Record oil prices equals record carbon black prices!

In the past year, the surging cost of crude oil has propelled the price of carbon black to record levels, but even though oil has recently retreated, tags for this widely used black pigment continue to remain stubbornly high. This has caused hardships for tire makers especially, which consume the lion’s share of carbon black. But industry analysts say carbon black prices have probably peaked and may even edge downward over the next 12 months.

In the past year, the surging cost of crude oil has propelled the price of carbon black to record levels, but even though oil has recently retreated, tags for this widely used black pigment continue to remain stubbornly high. This has caused hardships for tire makers especially, which consume the lion’s share of carbon black. But industry analysts say carbon black prices have probably peaked and may even edge downward over the next 12 months.To see how Klean Industries is producing cost effective, environmentally sustainable industrial scale commodities such as low CO2 carbon blacks and green fuel oils and ultra low sulphur diesel fuels please visit Klean Carbon by clicking here »> GO!.

Manufacturers of carbon black in the U.S. have been in the retrenchment mode for the past year, mainly due to lackluster domestic sales of tires. In the last few months, such major producers as Cabot Corp., Columbian Chemicals and Degussa have announced job cuts or plant shutdowns in their carbon black operations. In a statement last August, Columbian attributed the permanent closing of its El Dorado, Ark. carbon black facility to a slump in tire demand that began in late 2005. The problem has been exacerbated, said Columbian, by tire plant shutdowns in the U.S. this year and a rise of tire imports from overseas.

Cabot, Columbian and Degussa Engineered Carbons (a joint venture of Degussa and Engineered Carbons) are the big three U.S. carbon black producers, accounting for about half the market, says Anand Mehta, an analyst with The Freedonia Group. Other key players include Continental Carbon, Sid Richardson Carbon Co., as well as Taiwan’s China Synthetic Rubber, Japan’s Tokai Carbon, and the Aditya Birla Group, based in India.

Carbon black is typically made by the heating of heavy residual oil to very high temperatures in the absence of oxygen. Most of the world’s output of the pigment—about 90%—consists of furnace blacks (also called rubber blacks), which are relatively low-cost, commodity chemicals used mostly in tires and other rubber products. Higher cost “special blacks” are found in inks, paints, plastics, coatings and other nonrubber applications.

No new carbon-black capacity is on tap for the U.S. In fact, Trey Hamblet, a market researcher with Industrial Info Resources in Sugar Land, Texas, says that spending for carbon black facilities “doesn’t even appear on my radar screen.”

While producers are limiting U.S. carbon black growth, they are expanding elsewhere. Bridgestone is building an $81 million carbon black unit in Mexico to serve its own tire making needs. Columbian is enlarging its carbon-black plant in Hungary to tap the fast-growing Central European market, and is planning another facility in Brazil. Earlier this year, Cabot started a joint-venture carbon-black plant in China with its partner, Shanghai Coking Chemical.

There is little mystery to the current pattern of expansions, say industry observers. For one thing, feedstocks and natural gas for making carbon black are “much more affordable” outside the U.S., says Hamblet. Tough environmental restrictions are another deterrent to U.S. carbon black manufacturing, he adds.

There is little mystery to the current pattern of expansions, say industry observers. For one thing, feedstocks and natural gas for making carbon black are “much more affordable” outside the U.S., says Hamblet. Tough environmental restrictions are another deterrent to U.S. carbon black manufacturing, he adds.But the biggest reason for expansions outside the U.S. and Western Europe is that such regions offer prospects for growth, notes Mehta. He says that carbon-black producers particularly want to address markets in rapidly industrializing countries with large populations that have a pent-up desire to own automobiles. These promising markets include not only China and India, but also Brazil and Russia, Mehta says. Expansions in Mexico, he adds, are due to a burgeoning local market (with a population of around 100 million), and the country’s relatively low manufacturing costs.

Global consumption of carbon black is roughly 4 million metric tons, according to a 2005 report by SRI Consulting. A 2005 Freedonia study on carbon black, authored by Mehta, predicted that worldwide demand for carbon black will increase by about 4% annually through 2008. But right now, U.S. tire markets for carbon black are not expanding and may even be contracting. A recent survey by the Rubber Manufacturers Association projected that U.S. tire shipments for 2006 will decrease by 2.8% over 2005. This is not good news for carbon-black makers, notes Mehta, adding that there is a “strong correlation” between demand for tires and demand for carbon black.

Nearly all the major suppliers of carbon black have raised their prices this year at regular intervals, typically 10% or more each quarter. In announcing a round of 10-15% increases that were set for Aug. 1, Columbian vice president of sales for North America Lester Tyra said the hikes were made necessary by “the near record-level price of oil.”

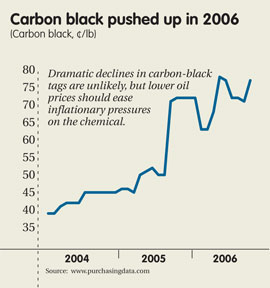

Oil tags have eased up a bit in the past few months, but this has not yet been reflected in lower selling prices of carbon black (see chart). But Mehta says the slide in oil should eventually keep prices from rising much higher and might contribute to a decline over the next year. Another possible harbinger of lower prices, he says, is the end of shortages caused by the Gulf Coast hurricanes of 2005. Those shortages, he notes, contributed to higher carbon-black prices for months after the storms.

Oil tags have eased up a bit in the past few months, but this has not yet been reflected in lower selling prices of carbon black (see chart). But Mehta says the slide in oil should eventually keep prices from rising much higher and might contribute to a decline over the next year. Another possible harbinger of lower prices, he says, is the end of shortages caused by the Gulf Coast hurricanes of 2005. Those shortages, he notes, contributed to higher carbon-black prices for months after the storms.Whatever future price trends may develop, present tags are a burden for purchasers of carbon black. For example, two tire giants, Goodyear and Cooper Tire & Rubber, posted losses for the quarter ending Sept. 30, and both companies cited rising costs of raw materials, including carbon black, as main contributors to their woes.

While some price relief may be in sight, Mehta doesn’t expect anything dramatic. Although carbon-black tags did decline substantially several years ago in Western Europe due to cheap imports of the chemical from Russia and Egypt, a parallel situation does not seem to be in the cards for the U.S. Imports of carbon black from outside North America are “cost prohibitive,” he says. Most imports of carbon black into the U.S. come from Mexico. But such imports, Mehta notes, are no cheaper than domestic carbon black.

By Gordon Graff – Purchasing, 12/14/2006

You can return to the main Market News page, or press the Back button on your browser.