Germany is trying to rely less on Russian energy

For decades, Germany has been a steadfast consumer of Russian natural gas, a relationship that has seemingly grown closer over the years, surviving Cold War-era tensions, the breakup of the former Soviet Union and even European sanctions against Moscow over its annexation of Crimea. Until this winter.

For decades, Germany has been a steadfast consumer of Russian natural gas, a relationship that has seemingly grown closer over the years, surviving Cold War-era tensions, the breakup of the former Soviet Union and even European sanctions against Moscow over its annexation of Crimea. Until this winter.

Since November, the amount of natural gas arriving in Germany from Russia has plunged, driving prices through the roof and draining reserves. These are changes that Gazprom, Russia’s state-controlled energy behemoth, has been regularly pointing out.

“As much as 85 percent of the gas injected in Europe’s underground gas storage facilities last summer is already withdrawn,” Gazprom said on Twitter a couple of weeks ago, adding that “facilities in Germany and France are already two-thirds empty.”

With tensions between the West and Russia over Ukraine — a key transit country for Russian gas — showing few signs of easing, Germany’s new minister for the economy and climate change, Robert Habeck, has begun to raise an issue that was unthinkable just a year or two ago: looking beyond Russia for the country’s natural gas needs.

“The geopolitical situation forces us to create other import opportunities and diversify supply,” Mr. Habeck, who is a member of the environmentalist Greens, said last week. “We need to act here and secure ourselves better. If we don’t, we will become a pawn in the game.”

Now the government is reviving plans for building a terminal for liquefied natural gas, or L.N.G., on Germany’s northern coast. That proposal, long pushed by Washington, was previously shelved as being too costly. But in recent months, liquefied natural gas, arriving via giant tankers from the United States, Qatar and other locations, has become a vital source of fuel for Europe as supplies piped in from Russia have dwindled.

Europe has more than two dozen L.N.G. terminals, including ones in Poland, the Netherlands and Belgium, but the one proposed for Germany’s coast would be the country’s first.

The government is also considering rules that would require energy companies to maintain a base level of natural gas in reserve. Last week, the amount of natural gas in the country’s storage tanks had dropped to 35 to 36 percent, the government said, below the level considered necessary at the start of February to survive a week of bitter cold. Roughly a quarter of all Germany’s natural gas capacity is held in facilities owned by Gazprom, including the country’s largest underground tank.

These moves are in addition to efforts to build more renewable sources of power, such as expanding wind and solar capacities.

Natural gas is an increasingly critical source of energy for Germany. Last year it accounted for nearly 27 percent of the energy consumed, according to government figures, an increase from 2020 that is expected to continue when the country shutters its last three nuclear power plants in December and works to phase out coal-burning power plants by 2030. And two-thirds of the gas Germany burned last year came from Russia.

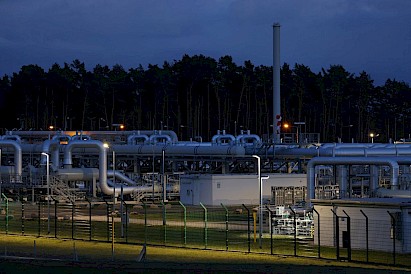

For years, Germany’s Western and European partners — especially the United States, Poland and the Baltic countries — have expressed concern over Germany’s reliance on Russia for natural gas. Construction of a pipeline called Nord Stream 2 was completed last year and further outraged Germany’s partners. The pipeline runs 746 miles under the Baltic Sea from the Russian coast near St. Petersburg to northeastern Germany.

German allies’ repeated warnings that President Vladimir V. Putin of Russia could use the link as a way to exert energy blackmail over Europe fell on deaf ears in Berlin, where, as recently as December, Chancellor Olaf Scholz referred to the $11 billion pipeline as “a private-sector project.”

Even as Germany tries to become more independent of Russia, Nord Stream 2 is a continuing reminder of a tight relationship.

The undersea pipeline is owned by a subsidiary of Gazprom, but it was financed with money from European energy companies. Two German energy companies, Uniper and Wintershall DEA, along with Austria’s OMV, Energie from France and Shell, put up a total of 950 million euros (about $1.08 billion) in 2017, providing half the cost of construction.

The pipeline has yet to begin operating, as it awaits approval from a German regulator that is not expected before the second half of this year. But last week, President Biden told reporters in a news conference with Mr. Scholz that if Russia invaded Ukraine, “then there will be no longer a Nord Stream 2,” adding: “We will bring an end to it.”

Standing nearby, Mr. Scholz noticeably didn’t match those words. Although he no longer insists the pipeline is purely an economic undertaking, he has not yet been as forthcoming about preventing it from operating. The financial implications of such a move may be part of his reasoning.

If the German government prevents the pipeline from ever going into operation, it could potentially be liable for damages owed to the companies involved, including claims for the years that it should have been in operation.

Those costs could run as high as €40 billion, according to estimates worked out by Jonathan Stern, a distinguished research fellow at the Oxford Institute for Energy Studies.

“This is only if it is assumed that the pipeline never operates,” he said in an email, stressing that the calculation was based on a lot of assumptions. “It could be claimed that it is just ‘delayed,’ i.e. that it could start up in a few years if ‘circumstances change.’”

The ties binding Germany to Russian gas are more than financial. Gerhard Schröder, who preceded Angela Merkel as chancellor from 1998 to 2005, is known for his cordial ties with Mr. Putin. He is the chairman of Rosneft, the Russian state oil firm, and chairman of Nord Stream, the subsidiary of Gazprom that owns the pipeline, and has been nominated to join the board of Gazprom.

Recently, the chief executive of a company that gave Nord Stream 2 financial backing, Alfred Stern of OMV, warned against singling out the pipeline when gas levels in Europe were low and prices high.

“I believe that neither Nord Stream 2 nor any other distribution channels need to be seen in isolation,” Mr. Stern said. “We should be aware of the fact that we need gas in Europe — there is a shortage of gas, production levels are going down, and demand now and in the near future will remain high.”

And the market for liquefied natural gas may tighten. Concern is growing in the United States that the push to export natural gas is disrupting the domestic market, driving up prices for Americans who rely on it to heat their homes.

“There has been a lot of talk about energy transformation, diversification away from Russia, but realizing we still depend very much on natural gas and Russia,” said Kirsten Westphal, executive director of the H2 Global Foundation and a member of the German Hydrogen Council.

The ultimate solution to this problem, she said, is to focus much more resources on developing clean replacements for natural gas, including hydrogen, which many hope could eventually replace the fossil fuel in existing pipelines and power plants.

“Now is the time for the government to really push for green and clean gases and to quickly transition to green and climate-neutral hydrogen and make the infrastructure hydrogen-ready,” she said.

While that remains the German government’s goal, leaders in the interim have been forced to acknowledge the reality of their reliance on natural gas from Russia and the dangers that dependence poses to Europe’s largest economy.

“Germany is still highly dependent on imports of fossil fuels,” Mr. Habeck told lawmakers last month, acknowledging that the expansion of renewables would not happen overnight or without resistance from some corners. “Strategically, it is the right thing to do, not only to protect the climate but also to increase the resilience of the German economy.”

You can return to the main Market News page, or press the Back button on your browser.