Business-as-unusual outlook for oil in the medium term

There is a curious twist to the many messages emerging from the International Energy Agency (IEA) annual Medium-Term Oil Market Report (MTOMR) released today.

On the one hand, says the Agency, it will be business as usual for oil in the medium term; but on the other hand everything has changed.

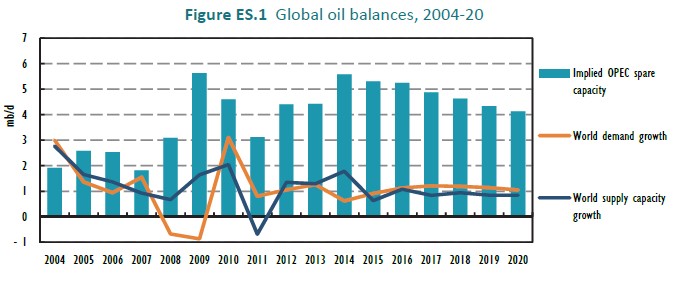

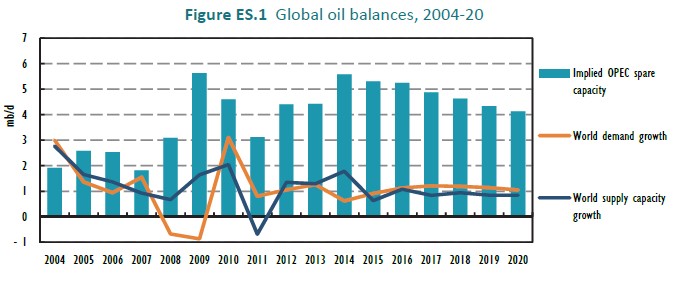

The recent crash in oil prices will cause the oil market to rebalance in ways that challenge traditional thinking about the responsiveness of supply and demand. In effect, supply will increase, but demand will stay sluggish for the medium term.

The US light, tight oil (LTO) revolution has made non-OPEC production more responsive to price swings than during previous market selloffs, the report said, adding that this would likely set the stage for a relatively swift recovery.

At the same time, lower oil prices will not provide as strong a boon to oil demand growth as one might have expected. As producers take an axe to their spending, supply will grow far more slowly than previously projected, but global capacity is still forecast to expand by 5.2 mb/d by 2020, and the toll on production will vary by country.

Growth in US LTO is expected to regain momentum in the latter part of the forecast period as prices recover, and North America remains a top source of supply growth for the remainder of the decade.

But Mother Russia faces a perfect storm of lower prices, sanctions and currency swings, pushing its production into contraction. OPEC’s share of global supply will inch up from recent lows but will not recover to the levels enjoyed before the surge in LTO supply.

“This unusual response to lower prices is just one more example of how shale oil has changed the market,” said IEA Executive Director Maria van der Hoeven, who launched the report at the Energy Institute’s International Petroleum Week in London.

“OPEC’s move to let the market rebalance itself is a reflection of that fact. It may have effectively turned LTO into the new swing producer, but it will not drive it out of the market. LTO might in fact come out stronger,” she says.

Also affecting the traditional assumptions about supply and demand is the fact that the latest price drop is also occurring at a time when the dynamics of global demand and the place of oil in the fuel mix are undergoing dramatic change.

Emerging economies – China chief among them – which 10 years ago seemed an unstoppable engine of near-vertical demand growth, have entered a new, less oil-intensive stage of development.

The global economy, reshaped by the information technology revolution, has generally become less fuel intensive. Concerns over climate change are recasting energy policies.

And the globalization of the natural gas market, coupled with steep reductions in the cost and availability of renewable energy, are causing oil to face a level of inter-fuel competition that would have seemed unfathomable a few years ago.

What about the price of oil?

The real question is not so much how price and supply growth expectations have been reset, nor whether a rebalancing of the market will occur – for that is inevitable, says the IEA.

The issue is how that necessary rebalancing, and the price recovery that will accompany it, might depart from those that followed similar price drops in the past, and where they will leave the market after they run their course.

Unlike earlier price drops, this one is both supply- and demand-driven, with record non-OPEC supply growth in 2014 providing only one of the factors behind it, unexpectedly weak demand growth another.

On the supply side, US light, tight oil (LTO) extraction technologies, which at the time of the previous market correction barely registered as a source of production, have unlocked a vast resource that long seemed off-limits, and have profoundly upended the traditional division of labour between OPEC and non-OPEC.

As with previous editions of this Report, the price assumptions (the IEA does not do forecasts) used as modelling input as derived from the futures curve suggests price will remain roughly at USD 55/bbl for 2015, ramping up gradually to USD 73/bbl in 2020.

These prices suggest the market will recover somewhat as it rebalances following cuts in upstream investment. Despite that improvement, however, the market does not seem to be expecting prices to revisit earlier highs any time soon.

Not only have prompt prices collapsed, even price expectations for the back end of the curve have been significantly downgraded.

Geopolitical uncertainties abound

Rarely has the oil market faced geopolitical changes as sweeping as today, notes the report.

Not all factors can be easily predicted, it states. Much hangs on the outcome of talks between Iran and the “P5+1”, on Islamist violence in oil-producing countries, and on future relations between Russia and the West. Such geopolitical risk factors are themselves a defining feature of the oil market for the medium term.

Assuming that international sanctions on Iran remain in place, OPEC growth in crude production capacity is expected to be limited to 200 kb/d per year. The overwhelming majority of that growth will come from Iraq and will thus be at significant risk as geopolitical instability there persists.

Political risk to supply will remain extraordinarily elevated in the next few years, both on the upside and the downside. Lower oil prices may heighten the risk of political disturbances in oil-export-dependent economies countries with low buffers, but can also offer an incentive to maximize output and stimulate production growth.

A combination of cyclical and structural factors will keep the demand response to lower prices relatively subdued, and demand in several key oil exporters will be hurt by the revenue loss.

Nevertheless, global demand is now expected to grow slightly faster than supply capacity, causing the market to gradually tighten and the “call on OPEC and stocks change” to rise from 2016 onwards.

Refining and product supply

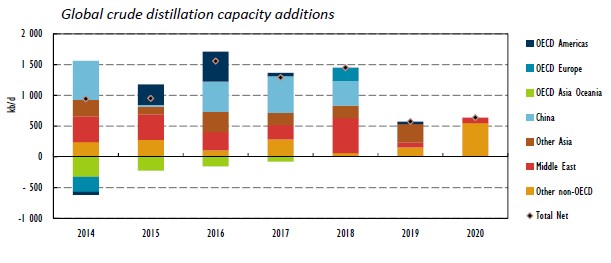

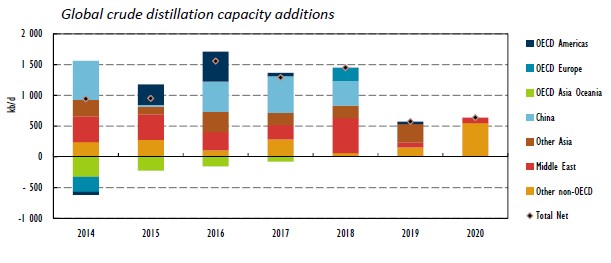

Meanwhile the global refining industry continues to reinvent itself. Expansions continue, with capacity set to rise by 6.4 mb/d by 2020 to 102.1 mb/d, slightly more slowly than previously forecast, as China, in particular, scales back some projects in the face of weaker-than-expected domestic demand growth.

Most of the capacity growth takes place east of Suez, notes the report, with emerging Asia (including China) in the lead, followed by the Middle East.

Although refining capacity growth closely tracks demand growth, in practice excess refining capacity looks set to grow, as up to one third of incremental product demand is expected to be met by liquids that will bypass the refining system altogether such as natural gas liquids, biofuels, gas-to-liquids and coal-to-liquids.

As such, refinery margins are expected to remain under pressure and further capacity rationalization in mature markets looks inevitable, as product flows from new start-ups hit the market.

Biofuels production to rise

Biofuels In addition to providing most of the world’s new liquid hydrocarbon supply, the Americas also remain the leading source of renewable fuels, particularly ethanol.

While lower oil prices may theoretically cause biofuels to grow less competitive against hydrocarbon fuels in mature markets, in practice production is expected to remain unaffected as biofuel consumption remains largely mandate-driven.

Demand growth in the United States, Brazil and even the European Union appears to be running out of steam, but new mandates in Asia – largely a lagged legacy of years of record-high oil prices, growing oil-import bills and oil-subsidy costs – is picking up the slack.

Indeed, world biofuel production is projected to rise slightly faster than previously expected, reaching 2.4 mb/d by 2020, up from roughly 2.2 mb/d in 2014.

Like previous editions, MTOMR 2015 offers detailed analysis and forecasts of demand, OPEC and non-OPEC supply, refining capacity, crude trade and product supply. This year’s edition also includes a focus on the impact of changing emission standards for marine fuels, which make up 4% of global demand.

On the one hand, says the Agency, it will be business as usual for oil in the medium term; but on the other hand everything has changed.

The recent crash in oil prices will cause the oil market to rebalance in ways that challenge traditional thinking about the responsiveness of supply and demand. In effect, supply will increase, but demand will stay sluggish for the medium term.

The US light, tight oil (LTO) revolution has made non-OPEC production more responsive to price swings than during previous market selloffs, the report said, adding that this would likely set the stage for a relatively swift recovery.

At the same time, lower oil prices will not provide as strong a boon to oil demand growth as one might have expected. As producers take an axe to their spending, supply will grow far more slowly than previously projected, but global capacity is still forecast to expand by 5.2 mb/d by 2020, and the toll on production will vary by country.

Growth in US LTO is expected to regain momentum in the latter part of the forecast period as prices recover, and North America remains a top source of supply growth for the remainder of the decade.

But Mother Russia faces a perfect storm of lower prices, sanctions and currency swings, pushing its production into contraction. OPEC’s share of global supply will inch up from recent lows but will not recover to the levels enjoyed before the surge in LTO supply.

“This unusual response to lower prices is just one more example of how shale oil has changed the market,” said IEA Executive Director Maria van der Hoeven, who launched the report at the Energy Institute’s International Petroleum Week in London.

“OPEC’s move to let the market rebalance itself is a reflection of that fact. It may have effectively turned LTO into the new swing producer, but it will not drive it out of the market. LTO might in fact come out stronger,” she says.

Also affecting the traditional assumptions about supply and demand is the fact that the latest price drop is also occurring at a time when the dynamics of global demand and the place of oil in the fuel mix are undergoing dramatic change.

Emerging economies – China chief among them – which 10 years ago seemed an unstoppable engine of near-vertical demand growth, have entered a new, less oil-intensive stage of development.

The global economy, reshaped by the information technology revolution, has generally become less fuel intensive. Concerns over climate change are recasting energy policies.

And the globalization of the natural gas market, coupled with steep reductions in the cost and availability of renewable energy, are causing oil to face a level of inter-fuel competition that would have seemed unfathomable a few years ago.

What about the price of oil?

The real question is not so much how price and supply growth expectations have been reset, nor whether a rebalancing of the market will occur – for that is inevitable, says the IEA.

The issue is how that necessary rebalancing, and the price recovery that will accompany it, might depart from those that followed similar price drops in the past, and where they will leave the market after they run their course.

Unlike earlier price drops, this one is both supply- and demand-driven, with record non-OPEC supply growth in 2014 providing only one of the factors behind it, unexpectedly weak demand growth another.

On the supply side, US light, tight oil (LTO) extraction technologies, which at the time of the previous market correction barely registered as a source of production, have unlocked a vast resource that long seemed off-limits, and have profoundly upended the traditional division of labour between OPEC and non-OPEC.

As with previous editions of this Report, the price assumptions (the IEA does not do forecasts) used as modelling input as derived from the futures curve suggests price will remain roughly at USD 55/bbl for 2015, ramping up gradually to USD 73/bbl in 2020.

These prices suggest the market will recover somewhat as it rebalances following cuts in upstream investment. Despite that improvement, however, the market does not seem to be expecting prices to revisit earlier highs any time soon.

Not only have prompt prices collapsed, even price expectations for the back end of the curve have been significantly downgraded.

Geopolitical uncertainties abound

Rarely has the oil market faced geopolitical changes as sweeping as today, notes the report.

Not all factors can be easily predicted, it states. Much hangs on the outcome of talks between Iran and the “P5+1”, on Islamist violence in oil-producing countries, and on future relations between Russia and the West. Such geopolitical risk factors are themselves a defining feature of the oil market for the medium term.

Assuming that international sanctions on Iran remain in place, OPEC growth in crude production capacity is expected to be limited to 200 kb/d per year. The overwhelming majority of that growth will come from Iraq and will thus be at significant risk as geopolitical instability there persists.

Political risk to supply will remain extraordinarily elevated in the next few years, both on the upside and the downside. Lower oil prices may heighten the risk of political disturbances in oil-export-dependent economies countries with low buffers, but can also offer an incentive to maximize output and stimulate production growth.

A combination of cyclical and structural factors will keep the demand response to lower prices relatively subdued, and demand in several key oil exporters will be hurt by the revenue loss.

Nevertheless, global demand is now expected to grow slightly faster than supply capacity, causing the market to gradually tighten and the “call on OPEC and stocks change” to rise from 2016 onwards.

Refining and product supply

Meanwhile the global refining industry continues to reinvent itself. Expansions continue, with capacity set to rise by 6.4 mb/d by 2020 to 102.1 mb/d, slightly more slowly than previously forecast, as China, in particular, scales back some projects in the face of weaker-than-expected domestic demand growth.

Most of the capacity growth takes place east of Suez, notes the report, with emerging Asia (including China) in the lead, followed by the Middle East.

Although refining capacity growth closely tracks demand growth, in practice excess refining capacity looks set to grow, as up to one third of incremental product demand is expected to be met by liquids that will bypass the refining system altogether such as natural gas liquids, biofuels, gas-to-liquids and coal-to-liquids.

As such, refinery margins are expected to remain under pressure and further capacity rationalization in mature markets looks inevitable, as product flows from new start-ups hit the market.

Biofuels production to rise

Biofuels In addition to providing most of the world’s new liquid hydrocarbon supply, the Americas also remain the leading source of renewable fuels, particularly ethanol.

While lower oil prices may theoretically cause biofuels to grow less competitive against hydrocarbon fuels in mature markets, in practice production is expected to remain unaffected as biofuel consumption remains largely mandate-driven.

Demand growth in the United States, Brazil and even the European Union appears to be running out of steam, but new mandates in Asia – largely a lagged legacy of years of record-high oil prices, growing oil-import bills and oil-subsidy costs – is picking up the slack.

Indeed, world biofuel production is projected to rise slightly faster than previously expected, reaching 2.4 mb/d by 2020, up from roughly 2.2 mb/d in 2014.

Like previous editions, MTOMR 2015 offers detailed analysis and forecasts of demand, OPEC and non-OPEC supply, refining capacity, crude trade and product supply. This year’s edition also includes a focus on the impact of changing emission standards for marine fuels, which make up 4% of global demand.

You can return to the main Market News page, or press the Back button on your browser.