Environmental Services in Mexico

Summary

SummaryThe environmental goods and services industry consists of activities which produce goods and services to measure, prevent, limit, minimize and correct environmental damage to water, air and soil, as well as problems related to waste, noise and eco systems. This includes cleaner technologies, products and services that reduce environmental risk and minimize pollution and resource use.

The total market size for environmental products and services at the end of 2007 was over US$7.5 billion of which engineering services are over 15 percent. The market for this sector is expected to grow at seven percent from 2007 to 2008. An environmental business directory recently announced that there are about 2,800 environmental service companies actually operating in Mexico.

Overview:

This report provides a strategic profile of Mexico’s environmental services sector. The report investigates the economic fundamentals affecting Mexico. These fundamentals are the source for Mexico’s latent demand. If a firm decides to have a local presence in Mexico, this requires a strategic understanding of local business conditions.

Over the past few decades, Mexico has experienced rapid economic growth. Despite several serious economic crises, Mexico’s real gross domestic product (GDP) grew 205% between 1971 and 2007. While this economic expansion succeeded in raising average incomes for Mexico’s growing population, inadequate attention to pollution controls and infrastructure considerations led to significant environmental degradation.

Though there had been public health elements to previous pieces of legislation, Mexico only began to seriously address environmental protection in the late 1980’s and early 1990’s. The first comprehensive environmental bill, the General Law of Ecological Balance and Environmental Protection (LGEEPA), was enacted in 1988. In 1996, it was amended to make sustainable development an explicit concern of the federal government. Mexico has given principal responsibility for environmental policy to the Secretariat of Environment and Natural Resources (SEMARNAT), although important enforcement duties are delegated to state and local governments.

What are environmental goods and services?

The pollution management group includes goods that help control air pollution; manage wastewater and solid waste; clean up soil, surface water and groundwater; reduce noise and vibrations; and facilitate environmental monitoring, analysis and assessment. They are classified into four categories: Pollution management; Cleaner technologies and products; Resource management; and Environmentally preferable products.

The classification of environmental services better reflect how the industry operates. Growing public sensitivity to environmental problems, more stringent regulations, and trends towards privatizing and liberalizing services markets, have stimulated a wide range of specialized environmental services.

The different sectors are categorized as follows:

- Air Pollution Control & Climate Change Services

- Analytical & Testing Services

- Energy & Energy Saving Services

- Health & Safety Services

- Information & Data Services

- Insurance Services

- Legal & Regulatory Services

- Management Services

- Professional Organizations

- Soil & Groundwater Services

- Waste Management & Recycling Services

- Tire Recycling Services

Goods under the category of resource management are used to control indoor pollution, supply water, or to help manage farms, forests or fisheries sustainability.

Priority of Services:

A major priority for Mexico is water and wastewater treatment infrastructure. Private operators already treat almost 40% of municipal wastewater in Mexico. Municipalities throughout Mexico anticipate construction and operation of many wastewater treatment plants by the end of 2008. The Mexican government is providing funding for most of these plants.

A study by the Federal Urban Development Department indicates that a national strategy and regulatory framework must be drawn up for management and disposal of solid waste in Mexico given that garbage production will rise to 39.1Mt a year by 2010. To date, 48 cities in the country have decided to privatize some aspect of waste management, with just seven companies offering services. Environmental investment forecasts to the year 2025 indicate Mexico needs to invest nearly US$5 billion to modernize irrigation, and improve water and wastewater treatment systems.

Air Pollution and Control Services

Much discussion of Mexico’s environment now occurs within the context of the North American Free-Trade Agreement (NAFTA), which mandates that Mexico raise its environmental protection standards to those in the United States. The incongruities between Mexican and United States environmental laws are being addressed through bilateral negotiations.

The attention that Mexico is now paying to environmental protection has achieved some benefits according to the Organization for Economic Co-operation and Development (OECD). For example, pollution control measures that went into effect in the mid-1990s have succeeded in visibly improving air quality in Mexico City. Nevertheless, economic and population growth continue to place pressure on the Mexican environment.

Mexico City, Guadalajara and Ciudad Juarez are the most polluted, with Mexico City’s air quality being among the worst in the world. The Mexican government recognizes the severity of pollution levels and has implemented legislation addressing the problem.

Air quality in Mexico City is poor, with other Mexican cities experiencing increasing elevations of harmful pollutants. Exhaust fumes from Mexico City’s 3.5 million cars (approximately) are the main source of air pollutants. Problems resulting from the high levels of exhaust are exacerbated by the fact that Mexico City is situated in a basin 7,400 feet above sea level. The geography prevents winds from blowing away the pollution, trapping it above the city. Guadalajara, Mexico’s second largest urban center exceeds pollution limits 90% of the year, due largely to the large number of vehicles operating in the city.

Ciudad Juarez, a border city of 1.4 million inhabitants, is home to many assembly plants (“maquiladoras”) that are responsible for the release of dangerous substances into the environment. Though automobiles still account for 90% of air pollution, industrial growth is also causing increased environmental damage to the area. Air pollution in northern Mexico also impacts U.S. border areas. The Mexican government has presented several innovative proposals for fighting air pollution, including incentives for using cleaner fuels and smog control measures. Mexican environmental initiatives include developing clean taxis and small buses in order to reduce urban emissions; improving environmental infrastructure; and strengthening the northern border regions’ environmental planning and administration.

In Mexico City, environmental authorities are implementing “Proaire”, a ten-year quality management program for the metropolitan area that started in 2001. Efforts have not been very successful due to a rapid increase in used vehicles in circulation. The authorities have increased the number of “no circulating” days to include Saturdays and sometimes Sundays.

Mexican environmental initiatives include developing clean taxis and small buses in order to reduce urban emissions; improving environmental infrastructure; and strengthening the northern border regions’ environmental planning and administration.

Other environmental initiatives throughout Mexico include:

- Replacing, retrofitting and upgrading inefficient machinery, engines, and equipment for clean technologies

- Emissions testing and control

- Medical waste incineration

- Reducing energy consumption

- Cost-effective alternative energies and fuels

- Improving internal combustion

- Fuel conversion technologies

- Tire recycling plants

Mexico requires significant investment in both hazardous waste and municipal solid waste management. Less than half of both municipal solid waste and hazardous waste receives proper handling, confinement and/or treatment in Mexico. In recent years, Mexico’s Environmental Protection Attorney’s General Office, PROFEPA, has stepped up enforcement efforts aimed at ensuring the proper management of hazardous waste, thereby creating significant opportunities for suppliers of specialized technology, services and equipment.

Likewise, many local governments are investing considerable resources in solid waste infrastructure and services. Nevertheless, virtually all-urban areas in Mexico still lack adequate waste management facilities and processes.

The SEMARNAT has put in place programs to promote waste minimization and recycling but these represent only partial solutions. Mexican cities are home to a large number of illegal dumps, while industrial waste is often mixed with municipal waste, discharged into sewers or water bodies, and improperly stored on-site.

These conditions create a great risk to public health and the environment. The border regions and large metropolitan areas offer the opportunities for companies specializing in solid and hazardous waste treatment. Border projects also benefit from funds made available from the North American Development Bank (which finances municipal solid waste projects within 100 km of the border) and other financing mechanisms. Likewise, urban areas have the greatest need for new landfills and have the greatest amount of financial resources to meet the need.

Municipal Solid Waste

As in the case with many developing nations, Mexico faces serious difficulties in the management of urban refuse and solid waste. It is estimated that over 92,000 tons of solid waste is generated in the country every day. Yet, there is a general lack of proper treatment and disposal facilities, institutional capacities are weak, and financial support at local and municipal levels is frequently deficient. The problem is exacerbated by (a) the sustained population growth; (b) the high rate of rural migration to urban settings; and (c) an increased degree of industrialization and associated local consumption patterns.

Currently, more than 60% of the population of 97 million live in cities with over 15,000 inhabitants. Per capita generation of urban refuse has also increased. It is estimated that 0.7 kilograms to 1.3 kilograms of solid waste is generated per person per day, with an average organic content of about 71%.

Regrettably, of all the solid waste generated, only 77% is collected (62 000 tons), and less than 35% is disposed of under sanitary conditions (29,000 tons). Per capita solid waste generation is linked to household income and city size.

In recent years, Mexican cities have been involving the private sector more and more to assist them in managing the collection, transportation and/or disposal of municipal solid waste (MSW).

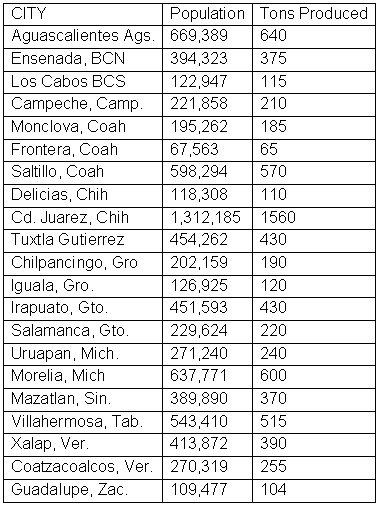

Today, 39 Mexican cities have some form of private sector involvement in solid waste management. SEDESOL (Secretariat of Social Development) is responsible for providing technical and administrative assistance to municipalities related to MSW. The cities that are good candidates for private sector involvement in the near future include those listed in the table below.

Industrial Waste

Mexican industry produces in the neighborhood of 10 million tons per year of hazardous waste. The lack of proper collection, treatment, and disposal of hazardous waste is a serious problem in Mexico. Although new treatment technologies such as waste to energy schemes, recycling, reclamation and remediation are beginning to take hold in Mexico, the vast majority of hazardous waste produced in Mexico is not properly disposed of.

The drivers that may translate the hazardous waste treatment solutions into private sector opportunities are, among others:

- Stricter enforcement of existing hazardous waste mandatory standards;

- Creation of mandatory soil remediation standards;

- Reducing the cost of treatment alternatives by breaking a monopoly on hazardous waste confinement.

- Residuos Industriales Multiquim (RIMSA) is the most important hazardous waste dump and is located in northern Mexico near Monterrey). This will drive down not only confinement and transport costs (as there is only one facility in the whole country) but also recycling and other treatment due to competitive factors.

- Develop and implement training, education and public relations programs to inform SME industries regarding the multiple options available in the marketplace, as well as the need to separate non-hazardous from hazardous industrial wastes.

- Develop and maintaining an accurate and reliable national hazardous waste inventory.

Contaminated Site Remediation and Restoration Program

The Mexican Environmental Infrastructure Commission (COMIA) is spearheading a program to develop and implement a plant to restore over 300 contaminated sites across Mexico.

The COMIA is currently finalizing the list of contaminated sites, which is expected to reach approximately 300. Once the inventory is complete, a trust will be created, consisting of approximately US$10 million, which will be used to provide the landowners short-term loans to contract private companies to conduct the site remediation. In exchange for the loan, the trust will take a security interest in the property, which will be released once paid back.

The program includes both a carrot and a stick: The carrot being the loan (in many cases the property is so contaminated that title is no longer marketable) and technical assistance in assessing the problem and choosing the contractor), and the stick being PROFEPA, who, if the remediation is not carried out, will condemn the property.

Companies interested in providing site remediation and restoration services under the program are advised to contact the COMIA directly as indicated below.

Comisión Mexicana de Infraestructura Ambiental COMIA

Lancaster N° 15, piso 4

Col. Juárez

México D.F., 06600,

Tel (52-55) 5229-1179

Fax: (52-55) 5229-1193

e-mail: comia@cce.org.mx

For More Information

The U.S. Commercial Service in Monterrey, Mexico, can be contacted via e-mail at: ernesto.dekeratry@mail.doc.gov; Phone:+52-81-834-2120, ext 496, Fax: +52-81-8343-4440 or visit our website: www.buyusa.gov/your_office.

Excerpts from: Overview of the Environmental Services Sector In Mexico, U.S. Commercial Service, September 2008.

You can return to the main Market News page, or press the Back button on your browser.