Making It Across The Valley of Death

Many cleantech entrepreneurs are in the tough place we commonly

call the Valley of Death. Stable, but underfunded, which they

need for growth. If this describes your company, find out

what you should do.

Is your cleantech startup falling short of your 2011 funding

goals? The answer is most likely “yes.” But the reality is this

doesn’t make you different from the vast majority of startups, both

in the cleantech sector and beyond.

Many cleantech entrepreneurs I speak with are in the tough place

we commonly call the Valley of Death. [See

target=”_blank”>Why Can’t Cleantech Companies Get Funded When

There is Plenty of Capital for Them]

What is the Valley of Death? On the near side of the valley of

death is safety: Your company is small, but relatively stable. You

haven’t taken on a lot of debt, so there’s less risk.

You’ve probably invested some of your own money into the

project, but most of your savings are still safe. Of course,

there’s a downside to this safety: Your prospects for growth are

much smaller because you need funding to reach a critical mass and

gain some momentum.

When you look across the Valley of Death, what do you see?

Stability is there, also.

This is the oasis that companies find after they’ve hit their

funding goals, and they can focus on the blocking-and-tackling

execution of creating a successful business. I can’t tell you how

many cleantech entrepreneurs have told me that if they could just

get funding, there’s no doubt in their mind they have a product

that will find a market, scale, and turn a profit.

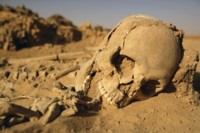

The Valley of Death lies between these two comfortable places,

and it’s a place where you’re exposed and at risk. You can’t stay

on the safe side of the valley forever: You’ll need to grow to

survive. And to achieve this growth, you’ll need funding.

In this economic climate, very few startup companies get

sufficient funding while they’re still on the safe side of the

valley. Investors want to see that the company can scale, that

there’s a market for the product, and that the company has the

ability to execute its business plan. It’s hard to prove that when

you’re playing it safe.

Here’s the Catch-22 of the Valley of

Death: You need funding to grow, but you need to grow to get

funding.

Once you’re across the Valley, you’ll be far less risky to

investors, because you’ve provided them with evidence you can

deliver what they need to see. But can you get there? Can you make

it across? And if you don’t get funded in the second half of this

year, what should you be doing?

You should invest the rest of 2011 in relationships. When the

money comes back into the market in a bigger way, you’re going to

want investors to know who you are, and what you do. Go to

conferences. Network. Understand that it’s a long game and make

sure you can last.

Proterra, a Colorado-based electric bus manufacturer, announced

this month a $30 million venture capital investment. The money is

starting to loosen up for good companies, even if you think you’ve

heard that before in the last couple of years. In Colorado, the

cleantech industry grew 33 percent in the last five years, and it

was the only sector that showed growth last year.

The Valley of Death is a dark, lonely place. But it can be

crossed. Realize that it won’t happen all at once, and start

planning your crossing today.

This article first appeared in the

target=”_blank”>Green Economy Post and is reprinted here

with the kind permisson of the author.

Source: www.minellc.com

by Michele Ashby, CEO of MiNE LLC