What Happens When the U.S. Isn't the Biggest Gas Guzzler?

Americans burn through 1.2 gallons of gasoline per person each day. There’s no other country that comes close. Even Canadians, themselves gas hogs, use almost a third less.

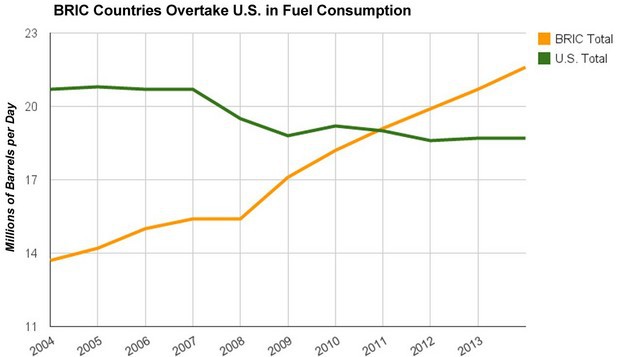

That’s why the chart above should scare the fuel out of everyone.

Brazil, Russia, India and China – four rising economies known collectively as the BRIC countries – surpassed the U.S. in liquid-fuel consumption in 2011 and haven’t looked back, according to data compiled by the Bloomberg Best (and Worst) Rankings. Liquid fuels include everything from jet fuel to gasoline.

The chart above represents hundreds of millions of people worldwide emerging from energy poverty, a lack of access to affordable fuels that restricts quality of life. Unfortunately, the Earth can’t take the abuse of having more countries that burn through fossil fuels as freely as Americans, according to the International Energy Agency, which estimates that 80 percent of the world’s fossil fuels must remain buried in the ground if we have a chance of avoiding catastrophic climate change.

By 2030, the global middle class is expected to grow by two-thirds. That’s 3 billion more shoppers buying cars and riding in planes and eating food produced with energy-intensive farming. In Bloomberg’s Pain at the Pump ranking, available here, India has the least affordable gas of the 61 nations on our list; it takes more than an average day’s wages there to buy a single gallon. China and Brazil aren’t far behind. But as GDP rises across emerging markets, gas becomes increasingly affordable.

Pain at the Pump: Gasoline Prices by Country

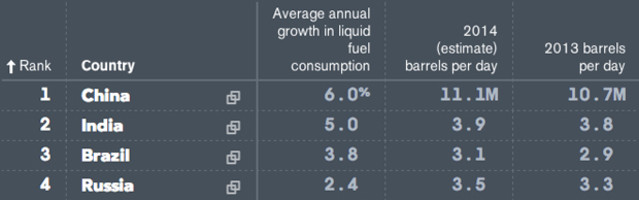

China, the biggest contributor to the rise of BRIC fuel use, bears watching, according to a June report by consulting firm McKinsey & Co. McKinsey highlights what it calls the G2 (Generation 2), China’s 200 million middle-class teenagers and early 20-somethings who were raised in the country’s new age of rapidly rising abundance. In ten years, G2 will be three times as large as the U.S. baby-boom generation and will be responsible for 35 percent of China’s urban consumption. According to China’s State Information Center, by 2020 the number of vehicles on the road will more than double to 260 million, surpassing the U.S.

A crumb for environmental optimists: Growth in fuel consumption in these countries trails growth in GDP. With any luck, the world’s future middle classes will drive more efficiently than America’s present one.

That’s little consolation to a planet where climate change has already doubled the likelihood of a Hurricane Sandy, a flood event that caused $60 billion in damage and would have been expected to occur once every 2,330 years in 1950, according to a study this month published in the Bulletin of the American Meteorological Society. Under the most dire scenarios, by the end of the century a Sandy-level storm could strike the U.S. Northeast every few years.

There’s a common misconception that if the world’s biggest economies could just halt the growth of greenhouse gas emissions, the future impact on climate will also be stabilized. However, heat-trapping CO2 remains in the atmosphere for centuries after it is emitted. Just as a smoker who stabilizes his habit at a pack a day hasn’t fixed his smoking problem, capping emissions at current rates – no easy task – would do little more than guarantee a planet that’s inhospitable for life as we know it.

Transportation fuels make up about 28 percent of global greenhouse gas emissions, not to mention their contribution to life-shortening air pollution. The biggest pollution culprits are coal-burning power plants. Scientists say humanity won’t hit necessary carbon targets without every industry taking part, which is why the rise of BRIC-mobiles is so important.

The challenge facing the international climate talks, which resume in Warsaw in November, is twofold: how to get petroleum addicts like the U.S. to kick the habit and how to get emerging economies to avoid this level of addiction in the first place. The simplest solution, a carbon tax, isn’t on the table.

You can return to the main Market News page, or press the Back button on your browser.