The Future of Oil and Gas?

Claims that the world has “plenty of oil left are bunk,” says Sadad Al-Husseini, a former executive at Saudi Aramco, in recent articles. “Oil-producing countries are inflating the size of their oil reserves by as much as 300 billion barrels by padding supposedly proven reserves with ‘probable’ reserves and tar and oil sands.”

Claims that the world has “plenty of oil left are bunk,” says Sadad Al-Husseini, a former executive at Saudi Aramco, in recent articles. “Oil-producing countries are inflating the size of their oil reserves by as much as 300 billion barrels by padding supposedly proven reserves with ‘probable’ reserves and tar and oil sands.” Oil production, he continues, has peaked and will begin dropping in 15 years or less. Companies mix “proven finds with probable reserves that may have only a 50 percent chance of getting out of the ground.”

Even the International Energy Agency is concerned with world oil supplies, studying depletion rates at about 400 oil fields. We’ll talk more about the IEA study below.

Regardless of the studies, the global economy wants a solution now.

After paying $4 a gallon, we were told that gas prices fell 2% last month.

But that’s what happens when gas prices rise 5.6% in April, and economists are allowed to statistically readjust for seasonal oddities.

You see, historically, gas prices rise in April as we near warmer weather months and summer driving season. Taking that into consideration, the government adjusts its data to reflect the expected rise in gas prices, underscoring trend variations.

And since gas prices did not rise as much as they’ve historically risen in April, the adjustment showed that prices fell in April.

But flawed stats aside, energy costs are skyrocketing.

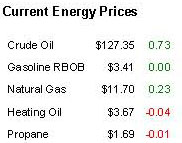

Americans want a solution… and they want it now. $4+ at the pump, $127 a barrel oil, $11.50 natural gas, skyrocketing electricity costs… America and the global economy want a solution now.

Domestically, there’s the Bakken solution. There’s even oil sitting under the Rockies.

And what makes these domestic oil production companies even more attractive as long-term investments are the oil and gas discoveries, and the fact that these explorations are more appealing, given geopolitical tension.

You know as well as we do that prices would come down sharply if we started producing on our own. And it’d be a strong global signal that we’re not willing to be hostages of oil rich companies.

Even the President agrees.

“Our problem in America gets solved when we aggressively go for domestic exploration,” Bush said.

And we need all the oil we can get. We’ve all heard the $200 oil forecasts.

Goldman just raised its oil price outlook to $141 from $107, citing supply issues.

Arjun Murti believes that we could see $150 to $200 oil over the next six to 24 months.

OPEC President Chakib Khelil won’t rule out $200.

And, while the International Energy Agency’s oil supply forecast won’t be released until November 2008, there’s growing fear of a sharp downward revision in supplies. That means supply could be much tighter than previously thought, a nightmare scenario if proven true.

Any pessimistic IEA view will shock the market, spawning oil super spikes. We’ve already seen prices rocket to $130, doubling year over year. And it’ll only get worse on a dismal IEA forecast.

For years, the IEA has said that crude supplies and other liquid fuels would keep up with rising demand, topping 116 million barrels a day by 2030. But now there’s fear that the IEA, basing findings on aging oil fields, could revise sharply lower and warn of a struggle to keep up with 100 million barrel a day demand over the next 20 years.

But IEA pessimism is nothing new. Just last summer, the IEA warned that spare OPEC capacity could fall to “minimal levels by 2012.”

Even the U.S. Energy Department is embarking on its own supply studies, which could be finished by summer. But they, too, may have nothing positive to say. They already suggest that daily 73 million barrel daily output will level off at 84 million barrels. To then reach 100 million barrels a day by 2030, we’ll need a sizeable boost from other fuel sources.

Natural Gas Squeeze

Natural gas prices are rising just as fast as oil, and could be subjected to the same supply and demand issues that drove crude oil well above $130 a barrel.

That’s as liquefied natural gas (LNG) shipments to the U.S. slow, and as companies like Cheniere and other companies drop plans to build more terminals.

Tankers full of gas from Africa and the Middle East are going to other countries instead, pushing up the price of gas and choking our stockpiles ahead of U.S. hurricane season.

Truth told natural gas prices are going a lot higher if a solution isn’t found.

Global natural gas demand has grown about 2.6% a year over the last 10 years. But in Asia, the Mid East and in Africa, demand has been more like 7% over the same time frame. And demand growth will only rocket further refinery and power growth in the developing world.

By Ian Cooper

You can return to the main Market News page, or press the Back button on your browser.