Clean energy just got a lot more cost-competitive, report says

The Inflation Reduction Act will cause the cost of renewable energy to decline dramatically over the next decade, according to an analysis shared exclusively with The Climate 202.

The Inflation Reduction Act will cause the cost of renewable energy to decline dramatically over the next decade, according to an analysis shared exclusively with The Climate 202.

The analysis from ICF Climate Center, a global consulting firm, concludes that the climate law will make clean energy projects easier to finance across the country, quickening the pace of America’s energy transition.

“At over 700 pages, the Inflation Reduction Act (IRA) is a dense piece of legislation,” the report says. “At the same time, its impact on the energy sector can be summarized succinctly: clean energy economics just got a whole lot better.”

The report’s findings are a big deal. They’re also very wonkish and technical. If you’re not a climate economist or policy wonk, here’s a quick explanation of the findings and why they matter for the nation and the planet:

Cost curves

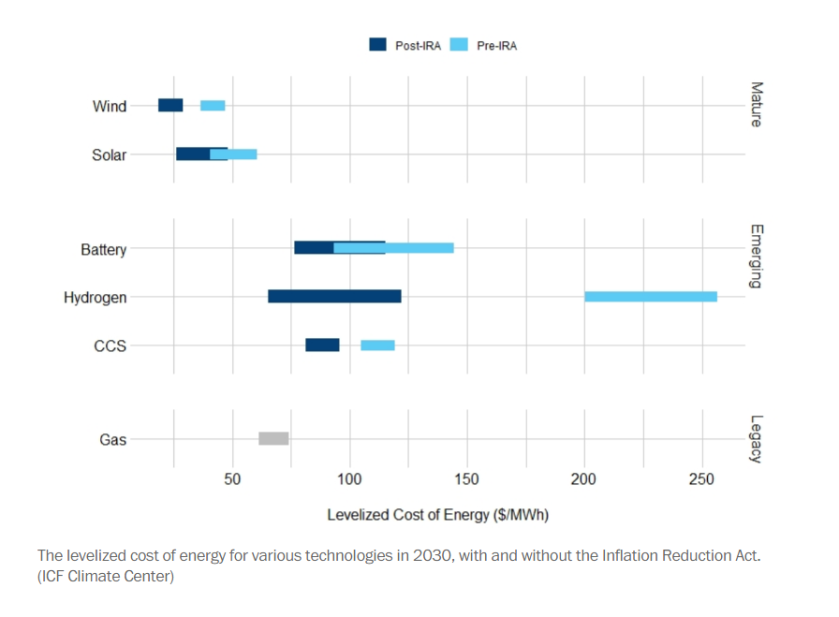

The report’s authors looked at the levelized cost of energy — the average cost of electricity generation over the lifetime of a facility — for various technologies in 2030 with and without the clean energy tax credits in the Inflation Reduction Act.

All of the technologies they analyzed would see double-digit percentage declines in their levelized costs of energy, including mature technologies such as wind and solar, whose costs have already plummeted over the last decade.

- With the climate law, wind’s levelized cost of energy in 2030 could be 38 to 49 percent lower than without the climate law.

- Solar’s levelized cost of energy could fall 20 to 35 percent. By 2030, solar could cost as little as $26.30 per megawatt-hour on average — down from a 2020 average of $34 per MWh, according to Energy Department research.

Emerging technologies could also see significant cost reductions, the analysis found.

- Hydrogen could see the biggest cost decline — a whopping 52 to 67 percent — of any technology. Green hydrogen facilities that take advantage of the climate law’s tax credits could become cost-competitive with new natural-gas-powered facilities by 2030.

- Carbon capture and storage could become economical for the first time, with its levelized cost of energy falling 20 to 23 percent by 2030. (It’s worth noting that some environmentalists oppose federal incentives for carbon capture and storage, which they view as a false climate solution because it could prolong the life of fossil fuel infrastructure.)

For context, the Biden administration on Thursday announced an effort to bring down the cost of offshore floating wind by 70 percent by 2035, to about $45 per MWh.

“We know the cost goal is pretty audacious,” Energy Secretary Jennifer Granholm said on a call Thursday with reporters, adding that “the Inflation Reduction Act is a significant component in reducing costs of all kinds of energy.”

Ian Bowen, a co-author of the report and energy markets analyst at ICF, said the expected cost reductions will provide “certainty” to investors in renewable energy projects.

“We think that these large declines are going to really help provide certainty to investors over a long period,” Bowen said. “Hopefully that will be able to accelerate the transition.”

Caveats

Still, the report comes with a notable caveat: The authors assume that policymakers will address other thorny challenges facing clean energy projects.

- One challenge is NIMBYism, which refers to “not in my backyard” sentiments. Project siting could become increasingly difficult if these sentiments intensify and available land becomes scarce, the report says.

- Another challenge is interconnection, which refers to the process of connecting new energy sources to the electrical grid. In the PJM Interconnection region stretching from D.C. to Illinois, more than 2,000 solar, wind and battery storage projects have already waited years to connect to the grid, according to Advanced Energy Economy, an industry association.

“If the goal is to increase deployment of renewable energy, then this [law] is absolutely a major step in that direction,” said Shanthi Muthiah, another co-author of the report and managing director of ICF’s energy practice.

“But,” she said, “it’s one of several steps that’s needed.”

You can return to the main Market News page, or press the Back button on your browser.