What happens when the energy price falls to zero?

One of the big questions about scenarios for 100 per cent renewable energy production is how to structure the energy market. We now know that having electricity supplied to a major economy entirely by renewable energy sources is possible, and most likely no more expensive than building new fossil fuel generation.

What we don’t know is how to structure the energy market so it provides the right incentives: If the marginal cost of solar and wind energy is close enough to zero (because there is no fuel cost), then the energy price in a 100 per cent wind and solar market is going to be zero – at least in the current market structure. But who would invest?

This is one of the major questions being put to regulators and policy makers around the world, but the country most in the firing line is Germany, one of the world’s most successful industrial nations.

It’s not that Germany is about to arrive at 100 per cent renewables any time soon. But the penetration of renewables (now above 25 per cent) is getting to the point where the current energy market, based around the cost of fuels, is no longer functioning as it used to. And by the time the country gets to 40 per cent by 2020, and close to 60 per cent soon after 2030, this will be a critical issue.

Some analysts, such as Macquarie Bank, have described the energy market as already broken, and there is no doubt that fossil fuel generators are screaming in pain because their coal and gas fired plants no longer make the profits they once did. German regulators and policy makers concede that their energy markets need to be redesigned.

How they do that is going to be one of the big tests for Germany’s Energiewende, the transition from a largely centralized base-load generation system, with lots of nuclear, to one based around renewables. And it is going to be one of the big challenges of the new “grand coalition” between Angela Merkel’s centre right CDU, and the left of centre SPD, which has its base the coal-rich regions of northern Germany.

And what is decided, and is achieved in Germany, will likely have a significant impact on the pace, and ambition, of renewable energy schemes in other major economies.

Still, despite the clamouring of the incumbent industries to have capacity mechanisms introduced into the market, the German policy makers appear to be in no hurry to indulge them. The recent treaty between the two main parties provides for no capacity mechanism before 2018, by which time the share of German renewables may well be close to one third of total demand.

It could be that Germany is looking for the survival of the fittest. “I would be very, very careful not to jump into capacity markets too early,” says Andreas Loeschel, who heads a government appointed expert committee looking into the energy transition process. Loeschel is also based at the Centre for European Economic Research (ZEW), and is also professor of economics at the University of Heidelberg.

“We don’t need them (capacity markets) at the moment,” he says. “We have excess capacity, but maybe it is something for the future.”

Rainer Baake, a former permanent secretary to Germany’s Minister of the Environment and now head of an energy industry think tank called Agora Energiewende, says some form of capacity market in the future is inevitable, but it is likely to be a mechanism that allows maximum flexibility, and so encourages not just “baseload” generators but other enabling technologies such as energy storage, demand management, smart grids, or whatever else is needed to deliver flexibility in a market with high renewables penetration, and the potential for large amounts of “pro-sumers”, households and businesses that can generate their own electricity.

“We need market where different answers to the problem are able to compete with each other, and we need more flexibility in the system,” Baake told RenewEconomy in a recent interview in Berlin.

“A few years ago, we thought we would have an energy only market and everything would be fine. Now we are looking at what sort of market we should introduce and when the right time to introduce it will be.”

(And it won’t be a simple capacity market, where generators receive payments simply for the ability to provide output on demand, even if it is rarely used, as is the case in Western Australia. It is more likely to be a sort of “capabilities” market, a more refined version that reflects environmental and other qualities. It’s just the name “capabilities” market hasn’t caught on yet).

This transition seems to be accepted by the two biggest generation groups in germany, RWE and E.ON, who are both now talking of a move away from centralized generation and towards distributed systems, where consumers do produce a lot of their own energy, and the role of utilities is to provide security of supply, added value and services to those “pro-sumers”. (Please read today’s interview with E.ON’s chief executive, and the recent insight into RWE’s new strategy).

Of more immediate concern, however, to the German regulators is how to manage the cost of this energy transition, and the cost of what has already occurred in the form of feed-in tariffs. Although it is important to note that a lot of nonsense gets written about this issue.

Loeschel says Germany – as a whole – is paying the same percentage of GDP (2.5 per cent) on electricity costs as it did 20 years ago. The problem is how these costs are distributed. The retail consumer has borne the brunt of the EEG, the tariff assigned to support green energy support schemes, because many industries are exempt.

The irony is that as the amount of wind and soalr has increased, the price of wholesale electricity, on which many energy intensive industries costs are based, has fallen by nearly half. And because the way the EEG has been structured, a fall in the wholesale price results in an increase in the EEG tariff paid by consumers. This, says Loeschel, has allowed complaints about rising electricity bills to be exploited by those who want to slow the Energiewende down.

But as Baake points out, no party that had an Energiewende slowdown as its official policy got any seats in parliament in the recent elections. And the grand Coalition has rejected any talks of retrospective changes in tariffs. Indeed, it has actually increased and expanded the renewable energy targets out to 60 per cent by 2035 – although some people say the country could achieve more, and this in fact represents a slowdown!

Still, these costs need to be capped. One of the causes of the scare campaign against the Energiewende is that industry fears it will lose its recent favourable treatment and energy discounts. “The people who are complaining the most are actually better off than they were a few years ago,” Loeschel says.

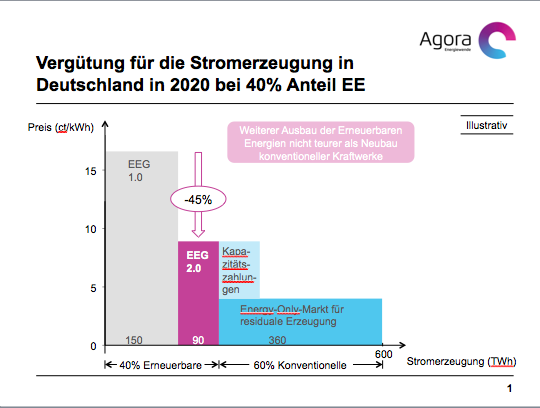

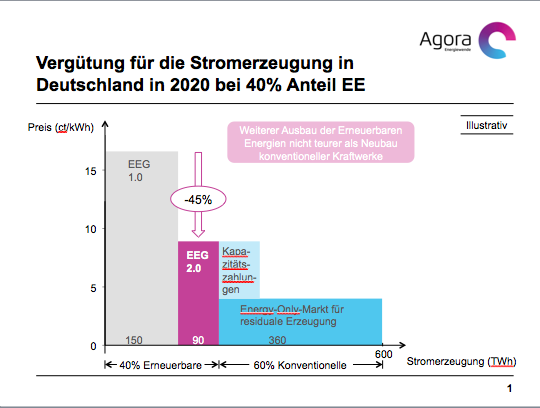

Baake’ Agore Energiewende has come up with its own solution, as illustrated by this graph below, although it probably requires a bit of explanation, particularly as it is in German.

The diagram is designed to illustrate how to get to 40 per cent renewables with minimum cost. This requires a total of 240Twh of renewable production – out of total grid demand of 600TWh. The vertical box on the left, EEG 1.0, represents the costs of tariffs already committed. Baake says this is around 17 euro cents/kWh. That, he says, was the cost of Germany’s learning curve, and it is locked in until 2020, when it will start to decline as the first tariffs expire. There is no talk of retrospective cuts, so the big question is what to do in the future.

Baake proposes something called EEG 2.0. Having installed 160TWh of renewables at an average of 17c/kWh, he suggests a cap of 8.9c/kWh for new renewable installations. This is nearly half the cost of EEG 1.0 and is highly significant, because from now on it means that whatever Germany invests in, be it fossil fuels or renewables, the energy costs will be the same. “We are at a turning point in the cost debate,” he says.

However, to encourage enough fossil fuel or balancing capacity to remain in the market, Baake proposes the capacity measures mentioned above. Right now, wholesale power prices are at 3c-5c/kwh, many plants need higher returns to ensure positive cash flows. This could come from some form of capacity premiums.

Of course, he incumbent fossil fuel industry would like that light blue rectangle to be bigger and broader, but Baake says it is important for this part to be controlled. Many see this as the biggest threat to the development of the Energiewende.

Loeschel is happy to see a shakeout in the market. “The wholesale price has probably dropped a little too far. But this will change if we allow capacity to go out of the market. The larger companies try to bribe policy makers by telling them going to shut down power plants. We should now allow that.”

But, he conceded, changes are needed. His proposal is to create “mini markets” that would result in capacity being installed where it is most needed, and maybe overcome germany’s principal problem of having a lot of generation away from the main areas of demand.

“I’m very confident about the future of the Energiewende,” he says. “This is a long term project and an important one for Germany. We should not throw this whole thing out just because we have some problems in the first few years.”

What we don’t know is how to structure the energy market so it provides the right incentives: If the marginal cost of solar and wind energy is close enough to zero (because there is no fuel cost), then the energy price in a 100 per cent wind and solar market is going to be zero – at least in the current market structure. But who would invest?

This is one of the major questions being put to regulators and policy makers around the world, but the country most in the firing line is Germany, one of the world’s most successful industrial nations.

It’s not that Germany is about to arrive at 100 per cent renewables any time soon. But the penetration of renewables (now above 25 per cent) is getting to the point where the current energy market, based around the cost of fuels, is no longer functioning as it used to. And by the time the country gets to 40 per cent by 2020, and close to 60 per cent soon after 2030, this will be a critical issue.

Some analysts, such as Macquarie Bank, have described the energy market as already broken, and there is no doubt that fossil fuel generators are screaming in pain because their coal and gas fired plants no longer make the profits they once did. German regulators and policy makers concede that their energy markets need to be redesigned.

How they do that is going to be one of the big tests for Germany’s Energiewende, the transition from a largely centralized base-load generation system, with lots of nuclear, to one based around renewables. And it is going to be one of the big challenges of the new “grand coalition” between Angela Merkel’s centre right CDU, and the left of centre SPD, which has its base the coal-rich regions of northern Germany.

And what is decided, and is achieved in Germany, will likely have a significant impact on the pace, and ambition, of renewable energy schemes in other major economies.

Still, despite the clamouring of the incumbent industries to have capacity mechanisms introduced into the market, the German policy makers appear to be in no hurry to indulge them. The recent treaty between the two main parties provides for no capacity mechanism before 2018, by which time the share of German renewables may well be close to one third of total demand.

It could be that Germany is looking for the survival of the fittest. “I would be very, very careful not to jump into capacity markets too early,” says Andreas Loeschel, who heads a government appointed expert committee looking into the energy transition process. Loeschel is also based at the Centre for European Economic Research (ZEW), and is also professor of economics at the University of Heidelberg.

“We don’t need them (capacity markets) at the moment,” he says. “We have excess capacity, but maybe it is something for the future.”

Rainer Baake, a former permanent secretary to Germany’s Minister of the Environment and now head of an energy industry think tank called Agora Energiewende, says some form of capacity market in the future is inevitable, but it is likely to be a mechanism that allows maximum flexibility, and so encourages not just “baseload” generators but other enabling technologies such as energy storage, demand management, smart grids, or whatever else is needed to deliver flexibility in a market with high renewables penetration, and the potential for large amounts of “pro-sumers”, households and businesses that can generate their own electricity.

“We need market where different answers to the problem are able to compete with each other, and we need more flexibility in the system,” Baake told RenewEconomy in a recent interview in Berlin.

“A few years ago, we thought we would have an energy only market and everything would be fine. Now we are looking at what sort of market we should introduce and when the right time to introduce it will be.”

(And it won’t be a simple capacity market, where generators receive payments simply for the ability to provide output on demand, even if it is rarely used, as is the case in Western Australia. It is more likely to be a sort of “capabilities” market, a more refined version that reflects environmental and other qualities. It’s just the name “capabilities” market hasn’t caught on yet).

This transition seems to be accepted by the two biggest generation groups in germany, RWE and E.ON, who are both now talking of a move away from centralized generation and towards distributed systems, where consumers do produce a lot of their own energy, and the role of utilities is to provide security of supply, added value and services to those “pro-sumers”. (Please read today’s interview with E.ON’s chief executive, and the recent insight into RWE’s new strategy).

Of more immediate concern, however, to the German regulators is how to manage the cost of this energy transition, and the cost of what has already occurred in the form of feed-in tariffs. Although it is important to note that a lot of nonsense gets written about this issue.

Loeschel says Germany – as a whole – is paying the same percentage of GDP (2.5 per cent) on electricity costs as it did 20 years ago. The problem is how these costs are distributed. The retail consumer has borne the brunt of the EEG, the tariff assigned to support green energy support schemes, because many industries are exempt.

The irony is that as the amount of wind and soalr has increased, the price of wholesale electricity, on which many energy intensive industries costs are based, has fallen by nearly half. And because the way the EEG has been structured, a fall in the wholesale price results in an increase in the EEG tariff paid by consumers. This, says Loeschel, has allowed complaints about rising electricity bills to be exploited by those who want to slow the Energiewende down.

But as Baake points out, no party that had an Energiewende slowdown as its official policy got any seats in parliament in the recent elections. And the grand Coalition has rejected any talks of retrospective changes in tariffs. Indeed, it has actually increased and expanded the renewable energy targets out to 60 per cent by 2035 – although some people say the country could achieve more, and this in fact represents a slowdown!

Still, these costs need to be capped. One of the causes of the scare campaign against the Energiewende is that industry fears it will lose its recent favourable treatment and energy discounts. “The people who are complaining the most are actually better off than they were a few years ago,” Loeschel says.

Baake’ Agore Energiewende has come up with its own solution, as illustrated by this graph below, although it probably requires a bit of explanation, particularly as it is in German.

The diagram is designed to illustrate how to get to 40 per cent renewables with minimum cost. This requires a total of 240Twh of renewable production – out of total grid demand of 600TWh. The vertical box on the left, EEG 1.0, represents the costs of tariffs already committed. Baake says this is around 17 euro cents/kWh. That, he says, was the cost of Germany’s learning curve, and it is locked in until 2020, when it will start to decline as the first tariffs expire. There is no talk of retrospective cuts, so the big question is what to do in the future.

Baake proposes something called EEG 2.0. Having installed 160TWh of renewables at an average of 17c/kWh, he suggests a cap of 8.9c/kWh for new renewable installations. This is nearly half the cost of EEG 1.0 and is highly significant, because from now on it means that whatever Germany invests in, be it fossil fuels or renewables, the energy costs will be the same. “We are at a turning point in the cost debate,” he says.

However, to encourage enough fossil fuel or balancing capacity to remain in the market, Baake proposes the capacity measures mentioned above. Right now, wholesale power prices are at 3c-5c/kwh, many plants need higher returns to ensure positive cash flows. This could come from some form of capacity premiums.

Of course, he incumbent fossil fuel industry would like that light blue rectangle to be bigger and broader, but Baake says it is important for this part to be controlled. Many see this as the biggest threat to the development of the Energiewende.

Loeschel is happy to see a shakeout in the market. “The wholesale price has probably dropped a little too far. But this will change if we allow capacity to go out of the market. The larger companies try to bribe policy makers by telling them going to shut down power plants. We should now allow that.”

But, he conceded, changes are needed. His proposal is to create “mini markets” that would result in capacity being installed where it is most needed, and maybe overcome germany’s principal problem of having a lot of generation away from the main areas of demand.

“I’m very confident about the future of the Energiewende,” he says. “This is a long term project and an important one for Germany. We should not throw this whole thing out just because we have some problems in the first few years.”

You can return to the main Market News page, or press the Back button on your browser.