Libya Bombs and Saudi Bribes | Energy Information Administration

Welcome to the other side of the world’s oil troubles.

Usually, we focus on the supply and demand portion of the equation.

We’ve followed the death of Mexico’s Cantarell oil field, even coming to terms with the fact that nearly all of the world’s largest oil fields are in decline, perilously sliding down the backside of the Peak Oil curve.

And we’ve taken it all in stride…

Over the years, we’ve gotten used to a certain level of political volatility. We’re used to the threats coming from Iran’s latest gripe, or even some of Chavez’s antics.

I dare say people have grown accustomed to hearing about those issues.

Recently, we talked about how the Libya’s oil upheaval is taking its toll on the nation’s oil exports — 1.6 million barrels flowing out of Libya is at stake.

Typically, we know where to turn when disruptions like this take place.

In the past, Saudis have been the world’s go-to player in the oil game. They’re the ones that take the game-winning shot. In fact the Saudis are only one of two countries with any potential for raising production…

And that’s exactly why you should be worried.

Libya bombs and Saudi bribes

Not surprisingly, Gaddafi refuses to back down to the opposition. And he’s not pulling any punches, either.

The latest round of air strikes took place close to Ras Lanuf, a major oil hub on the Mediterranean. The Ras Lanuf refinery has a capacity of 220,000 barrels per day.

The news fueled the speculator frenzy, pushing Brent prices to nearly $120/bbl and WTI crude to a 29-month record over $105 per barrel. And yet, despite the increasing violence in Libya, the simple truth is that losing their 1.6 million barrels per day isn’t enough to lead to a collapse…

But 9 million barrels per day is something to worry about.

And that’s roughly the amount of oil flowing from Saudi Arabia every day.

Imagine how speculators will react if and when the political unrest spreads, or catches hold in the Saudi Kingdom…

Instead of bombs, the Saudi King is using another tactic: bribes.

Last week, the Saudi king shelled out more than $30 billion in welfare benefits, apparently crossing his fingers that it’s enough to quell any planned uprisings.

Like it or lump it, the Saudis hold the world’s oil production on their shoulders. The country boasts the mighty Ghawar oil field, which produces more than five million barrels per day. As you know, the Saudis have pledged to increase oil production in light of Libya’s geopolitical fiasco.

Unfortunately, the Saudis can’t bail the world out — not this time.

One problem glossed over by most people is the fact that much of OPEC’s spare capacity is heavy, high-sulfur crude.

Europe’s refineries have already given Saudi oil a thumbs-down.

Sadly, the Saudi’s sour crude isn’t the same. And it certainly isn’t a good replacement for the light, sweet crude coming out of Libya….

You see, while Libya’s oil production might only account for approximately 2% of the world’s oil, it’s a high-quality grade — which means it’s much cheaper to refine.

This adds to the problem. Do we need to be reminded of the last time there was a shortage of this sweet crude?

All of our wallets felt that unpleasantness as crude prices surged to $147/bbl in the summer of 2008.

That puts the ball into Kuwait’s hands.

The country — along with the UAE and Nigeria — have said they will increase total production by 300,000 barrels per day. However, Kuwait’s oil industry has problems of their own, some of which we’ll delve into next week.

For now, just hold your nose and brace for the plunge.

Summertime blues

While you’re at it, you also might want to get used to the exorbitant pump prices.

Even though our largest source for crude oil is Canada, but we still haven’t kicked our addiction to OPEC.

Approximately 14% — 1.5 million barrels per day — comes from the Persian Gulf.

The Energy Information Administration recently increased their latest projection for crude, and now expect prices to average about $105 per barrel in 2011.

And gasoline prices are going to rise right alongside crude oil…

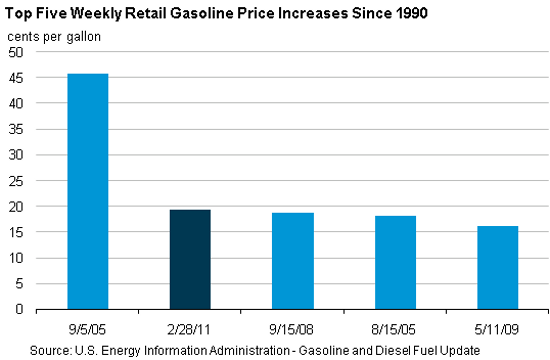

The EIA said today that gasoline prices jumped 34 cents per gallon this week. On February 28, the EIA reported the second largest one-week increase in gasoline prices since 1990.

Take a look for yourself:

Sadly, this is just the beginning of your painful fill-ups…

Gasoline prices averaged $3.52 per gallon this week. The EIA is expecting gasoline prices to average $3.71 per gallon during this year’s driving season, even exceeding $4 per gallon during the peak of the driving season (April through September).

Then again, if the Saudis fall victim to the same geopolitical turmoil dominating the Middle East… we’ll be wishing for $4 per gallon.

Until next time,

Keith Kohl

You can return to the main Market News page, or press the Back button on your browser.