U.S. poised for boom in crude oil exports

Some of the world’s biggest oil companies and traders are poised to export substantial amounts of crude from the United States for the first time in decades, as booming output there promises to reshape global energy markets.

Some of the world’s biggest oil companies and traders are poised to export substantial amounts of crude from the United States for the first time in decades, as booming output there promises to reshape global energy markets.Royal Dutch Shell, BP and Vitol, the world’s largest independent oil trading house, are among a number of companies that have applied to the U.S. government for export licences, the Financial Times has learned.

A surge of exports from the U.S. would affect oil trading patterns between Europe, west Africa and North America. Greater supplies in the Atlantic basin are likely to put pressure on physical prices of other crudes in the region, particularly Brent, the North Sea benchmark.

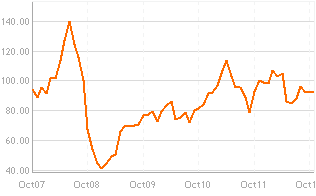

Oil prices have this year soared to well above the $100 (U.S.) per barrel level that many governments consider a drag on economic growth.

U.S. federal rules and the country’s dependency on imports have kept all but a trickle of crude from leaving the U.S. But a surge in supplies from states such as Texas and North Dakota have prompted companies to seek out refinery customers in Canada.

As rising crude volumes reach the coasts, “pressure should build and will trigger policy debates about whether to expand the list of allowable countries beyond Canada,” said Ed Morse, head of commodities research at Citi Group.

Domestic oil output in the U.S. has rebounded strongly, to its highest level since 1995, after drillers pioneered new techniques to coax oil from reserves previously regarded as uneconomic. Rising exports are likely to influence debates on energy independence in the U.S., whose petroleum import bill was $436-billion last year.

Exporting U.S. crude requires a licence from the Bureau of Industry and Security, a branch of the U.S. Department of Commerce. The U.S. has exported less than 100,000 barrels per day of crude in the past decade, a fraction of the nine million barrels imported daily. “It’s generally prohibited except for a whole host of exceptions,” said John Felmy, chief economist at the American Petroleum Institute. By contrast, the U.S. is exporting record amounts of refined fuels such as petrol.

Shell confirmed it recently applied for licences to export domestic crude. “Crude oil trades on a global scale and imports/exports will follow supply and demand,” it said.

Vitol and BP were also among the companies that applied, people familiar with the matter said. Both declined to comment.

The Department of Commerce refused to confirm or deny the existence of licences or licence applications, citing U.S. law. But it said exports to Canada had a “presumption of approval.”

Until now, only minimal amounts of U.S. crude have been exported overland from the north of the country to Canada. Traders, though, now want to export crude by tanker from the Gulf of Mexico to the Atlantic coast of Canada, where Imperial Oil, Irving Oil and a unit of Korea National Oil Corp each own a refinery. In the Eagle Ford “shale” of Texas, production has jumped to 280,000 barrels-per-day from almost nothing four years ago and its low-sulphur crude is ill-suited for many refineries nearby.

One advantage of exporting the crude to Canada is that the U.S.’ Jones Act demands more expensive U.S.-flagged ships domestic routes along a single coast. Poten & Partners, a ship broker, estimates it would cost less than $1.50 per barrel to ship crude in a foreign-flagged medium-sized Aframax tanker from Texas to the largest Canadian refinery in St. John, N.B. A shorter journey from Texas to refineries in Philadelphia recently cost $4.55 a barrel.

Lucian Pugliaresi, president of the Energy Policy Research Foundation in Washington, said: “This is not about exports or imports. It’s about transportation and processing efficiency.”

Refineries in Canada are important fuel suppliers to U.S. markets. Irving says its St John refinery supplies 20 per cent of total petrol and diesel imports to the U.S. northeast. Under longstanding policy, the U.S. government is authorized to issue licences for crude exports to Canada for use in Canada or the U.S.

At the port of Corpus Christi in Texas, locally produced crude is being loaded for outbound shipment for the first time since the 1940s, said Frank Brogan, deputy port director. Thus far tankers have sailed only to other U.S. ports, he said.

You can return to the main Market News page, or press the Back button on your browser.