Financial Risks of Oil Sands Greater than BP's Gulf Oil Spill

While public attention is focused on widespread environmental and

financial damage from the Gulf of Mexico oil spill, a new Ceres

report released today shows that the environmental and financial

risks of producing oil in Canada’s vast oil sands region may be

even greater.

Alberta’s oil sands are already the world’s largest energy

project-with $200 billion in funds committed from the world’s

leading oil producers, including BP, ExxonMobil and Shell.

However, these producers face numerous environmental, production

and distribution challenges that will grow as the oil sands

industry pushes to boost production amid tighter regulations and

resource constraints, concludes the Ceres-commissioned report authored by RiskMetrics

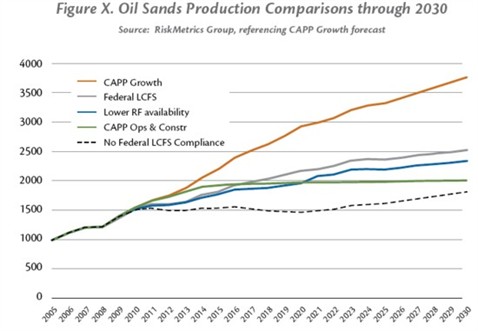

Group. Oil sands companies in Alberta are already producing 1.3

million barrels a day, and their goal is to triple production by

2030.

“The risks for companies involved in developing Canada’s oil

sands are arguably greater than those in the Gulf of Mexico,” said

Ceres president Mindy Lubber, whose group commissioned the report,

Canada’s Oil Sands: Shrinking Window of

Opportunity. “The energy-and water-intensive nature of

oil sands, combined with climate change regulations, permitting

obstacles and other challenges, are a recipe for diminishing

revenues and returns if not properly managed.”

The report recommends that oil sands companies move quickly to

examine and respond to these multiple challenges facing the

industry and that investors press the companies for such action,

too. Investors have already filed shareholder resolutions on the

oil sands topic with Royal Dutch Shell, ExxonMobil, BP and

ConocoPhillips. The Shell resolution will be voted on at tomorrow’s

annual corporate meeting in London. ExxonMobil’s shareholder

resolution is up for a vote on May 26.

While just over half of U.S. oil comes from overseas countries

like Venezuela and Saudi Arabia, the fastest growing source is from

two North American regions - the Gulf of Mexico and Canada’s vast

oil sands region. Oil production from these two areas has grown to

three million barrels a day in recent years, supplying more than 15

percent of total U.S. oil needs.

While deepwater oil production in the Gulf has huge

environmental risks that are obvious today, this report concludes

that long-term risks from development in Canada’s oil sands region

are arguably greater. Many of these risks stem from already-high

financial costs and the environmental impacts of transforming

highly viscous bitumen into synthetic crude oil - a process that

requires vast amounts of energy and water.

“Investors need to question whether this is a wise use of

resources,” says Doug Cogan, a report co-author and director of

climate risk management for RiskMetrics Group. “The oil sands

process takes natural gas-the cleanest-burning and lowest-carbon

fossil fuel-to turn one of the dirtiest and highest-carbon fuels

into a saleable product. Large volumes of freshwater are also

consumed in the process, and end up in toxic tailings

ponds.

It’s like the Gulf of Mexico spill, but playing out

in slow motion. From a climate and ecological perspective,

we’re really no better off.”

“This report makes clear that oil sands companies must do more

to analyze the far-reaching risks from current and future

production in Alberta,” said Jack Ehnes, chief executive officer of

the California State Teachers’ Retirement System (CalSTRS), the

nation’s second largest public pension fund. “With nearly $1.9

billion invested in the equity securities of BP, Shell, Exxon and

ConocoPhillips combined, we have quite of teachers’ money at stake

here. We need to ensure these companies are properly recognizing

and managing oil sand risks.”

The Ceres/RiskMetrics report examines how new carbon-reducing

and land reclamation regulations, climate change and other

environmental and social issues could create additional cost- and

profit-margin constraints on future oil sands production.

Among the report’s key findings:

Shrinking profit margin: The costs of

producing oil sands - already the world’s most expensive source of

new oil - are rising and will continue to do so due to the

onset of carbon pricing, higher input commodity prices, and rising

costs for water treatment and land reclamation. As a result, global

oil prices will need to remain high - possibly approaching $100 per

barrel - to ensure a competitive rate of return on $120 billion in

planned expansion projects. Oil sand operators must also be mindful

that if global oil prices get too high, between $120 and $150 a

barrel, it will likely reduce global oil demand and shift markets

in favor of alternative fuels.Vulnerability to changes in U.S.

Markets: Presently, the vast majority of of the 1.3

million barrels being produced every day flows to the United

States. Long-term access to this market is jeopardized, however, by

emerging low-carbon fuel standards in the U.S. that will require a

lower carbon intensity in transportation fuels. These fuel

standards, already adopted in California, will put carbon-intensive

oil sands fuel at a distinct disadvantage because oil sands output

will likely have to be mixed with next-generation biofuels that are

not yet being produced on a commercial scale.Other Distribution Obstacles:

Transporting expanded oil sands production west to China and other

Asian markets is another alternative. However, there is strong

opposition to building pipelines to Canada’s West Coast from

Aboriginal communities who have significant rights under the

Canadian constitution.Water and Other Resource Constraints:

Oil sands production is highly water intensive, with up to four

barrels of freshwater consumed for every barrel of oil produced

from surface mining extraction. Water withdrawals from the

Athabasca River watershed are already restricted during winter

months to protect fish habitat. If oil sands production volume

grows according to companies’ estimates, some oil sands mining

operations could exceed their wintertime allowances as early as

2014, causing possible production interruptions. Climate change may

also exacerbate this situation; glaciers feeding into the Athabasca

River watershed are already shrinking.Growing Land Reclamation

Costs/Liability: After 40 years of production, no oil

sand companies have yet fully reclaimed the extensive tailings

ponds used for holding polluted wastewater. This is because the

fine tailings in these ponds take decades to settle out. These

tailing ponds, already covering an area the size of Washington

D.C., pose risks of contaminating adjoining lands and water

resources, and present health problems in downstream communities.

Alberta’s Directive 74 requires oil sands miners to speed up

remediation of existing ponds - an order that creates especially

large liabilities for the industry’s legacy miners such as Suncor

and Syncrude.

The report calls on oil sands companies to take a cautious,

incremental approach to oil sands expansion that fully analyzes and

plans for managing these multiple risks before making additional

major investments.

The report specifically recommends that oil sands producers:

- Review the lasting impact of their proposed development plans

and pursue more pro-active, incremental strategies to manage

environmental and social risks; - Provide guidance for assumed oil, natural gas and carbon prices

in future production forecasts. - Do a better job of articulating to community groups and other

stakeholders their strategies for land use planning, water

management and carbon mitigation; - Disclose information from these more detailed evaluations to

investors; - Develop stronger ties with the U.S. biofuels industry both for

speeding up development of advanced biofuel capacity and sharing

existing infrastructure, such as oil sands pipelines that already

feed into the U.S. Midwest.

“All oil is getting dirtier and harder to

produce,” Bob Walker, vice president of sustainability at Northwest

and Ethical Investment in Canada.

“With Chinese investment and demand set to grow outside the

U.S., oil sands production is likely to grow. Investors need to be

aware of the environmental and social risks and engage oil sands

companies to improve disclosure, operational performance and to

make technological investments to reduce environmental and social

impacts.”

“We recognize that oil companies will continue to invest in the

oil sands,” continued Lubber, “but they shouldn’t do so blindly.

Investors need assurances that the risks outlined in this report

are being taken into account. This includes the fact that

carbon will be regulated, that water will be increasingly scarce,

that tailings ponds need to be cleaned up, and that doing all this

will be expensive. Companies need to build solutions in up front or

they shouldn’t be building these projects at all.”

The full report is available at

target=”_blank”>http://www.ceres.org//oilsandsreport and

Source: www.ceres.org