, a new report from CIBC World Markets says.

(by David Parkinson - Globe & Mail) - Companies representing 40 per cent of the Toronto Stock Exchange’s total market capitalization would be directly affected by a legislated system of greenhouse gas (GHG) emissions caps and trading, and that impact will be negative for most of them, a new report from CIBC World Markets says.Economists Jeffrey Rubin and Benjamin Tal wrote that the sector that would be most at risk from a carbon trading system would be coal-fired electrical utilities, followed by oil sands producers. Conversely, they said oil and gas pipeline operators and some gold mining companies could end up being net sellers of emission credits, gaining financially from such a system.

“The full extent to which corporate valuations will be impacted by carbon risk will depend on the distribution of permits, the initial severity of the emissions caps and the rate at which they are lowered over time. At the end of the day, legislators will determine those parameters,” they wrote. “But investors beware: Carbon emissions are very soon going to carry a price in the Canadian economy.”

In their report, Mr. Rubin and Mr. Tal said Canada is likely to eventually adopt a market-based GHG emissions cap-and-trading system similar to those recently introduced in California and being proposed in several other U.S. states. The system — under which an emissions cap is set and gradually lowered over time, and emitters who exceed the cap will have to purchase carbon “credits” from below-cap emitters to meet the targets — has been used successfully in the United States over the past decade to reduce acid-rain-related emissions.

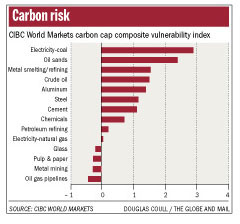

CIBC’s Carbon Cap Composite Vulnerability Index measures the exposure to risk from a carbon cap-and-trading system by industry.

They said the oil and gas and utility sectors, together with industrial-processing operations such as metal smelting and refining, account for almost half the GHG emissions in Canada. “Those emissions would be the prime targets of any Canadian cap-and-trade system,” they said.

Mr. Rubin and Mr. Tal have devised a Carbon Cap Composite Vulnerability Index to measure the exposure to risk from such a cap-and-trading system on those industries that would be targeted, assigning scores to the industries based on four criteria: intensity of their carbon emissions; intensity of their energy use, since the caps and credit-trading costs affecting energy producers would likely push up energy prices for consuming businesses; ability to pass any increased carbon-related costs along to customers; and ability to reduce emissions through improved practices.

Coal-fired electrical utilities posted the highest vulnerability score, due to their high emissions intensity, especially compared with alternative electricity-generation sources such as hydro and nuclear, which are carbon-free producers. Mr. Rubin and Mr. Tal said coal plants would run the risk of being supplanted by nuclear as their carbon-related costs soar, but added that carbon caps and trading could force the coal-fired industry to more rapidly implement cleaner-burning technologies.

Oil sands ranked second, even though they accounted for only 3.5 per cent of Canada’s total GHG emissions in 2004. Mr. Rubin and Mr. Tal said the planned massive expansion of oil sands production will sharply increase the sector’s emissions, even though the industry has been significantly improving its emission intensity and has scope to continue to do so.

Mr. Rubin and Mr. Tal said metal smelting and refining ranks third in its index, due to its high emissions, its heavy energy use and its limited ability to pass costs on to customers. They said the chemicals industry is also exposed to risk, even though it isn’t a major GHG emitter, because the industry is a significant user of energy and uses hydrocarbons as feedstocks for making chemicals.

On the other side of the ledger, pipelines stand to be net winners from a carbon cap-and-trade system, despite their link to the oil and gas sector, largely because they aren’t themselves significant emitters. The sector has demonstrated an ability to reduce its energy use significantly through technology improvements, has an ability to pass increased costs along to customers, and new technology could reduce the risk of pipeline leaks, they said.

The gold-mining industry also could be a winner, they argued. The sector, already a low emitter, has done little in the past to reduce emissions intensity, they said, leaving ample room for improvements.

You can return to the main Market News page, or press the Back button on your browser.