The End of Globalization: Peak Oil Conference, Part 2

China, Coal, and Renewable Energy Take Center Stage

(This is the second part of a two-part article; see also Part 1.)

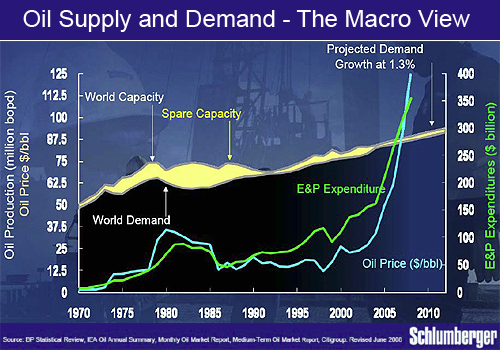

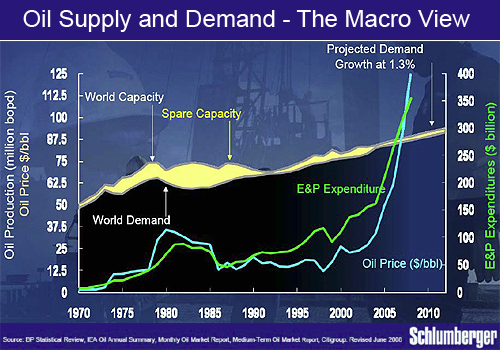

To wrap up the macro outlook for oil, I selected this excellent Schlumberger slide from Herman Franssen’s presentation:

The rapidly growing gap between expectation and reality could hardly be made more clear than that. Spare capacity cannot be significantly expanded, demand projections cannot be met, and prices will have to rise back into the stratosphere. We are now poised, it would seem, at a turning point, with far-reaching effects.

The End of Globalization

Jeff Rubin, the Chief Economist, Chief Strategist, and Managing Director of CIBC World Markets put his spotlight on those effects with a short but very pointed video presentation entitled “Triple Digit Oil Prices Will Reverse Globalization.” Rubin has long been on the peak oil trail, and has used his knowledge profitably in his economic forecasts. Transportation costs have finally become so high, he said, that global trade is now about shipping and logistics, not about seeking the lowest global labor cost.

For example, the cost of shipping a standard 40’ shipping container from Shanghai to NY went from $3000 a few years ago to about $9000 today. (A commentator on CNBC last week noted that it now costs more to ship a load of iron ore to China than the ore itself is worth.) The cost of shipping ore to China to make hot rolled steel and then shipping it back to the US adds about $90 to an $800 unit of finished product, according to Rubin; consequently US steel production is actually making a rebound after a long period of losing out to China.

Steel isn’t the only industry that is benefitting from the reversal of globalization. With oil at $100, Rubin calculates that transportation costs are 40% of total shipping costs. At $200, transportation is 80% of total shipping costs. And at $150, tariff rates quadruple. “This would take us back to the 1970s,” he warned, and suggested that the right prescription is to reverse globalization deliberately, until transportation costs become incidental. (I should note that Matthew Simmons has also called for an end to globalization, as well as a resurgence in local manufacturing and telecommuting, to reduce oil demand.)

Few people in the realms of policy and business seem to have gotten that memo, however.

Presenter Herman Franssen of International Energy Associates put a slightly different spin on the question, suggesting that a huge increase in oil demand from China and India could spell the end of globalization as the center of global industrial activity shifts to Asia. A doubling of cars is expected worldwide between now and 2025 as the population of the developing world seeks a First World standard of living. China and India together have 2.4 billion people—eight times the US population—but currently consume only about half the oil the US does. As their economies develop and their oil requirements rise, they will consume more of their own oil production, and they will compete more and more for dwindling global oil exports. (Later in the conference, Kjell Aleklett declared that the price of oil in the future will be set by whatever the Chinese are willing to pay for it, since they will become the world’s first and most important customer.) They will also increasingly become their own top customers, and their labor costs will increase.

All of these trends will tend to reverse globalization. This will be good for the US economy as manufacturing capability is repatriated. New jobs will created, and domestic producers like United States Steel Corp. (NYSE: X) could once again be excellent long-term investments. At the same time, the price of everything will go up, and we will find it increasingly difficult to fill an SUV with cheap stuff from China on our trips to Wal-Mart. There will be a bright side to that, too, though. I remember when “Made in USA” was stamped on almost everything we bought, and it was a mark of pride and quality. I, for one, would like to see those days again.

China and Coal

As China becomes the world’s dominant economy, coal takes center stage in the energy complex. Several presentations focused on the implications of this. David Fridley of the China Energy Group at the Lawrence Berkeley National Laboratory offered a few key facts:

Recognizing that petroleum is increasingly limited and expensive, China is also dramatically expanding its coal-to-liquids (CTL) and coal-to-chemicals efforts. China’s CO2 emissions are consequently expected to exceed that of the US by 2010, and effectively wipe out the CO2 reductions by the entire EU under the Kyoto accord. Soot from China’s coal burning is now the largest source of mercury deposition in California.

China is the world’s top producer—by a wide margin—of both cement and steel, most of which is consumed domestically. Both are extremely energy-hungry industries, and have caused China’s growth in energy demand to far outpace its growth in GDP. China is also the #1, #2 or #3 producer of all major metals. It is both the #1 producer and the #1 consumer of iron ore, the #1 importer of copper, and the #3 car manufacturer.

To satisfy its enormous demand for all basic materials, China has been buying up raw material resources wherever they can, worldwide, and competing with us directly for nearly everything. According to Vince Matthews of the Colorado Geological Survey, China now controls 98% of the rare earth metals worldwide, and their all-encompassing centralized strategy will eventually corner the global markets for most materials.

Like oil, the worldwide prices for raw materials are thus increasingly set by China’s demand. The cement shortage in the US for the last several years was a direct result of China’s increased demand. Conflicts like the one in Sudan, and disputes over resource claims with Vietnam and the Philippines, are also direct results of China’s voracious appetite.

Although the financial market meltdown has dampened the rate of China’s growth from nearly 12% last year to an estimated 9% this year (with similar numbers for India), and brought down commodity prices from their summer highs, demand for basic materials in these rapidly developing countries is still enormous. China’s average growth rate over the last 4 years has been 10.4%.

That demand should help to put a global floor under commodity prices. We didn’t get the post-Olympics bump in coal and oil demand that many of us expected, because the world was reeling from the fallout in the financial markets and guidance on demand for basic materials was falling. My estimation is that much of the fast money that was long commodities has now been shaken out, and commodities may now be priced near the low end of the forward range.

In fact, it’s hard to imagine coal demand going anywhere but up. David Hughes gave a typically shocking presentation on coal, with numerous “hockey stick” charts showing the relationship between energy and population. The rate of coal consumption has shot up since the 1980s, as oil and natural gas became harder to produce and more expensive. Consider these facts:

Michael Webber, the Associate Director of the Center for International Energy & Environmental Policy at the University of Texas at Austin, focused on CTL for his presentation. Although CTL fuels have excellent performance characteristics and have been approved by the US Air Force as an alternative liquid domestic fuel, their carbon footprint is much higher than that of other fuels, and the Energy Independence and Security Act of 2007 essentially blocks their use by setting emissions limits. CTL also requires high energy and water inputs, leading to the running joke that the cost of CTL is always the price of oil plus $10/barrel. CTL probably isn’t feasible without government subsidies, he says, and carbon capture and sequestration technology (CCS) only really works—if at all—when attached to power plants, not to millions of tailpipes.

Pamela Tomski’s of EnTech Strategies also addressed the future of CCS. Her outlook was cautiously optimistic, pointing out that global growth in coal consumption is basically a foregone conclusion, and that CCS can and should be pursued as much as possible with a goal of capturing at least 1 billion tons of carbon per year by 2050 (equivalent to about half the carbon output of today’s US coal plants). However, the scalability of CCS remains to be proven. The cost of CCS is high too, incurring an energy penalty of 20-40%, and ultimately contributing 40-80% of the increase in grid power costs.

Moving on from CTL to other alternative liquid fuels, fuels engineer Robert Rapier tried to separate some facts from fallacies about biofuels, and gave an interesting overview of various biofuels including corn ethanol, sugarcane ethanol, cellulosic ethanol, methanol, butanol, renewable (or “green”) diesel, algal biodiesel, and regular biodiesel. He was quick to debunk the notion that the US could emulate Brazil’s success with sugarcane ethanol, because we do not have its crucial tropical climate, and noted that even in Brazil, oil still accounts for 90% of its energy needs. To be like Brazil, he said, the US would have to either quadruple its domestic oil production or cut consumption by 75%. After reviewing the various limits to each type of biofuel, Rapier concluded that none of them are true long term solutions, and that we should be focusing our efforts on reducing our demand for liquid fuels instead of trying to increase supply.

If CTL and biofuels can’t provide an alternative liquid fuel regime, then we must wonder what the future of the airline industry looks like. (I wrote about this in May, “Say Goodbye to Cheap Air Travel.”) We have already seen some 30 small carriers go bust in 2008, and the chief executive of British Airways warned last month that we could see an equal number disappear before the year is out.

Michael Boyd, an expert on the airline industry, kicked off his presentation with the quip that an airline is an excellent investment, if you use your ex-wife’s money and get even. The air travel industry is facing numerous challenges, and fuel costs are gradually shrinking fleets and reducing service, which will have knock-on effects on business and spending patterns. The airline industry currently has only about a 14% profit margin, he said, which is easily jeopardized by rising fuel costs. Hedging fuel costs as Southwest Airlines did (to become the only large profitable airline in Q1) only works at low price levels. At $100/barrel oil, he said, every airline in the world is obsolete. Despite its imminent threat, he said, most people in the airline industry still don’t know about peak oil.

Renewable Energy: Our First and Last Resort

If CTL and biofuels can’t fill the gap in traditional fuels, then somehow we must find a way to fill it with renewable energy. Analyst Paul Gipe presented a bold but plausible scenario under which the three-quarters of US electricity currently produced from fossil fuels could be replaced with renewables. He determined that it could be done, in theory, by deploying thousands of wind turbines, but only after we cut consumption to something approaching a European standard, and only with a vigorous commitment to build the new infrastructure at a much faster pace, at a cost of about $5 trillion.

Since renewable energy technologies produce electricity, and not liquid fuels, this raises the question of what the future of transportation looks like. A series of presentations on the final day of the conference explored options ranging from vehicle-to-grid storage technologies, to plug-in electric hybrids, to 100% electric cars and scooters, to bicycles, to autonomous (self-driving) auto technologies, to innovative “Pod Cars” that work like trains made up of interlinked, individual, self-piloting cars.

The conference concluded with a panel discussion focused on how to do a better job of getting the peak oil message out, and motivating communities and decision makers to take action. I think the overriding sense of it was that we are truly out of time and far too late in our responses to the peak oil threat, but that we must use that knowledge to galvanize us into action, and reach out to everyone we know in an effort to inform and prepare for the changes that will soon be upon us.

I hope you found this summary useful. Clearly, our focus on energy stocks and commodities as an investing theme is well warranted, and the game is far from over. For further reading, see my complete notes from the conference and the slide decks themselves, linked into the headings of my notes.

Until next time,

By Chris Nelder

(This is the second part of a two-part article; see also Part 1.)

To wrap up the macro outlook for oil, I selected this excellent Schlumberger slide from Herman Franssen’s presentation:

The rapidly growing gap between expectation and reality could hardly be made more clear than that. Spare capacity cannot be significantly expanded, demand projections cannot be met, and prices will have to rise back into the stratosphere. We are now poised, it would seem, at a turning point, with far-reaching effects.

The End of Globalization

Jeff Rubin, the Chief Economist, Chief Strategist, and Managing Director of CIBC World Markets put his spotlight on those effects with a short but very pointed video presentation entitled “Triple Digit Oil Prices Will Reverse Globalization.” Rubin has long been on the peak oil trail, and has used his knowledge profitably in his economic forecasts. Transportation costs have finally become so high, he said, that global trade is now about shipping and logistics, not about seeking the lowest global labor cost.

For example, the cost of shipping a standard 40’ shipping container from Shanghai to NY went from $3000 a few years ago to about $9000 today. (A commentator on CNBC last week noted that it now costs more to ship a load of iron ore to China than the ore itself is worth.) The cost of shipping ore to China to make hot rolled steel and then shipping it back to the US adds about $90 to an $800 unit of finished product, according to Rubin; consequently US steel production is actually making a rebound after a long period of losing out to China.

Steel isn’t the only industry that is benefitting from the reversal of globalization. With oil at $100, Rubin calculates that transportation costs are 40% of total shipping costs. At $200, transportation is 80% of total shipping costs. And at $150, tariff rates quadruple. “This would take us back to the 1970s,” he warned, and suggested that the right prescription is to reverse globalization deliberately, until transportation costs become incidental. (I should note that Matthew Simmons has also called for an end to globalization, as well as a resurgence in local manufacturing and telecommuting, to reduce oil demand.)

Few people in the realms of policy and business seem to have gotten that memo, however.

Presenter Herman Franssen of International Energy Associates put a slightly different spin on the question, suggesting that a huge increase in oil demand from China and India could spell the end of globalization as the center of global industrial activity shifts to Asia. A doubling of cars is expected worldwide between now and 2025 as the population of the developing world seeks a First World standard of living. China and India together have 2.4 billion people—eight times the US population—but currently consume only about half the oil the US does. As their economies develop and their oil requirements rise, they will consume more of their own oil production, and they will compete more and more for dwindling global oil exports. (Later in the conference, Kjell Aleklett declared that the price of oil in the future will be set by whatever the Chinese are willing to pay for it, since they will become the world’s first and most important customer.) They will also increasingly become their own top customers, and their labor costs will increase.

All of these trends will tend to reverse globalization. This will be good for the US economy as manufacturing capability is repatriated. New jobs will created, and domestic producers like United States Steel Corp. (NYSE: X) could once again be excellent long-term investments. At the same time, the price of everything will go up, and we will find it increasingly difficult to fill an SUV with cheap stuff from China on our trips to Wal-Mart. There will be a bright side to that, too, though. I remember when “Made in USA” was stamped on almost everything we bought, and it was a mark of pride and quality. I, for one, would like to see those days again.

China and Coal

As China becomes the world’s dominant economy, coal takes center stage in the energy complex. Several presentations focused on the implications of this. David Fridley of the China Energy Group at the Lawrence Berkeley National Laboratory offered a few key facts:

- 80% of China’s electricity is generated from coal

- Just last year China added 105 GW of power generation—equivalent to building California’s entire

- electrical base twice a year—almost all of it from coal.

- China has world’s third largest reserves of coal.

- China is becoming a net coal importer, largely due to price differentials between imports and exports. When prices were very high this past summer, China was tamping down on domestic consumption (in part to prepare for the Olympics) and vigorously exporting coal, but now with prices having fallen they’re importing again and consuming more of their own supply.

Recognizing that petroleum is increasingly limited and expensive, China is also dramatically expanding its coal-to-liquids (CTL) and coal-to-chemicals efforts. China’s CO2 emissions are consequently expected to exceed that of the US by 2010, and effectively wipe out the CO2 reductions by the entire EU under the Kyoto accord. Soot from China’s coal burning is now the largest source of mercury deposition in California.

China is the world’s top producer—by a wide margin—of both cement and steel, most of which is consumed domestically. Both are extremely energy-hungry industries, and have caused China’s growth in energy demand to far outpace its growth in GDP. China is also the #1, #2 or #3 producer of all major metals. It is both the #1 producer and the #1 consumer of iron ore, the #1 importer of copper, and the #3 car manufacturer.

To satisfy its enormous demand for all basic materials, China has been buying up raw material resources wherever they can, worldwide, and competing with us directly for nearly everything. According to Vince Matthews of the Colorado Geological Survey, China now controls 98% of the rare earth metals worldwide, and their all-encompassing centralized strategy will eventually corner the global markets for most materials.

Like oil, the worldwide prices for raw materials are thus increasingly set by China’s demand. The cement shortage in the US for the last several years was a direct result of China’s increased demand. Conflicts like the one in Sudan, and disputes over resource claims with Vietnam and the Philippines, are also direct results of China’s voracious appetite.

Although the financial market meltdown has dampened the rate of China’s growth from nearly 12% last year to an estimated 9% this year (with similar numbers for India), and brought down commodity prices from their summer highs, demand for basic materials in these rapidly developing countries is still enormous. China’s average growth rate over the last 4 years has been 10.4%.

That demand should help to put a global floor under commodity prices. We didn’t get the post-Olympics bump in coal and oil demand that many of us expected, because the world was reeling from the fallout in the financial markets and guidance on demand for basic materials was falling. My estimation is that much of the fast money that was long commodities has now been shaken out, and commodities may now be priced near the low end of the forward range.

In fact, it’s hard to imagine coal demand going anywhere but up. David Hughes gave a typically shocking presentation on coal, with numerous “hockey stick” charts showing the relationship between energy and population. The rate of coal consumption has shot up since the 1980s, as oil and natural gas became harder to produce and more expensive. Consider these facts:

- Coal accounts for 29% of the world’s primary energy consumption, second only to oil.

- China has been building a new coal-fired power plant at the rate of over one per week. China is on track to have 5000 more coal-fired plants over the next 6 years. Over the same period, India will have 200 more.

- In the US, there are currently 28 coal-fired plants under construction, with even more in Europe.

- Seaborne supplies of coal are tight, and prices have doubled in the last two years.

- On an energy content basis, the US reached “peak coal” in 1998, although the volume produced keeps going up. Global peak coal will likely be in the 2025-2030 range.

Michael Webber, the Associate Director of the Center for International Energy & Environmental Policy at the University of Texas at Austin, focused on CTL for his presentation. Although CTL fuels have excellent performance characteristics and have been approved by the US Air Force as an alternative liquid domestic fuel, their carbon footprint is much higher than that of other fuels, and the Energy Independence and Security Act of 2007 essentially blocks their use by setting emissions limits. CTL also requires high energy and water inputs, leading to the running joke that the cost of CTL is always the price of oil plus $10/barrel. CTL probably isn’t feasible without government subsidies, he says, and carbon capture and sequestration technology (CCS) only really works—if at all—when attached to power plants, not to millions of tailpipes.

Pamela Tomski’s of EnTech Strategies also addressed the future of CCS. Her outlook was cautiously optimistic, pointing out that global growth in coal consumption is basically a foregone conclusion, and that CCS can and should be pursued as much as possible with a goal of capturing at least 1 billion tons of carbon per year by 2050 (equivalent to about half the carbon output of today’s US coal plants). However, the scalability of CCS remains to be proven. The cost of CCS is high too, incurring an energy penalty of 20-40%, and ultimately contributing 40-80% of the increase in grid power costs.

Moving on from CTL to other alternative liquid fuels, fuels engineer Robert Rapier tried to separate some facts from fallacies about biofuels, and gave an interesting overview of various biofuels including corn ethanol, sugarcane ethanol, cellulosic ethanol, methanol, butanol, renewable (or “green”) diesel, algal biodiesel, and regular biodiesel. He was quick to debunk the notion that the US could emulate Brazil’s success with sugarcane ethanol, because we do not have its crucial tropical climate, and noted that even in Brazil, oil still accounts for 90% of its energy needs. To be like Brazil, he said, the US would have to either quadruple its domestic oil production or cut consumption by 75%. After reviewing the various limits to each type of biofuel, Rapier concluded that none of them are true long term solutions, and that we should be focusing our efforts on reducing our demand for liquid fuels instead of trying to increase supply.

If CTL and biofuels can’t provide an alternative liquid fuel regime, then we must wonder what the future of the airline industry looks like. (I wrote about this in May, “Say Goodbye to Cheap Air Travel.”) We have already seen some 30 small carriers go bust in 2008, and the chief executive of British Airways warned last month that we could see an equal number disappear before the year is out.

Michael Boyd, an expert on the airline industry, kicked off his presentation with the quip that an airline is an excellent investment, if you use your ex-wife’s money and get even. The air travel industry is facing numerous challenges, and fuel costs are gradually shrinking fleets and reducing service, which will have knock-on effects on business and spending patterns. The airline industry currently has only about a 14% profit margin, he said, which is easily jeopardized by rising fuel costs. Hedging fuel costs as Southwest Airlines did (to become the only large profitable airline in Q1) only works at low price levels. At $100/barrel oil, he said, every airline in the world is obsolete. Despite its imminent threat, he said, most people in the airline industry still don’t know about peak oil.

Renewable Energy: Our First and Last Resort

If CTL and biofuels can’t fill the gap in traditional fuels, then somehow we must find a way to fill it with renewable energy. Analyst Paul Gipe presented a bold but plausible scenario under which the three-quarters of US electricity currently produced from fossil fuels could be replaced with renewables. He determined that it could be done, in theory, by deploying thousands of wind turbines, but only after we cut consumption to something approaching a European standard, and only with a vigorous commitment to build the new infrastructure at a much faster pace, at a cost of about $5 trillion.

Since renewable energy technologies produce electricity, and not liquid fuels, this raises the question of what the future of transportation looks like. A series of presentations on the final day of the conference explored options ranging from vehicle-to-grid storage technologies, to plug-in electric hybrids, to 100% electric cars and scooters, to bicycles, to autonomous (self-driving) auto technologies, to innovative “Pod Cars” that work like trains made up of interlinked, individual, self-piloting cars.

The conference concluded with a panel discussion focused on how to do a better job of getting the peak oil message out, and motivating communities and decision makers to take action. I think the overriding sense of it was that we are truly out of time and far too late in our responses to the peak oil threat, but that we must use that knowledge to galvanize us into action, and reach out to everyone we know in an effort to inform and prepare for the changes that will soon be upon us.

I hope you found this summary useful. Clearly, our focus on energy stocks and commodities as an investing theme is well warranted, and the game is far from over. For further reading, see my complete notes from the conference and the slide decks themselves, linked into the headings of my notes.

Until next time,

By Chris Nelder

You can return to the main Market News page, or press the Back button on your browser.