A New Race For Solar

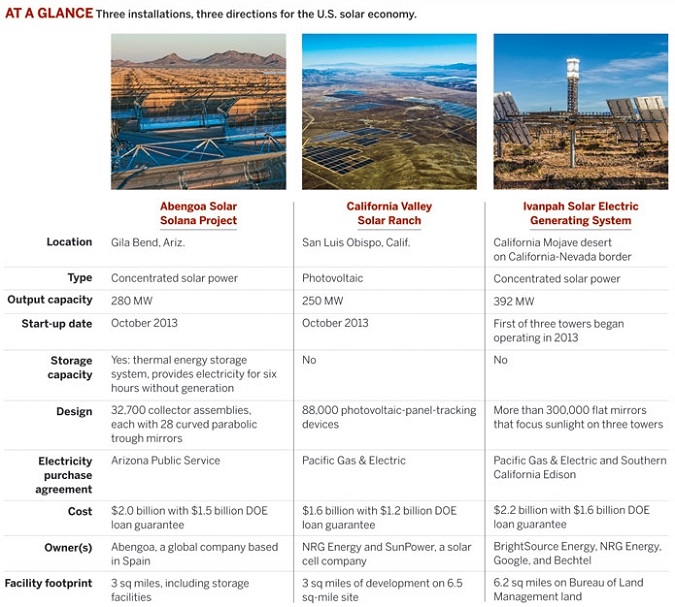

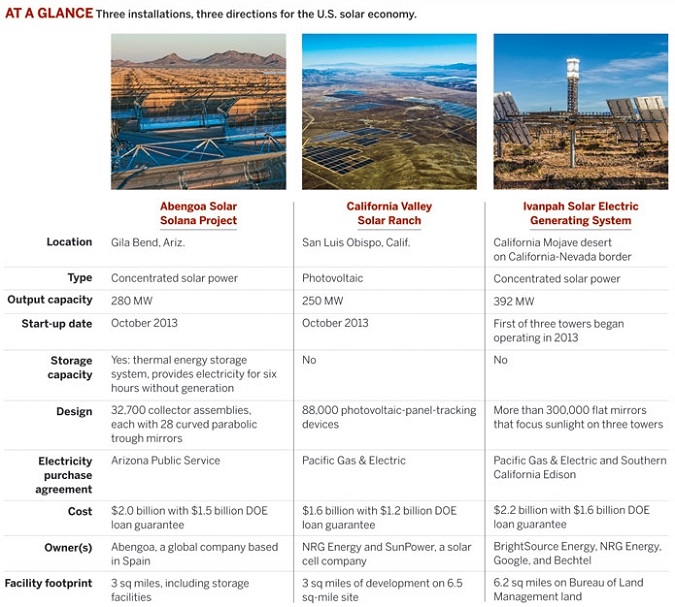

This fall, three new solar power plants came to life on large tracts of undeveloped, remote lands in the western U.S. Although solar, these three installations are huge when compared with familiar, traditional rooftop photovoltaic (PV) systems.

Combined, these utility-scale power plants have the capacity to produce more than 800 MW of electricity, equal in output to a large coal- or gas-fired power plant. And one has the capability of storing and providing electricity to the grid for six hours—without sunshine.

The three are the California Valley Solar Ranch near San Luis Obispo in central California; the Abengoa Solana project in Gila Bend, Ariz.; and the Ivanpah Solar Electric Generating System in California’s Mojave Desert.

These are just the first wave of a potential tsunami of large solar plants that are newly operating, under construction, or being planned for the southwestern U.S. They are the fastest-growing sector of a rapidly increasing solar marketplace. However, whether more of these large plants follow will depend on how well these first few fare, and specifically if electric utilities want to buy more of the electricity these plants generate.

Success will also turn on whether developers can overcome growing opposition to the projects’ large size and the environmental damage and habitat destruction that can occur with their placement. Of particular concern is their effect on fragile desert ecosystems.

These plants are being built by a mix of engineering firms, energy companies, and solar equipment manufacturers that are benefiting from a host of state and federal incentives intended to reduce carbon dioxide and other greenhouse gas emissions from fossil-fuel power plants. The incentives require electric utilities to purchase growing amounts of renewable energy, such as solar-generated electricity, and these companies are quickly building new solar power plants to make money and meet that demand.

One of the most powerful drivers has been state renewable portfolio standards, particularly California’s requirement that electric utilities obtain 33% of their electricity from renewable energy sources by 2020. The requirement has put utilities on a hunt to purchase electricity generated by solar and wind to meet state quotas.

Also backing up these incentives and the push for renewable energy is a billion-dollar Department of Energy program to provide loan guarantees for large-scale renewable energy projects and a federal investment tax credit that provides a 30% tax credit for solar construction.

It’s a perfect storm for solar generation, notes Katherine Gensler, director of federal affairs for the Solar Energy Industries Association (SEIA), a trade group. By the end of the year, about half of the U.S.’s 9,500 MW of solar power will be generated by utility-scale power plants; most of this capacity came on-line in the past year.

SEIA figures show some 4,200 MW of utility-scale generation is now under construction and another 23,000 MW of utility-scale projects are being developed. More deals are being negotiated, analysts say.

California accounts for about half the installed utility-scale solar capacity as well as some 13,000 MW of the projects under development.

What will actually be built, Gensler and other analysts note, is a big question—one with too many variables that can be answered only over time as the solar marketplace shifts away from government support.

The federal tax incentive program ends in 2016, and it is unlikely DOE’s loan guarantee program will keep its pace. Consequently, the solar expansion numbers are murky, and although solar energy has been on a sharp growth curve over the past couple of years, it still produces only around 1% of U.S. electricity. But that could swiftly change in the topsy-turvy world of energy.

Each of the three newly operating units embraces slightly different technologies. The California Valley Solar Ranch uses 88,000 PV panels, a well-known technology used in rooftop solar installations that converts the sun’s energy directly into electricity. But unlike usual rooftop units that vary from a couple of kilowatts of electricity on a house to a couple of megawatts on a Walmart or IKEA warehouse, the solar ranch produces 250 MW and is one of the largest PV systems in the world. Currently, PV installations, overall, make up about 80% of the utility-scale projects, SEIA notes.

The Abengoa Solana project and Ivanpah Solar Electric Generating System are concentrated solar power (CSP) systems that together will produce more than 650 MW of electricity. Solana generates 280 MW by using a system of curved mirrors to focus solar energy. Ivanpah generates 130 MW of electricity now but will grow to 390 MW next year as its system of flat concentrating mirrors, coupled with three power towers, is finally complete.

Like PV, these CSP systems use sunlight as fuel, but they focus the sun’s thermal energy to heat a conducting medium, such as oil or molten salt. The medium carries heat that is used to drive water to steam, and like a conventional power plant, the steam spins a turbine to do work, in this case generate electricity.

Because CSP uses a medium that retains thermal energy, it can smooth out temporary generation fluctuations in sunlight from storms or a passing cloud, which interrupts PV-generated electricity production. On the other hand, CSP systems need intense light levels for its mirrors and lenses to properly focus light and energy. Therefore, CSP is usually limited to deserts and other high-sunlight areas.

A key advantage of CSP is that it can incorporate storage into its design. The Solana project does this by storing thermal energy in molten salts, from which it is released over time. Solana can stretch out electrical output for six hours without sunshine. Similar plants with storage are in the works. Storage could be a game changer for solar power.

But this solar expansion—whether PV or CSP—has a steep price tag. These three installations are billion-dollar projects: The two CSP facilities run at around $2 billion each; the PV ranch costs $1.6 billion. The estimates are fluid, and the CSP developers hope costs will drop with more construction.

DOE has thrown its weight behind utility-scale solar installations, offering $10.5 billion in loan guarantees to help developers obtain funding for 11 projects. About one-quarter of the total dollars back up five CSP plants, two with storage. The rest of the money supports six PV plants.

Of the 11, three are the large plants that just came on-line. Two are smaller PV projects that received loan guarantees and are in operation; they have a combined capacity of 200 MW. The remaining six projects that are in development will generate 1,700 MW.

One huge PV unit—the Desert Sunlight Solar Farm—will produce 550 MW when complete. It will be built by the thin-film solar manufacturer First Solar with support and financing from a consortium of solar developers. First Solar claims the facility will be the world’s largest solar farm.

Electric utilities like these big projects, explains Bob Gibson, vice president for education and communication at the Solar Electric Power Association, a nonprofit organization of utilities and solar-related manufacturers. Utilities, he notes, are familiar with the large size and can easily manage these installations.

“Right now, there are 300,000 small rooftop photovoltaic solar units operating in the U.S. and feeding electricity into the electric grid,” he notes. “That is a lot of individual transactions for an electric utility to manage.”

The big units, Gibson says, might help encourage a “solar evolution” for utilities and might lift solar beyond the niche technology it has been in the past and elevate it to coal-plant size.

But there are problems with the jumbo size and location of these large plants. The Ivanpah project, for instance, will take up as much as 6 sq miles and is sited on the California-Nevada border. It is hundreds of miles from the homes and businesses of the Southern California population it will serve and so needs long-distance transmission lines. It is also located on fragile desert lands that turned out to be home to several hundred threatened desert tortoises. This fact was only discovered after developer BrightSource Energy began the $2.2 billion project.

A preliminary survey estimated that just 35 tortoises were on the site, and BrightSource planned to move them. However, as construction advanced, more were found, and the number of tortoises reached some 300, according to Ileene Anderson, a biologist and senior researcher with the Center for Biological Diversity, a nonprofit conservation group.

BrightSource did not return C&EN’s calls seeking comments beyond prepared statements. The firm estimated that the cost to relocate these newly found tortoises worked out to $55,000 each. Addressing these turtles also greatly stalled the project, the company says.

Anderson says Ivanpah and several other solar projects are part of a “green rush” to obtain DOE project loan support and federal tax breaks before they expire, as well as to comply with California renewable energy requirements. As a result, she says, many of these projects are not well suited for their location.

Other solar sites faced similar delays and restrictions as work began owing to a poor site selection process, she notes. One found ancient human cultural artifacts, and several turned up more threatened species living on proposed solar sites.

The proposed 250-MW Genesis Solar Energy Project site, near Blythe, Calif., for instance was found to be home to many families of kit foxes. Developer NextEra Energy Resources began harassing the fox families to drive them from their burrows at the site. Then state wildlife biologists found several foxes to be suffering from an outbreak of canine distemper, an unusual virus for foxes, and began an investigation that further delayed the solar project’s construction.

Groups like Anderson’s want to overhaul and closely regulate the site selection process. They also want to restrict solar sites to a negotiated system of state and federal “solar zones,” which is under development and where solar projects will be allowed and disruptions will be minimal.

“We want solar,” she says, “but our first choice is to put them on every rooftop in the Los Angeles Basin, not way out in the fragile desert.”

Utilities, however, need the renewable solar electricity. In a statement to C&EN, Southern California Edison, which is buying part of Ivanpah’s output, notes pressure is on to buy solar, and the utility will need to add thousands of megawatts of new projects. The California Public Utilities Commission prefers the generation source be within the state, the utility notes, and Ivanpah is just on the California side of the California-Nevada border.

“It takes a whole lot of 3- to 5-kW rooftop PV systems to make just one California Solar Ranch or an Ivanpah,” notes Cara Libby, solar research project manager at the Electric Power Research Institute, a utility-funded nonprofit.

The recent growth of utility-scale projects as well as the new expansion of CSP technologies has changed the solar formula, she adds. “There are so many new PV and CSP projects being discussed today, I really can’t keep up.”

Libby describes a race between PV and CSP technologies, both of which have inherent advantages and problems. Currently, PV is winning on market share, with about 80% of operating or under-construction utility-scale power plants. However, that could change.

“If the first utility-scale 100-MW-plus CSP projects are really successful, and we build more of them, and the cost really comes down nicely, CSP will perhaps be more attractive than PV at that point,” Libby says. “But who knows?”

A few years ago, she says, it appeared CSP systems would offer the lowest cost and have the advantage of an economy of scale, similar to a central power system, as well as storage.

Utility-scale CSP with storage goes back decades. The technology got its first big start in the 1980s and ’90s when nine CSP power plants were built in the California desert. The Solar Energy Generating Systems (SEGS) produced 354 MW, making it the largest solar power installation in the world at that time. The company that built the plants morphed into what became BrightSource Energy, Ivanpah’s builder.

Initially, some of the nine facilities in the complex had the ability to provide three hours of thermal energy storage, but in 1999, SEGS caught fire and the storage system was damaged. It was not replaced when the facility was rebuilt and improved, according to DOE. Most of SEGS is still operational today.

“The SEGS plants have been operating reliably, providing steady power for over 20 years,” notes Frank (Tex) Wilkins, an energy consultant who is retired but worked for DOE on experimental solar projects when SEGS was under construction. “Their track record convinced the financial sector that there was little risk with the technology, making it easier for today’s CSP industry to get project financing.”

But, Libby notes, big CSP units have been more difficult to permit and require significant up-front investments. PV systems also have the advantage of being built incrementally, she says, making construction easier to start without a large cash outlay. She notes that a few years back when the recession hit and solar panels plummeted in price, some solar builders switched from proposed CSP installations to PV projects.

Energy analysts say the near future of solar is unclear. “We see a lot of companies doing internal wrangling,” an analyst says. “Should we move forward with another round of projects, or should we wait and see how government policies develop?”

Gibson adds: “Future prospects for solar are good, but without state renewable portfolio standards, the scale of the plants is likely to come down. I think there is a sweet spot for utilities when building new plants at about 15 to 20 MW. PV prices are unlikely to continue to drop, but natural gas prices can go up as well as down, and coal seems too risky for investors. Nuclear is just so expensive. All this gives a boost to solar.”

Gibson and other analysts think PV construction is more likely in the near term, unless storage appears to be a highly valuable attribute, which will drive utilities to CSP.

Solar supporters were heartened by a recent announcement by Xcel Energy, a Colorado utility, to purchase 170 MW of utility-scale PV power without the enticement of federal or state incentives.

“For the first time,” notes Xcel spokesman Mark Stutz, “our analysis determined that utility-scale solar was competitive in price with other sources of electricity, including fossil-fuel-generated electricity, even without a carbon penalty.”

Combined, these utility-scale power plants have the capacity to produce more than 800 MW of electricity, equal in output to a large coal- or gas-fired power plant. And one has the capability of storing and providing electricity to the grid for six hours—without sunshine.

The three are the California Valley Solar Ranch near San Luis Obispo in central California; the Abengoa Solana project in Gila Bend, Ariz.; and the Ivanpah Solar Electric Generating System in California’s Mojave Desert.

These are just the first wave of a potential tsunami of large solar plants that are newly operating, under construction, or being planned for the southwestern U.S. They are the fastest-growing sector of a rapidly increasing solar marketplace. However, whether more of these large plants follow will depend on how well these first few fare, and specifically if electric utilities want to buy more of the electricity these plants generate.

Success will also turn on whether developers can overcome growing opposition to the projects’ large size and the environmental damage and habitat destruction that can occur with their placement. Of particular concern is their effect on fragile desert ecosystems.

These plants are being built by a mix of engineering firms, energy companies, and solar equipment manufacturers that are benefiting from a host of state and federal incentives intended to reduce carbon dioxide and other greenhouse gas emissions from fossil-fuel power plants. The incentives require electric utilities to purchase growing amounts of renewable energy, such as solar-generated electricity, and these companies are quickly building new solar power plants to make money and meet that demand.

One of the most powerful drivers has been state renewable portfolio standards, particularly California’s requirement that electric utilities obtain 33% of their electricity from renewable energy sources by 2020. The requirement has put utilities on a hunt to purchase electricity generated by solar and wind to meet state quotas.

Also backing up these incentives and the push for renewable energy is a billion-dollar Department of Energy program to provide loan guarantees for large-scale renewable energy projects and a federal investment tax credit that provides a 30% tax credit for solar construction.

It’s a perfect storm for solar generation, notes Katherine Gensler, director of federal affairs for the Solar Energy Industries Association (SEIA), a trade group. By the end of the year, about half of the U.S.’s 9,500 MW of solar power will be generated by utility-scale power plants; most of this capacity came on-line in the past year.

SEIA figures show some 4,200 MW of utility-scale generation is now under construction and another 23,000 MW of utility-scale projects are being developed. More deals are being negotiated, analysts say.

California accounts for about half the installed utility-scale solar capacity as well as some 13,000 MW of the projects under development.

What will actually be built, Gensler and other analysts note, is a big question—one with too many variables that can be answered only over time as the solar marketplace shifts away from government support.

The federal tax incentive program ends in 2016, and it is unlikely DOE’s loan guarantee program will keep its pace. Consequently, the solar expansion numbers are murky, and although solar energy has been on a sharp growth curve over the past couple of years, it still produces only around 1% of U.S. electricity. But that could swiftly change in the topsy-turvy world of energy.

Each of the three newly operating units embraces slightly different technologies. The California Valley Solar Ranch uses 88,000 PV panels, a well-known technology used in rooftop solar installations that converts the sun’s energy directly into electricity. But unlike usual rooftop units that vary from a couple of kilowatts of electricity on a house to a couple of megawatts on a Walmart or IKEA warehouse, the solar ranch produces 250 MW and is one of the largest PV systems in the world. Currently, PV installations, overall, make up about 80% of the utility-scale projects, SEIA notes.

The Abengoa Solana project and Ivanpah Solar Electric Generating System are concentrated solar power (CSP) systems that together will produce more than 650 MW of electricity. Solana generates 280 MW by using a system of curved mirrors to focus solar energy. Ivanpah generates 130 MW of electricity now but will grow to 390 MW next year as its system of flat concentrating mirrors, coupled with three power towers, is finally complete.

Like PV, these CSP systems use sunlight as fuel, but they focus the sun’s thermal energy to heat a conducting medium, such as oil or molten salt. The medium carries heat that is used to drive water to steam, and like a conventional power plant, the steam spins a turbine to do work, in this case generate electricity.

Because CSP uses a medium that retains thermal energy, it can smooth out temporary generation fluctuations in sunlight from storms or a passing cloud, which interrupts PV-generated electricity production. On the other hand, CSP systems need intense light levels for its mirrors and lenses to properly focus light and energy. Therefore, CSP is usually limited to deserts and other high-sunlight areas.

A key advantage of CSP is that it can incorporate storage into its design. The Solana project does this by storing thermal energy in molten salts, from which it is released over time. Solana can stretch out electrical output for six hours without sunshine. Similar plants with storage are in the works. Storage could be a game changer for solar power.

But this solar expansion—whether PV or CSP—has a steep price tag. These three installations are billion-dollar projects: The two CSP facilities run at around $2 billion each; the PV ranch costs $1.6 billion. The estimates are fluid, and the CSP developers hope costs will drop with more construction.

DOE has thrown its weight behind utility-scale solar installations, offering $10.5 billion in loan guarantees to help developers obtain funding for 11 projects. About one-quarter of the total dollars back up five CSP plants, two with storage. The rest of the money supports six PV plants.

Of the 11, three are the large plants that just came on-line. Two are smaller PV projects that received loan guarantees and are in operation; they have a combined capacity of 200 MW. The remaining six projects that are in development will generate 1,700 MW.

One huge PV unit—the Desert Sunlight Solar Farm—will produce 550 MW when complete. It will be built by the thin-film solar manufacturer First Solar with support and financing from a consortium of solar developers. First Solar claims the facility will be the world’s largest solar farm.

Electric utilities like these big projects, explains Bob Gibson, vice president for education and communication at the Solar Electric Power Association, a nonprofit organization of utilities and solar-related manufacturers. Utilities, he notes, are familiar with the large size and can easily manage these installations.

“Right now, there are 300,000 small rooftop photovoltaic solar units operating in the U.S. and feeding electricity into the electric grid,” he notes. “That is a lot of individual transactions for an electric utility to manage.”

The big units, Gibson says, might help encourage a “solar evolution” for utilities and might lift solar beyond the niche technology it has been in the past and elevate it to coal-plant size.

But there are problems with the jumbo size and location of these large plants. The Ivanpah project, for instance, will take up as much as 6 sq miles and is sited on the California-Nevada border. It is hundreds of miles from the homes and businesses of the Southern California population it will serve and so needs long-distance transmission lines. It is also located on fragile desert lands that turned out to be home to several hundred threatened desert tortoises. This fact was only discovered after developer BrightSource Energy began the $2.2 billion project.

A preliminary survey estimated that just 35 tortoises were on the site, and BrightSource planned to move them. However, as construction advanced, more were found, and the number of tortoises reached some 300, according to Ileene Anderson, a biologist and senior researcher with the Center for Biological Diversity, a nonprofit conservation group.

BrightSource did not return C&EN’s calls seeking comments beyond prepared statements. The firm estimated that the cost to relocate these newly found tortoises worked out to $55,000 each. Addressing these turtles also greatly stalled the project, the company says.

Anderson says Ivanpah and several other solar projects are part of a “green rush” to obtain DOE project loan support and federal tax breaks before they expire, as well as to comply with California renewable energy requirements. As a result, she says, many of these projects are not well suited for their location.

Other solar sites faced similar delays and restrictions as work began owing to a poor site selection process, she notes. One found ancient human cultural artifacts, and several turned up more threatened species living on proposed solar sites.

The proposed 250-MW Genesis Solar Energy Project site, near Blythe, Calif., for instance was found to be home to many families of kit foxes. Developer NextEra Energy Resources began harassing the fox families to drive them from their burrows at the site. Then state wildlife biologists found several foxes to be suffering from an outbreak of canine distemper, an unusual virus for foxes, and began an investigation that further delayed the solar project’s construction.

Groups like Anderson’s want to overhaul and closely regulate the site selection process. They also want to restrict solar sites to a negotiated system of state and federal “solar zones,” which is under development and where solar projects will be allowed and disruptions will be minimal.

“We want solar,” she says, “but our first choice is to put them on every rooftop in the Los Angeles Basin, not way out in the fragile desert.”

Utilities, however, need the renewable solar electricity. In a statement to C&EN, Southern California Edison, which is buying part of Ivanpah’s output, notes pressure is on to buy solar, and the utility will need to add thousands of megawatts of new projects. The California Public Utilities Commission prefers the generation source be within the state, the utility notes, and Ivanpah is just on the California side of the California-Nevada border.

“It takes a whole lot of 3- to 5-kW rooftop PV systems to make just one California Solar Ranch or an Ivanpah,” notes Cara Libby, solar research project manager at the Electric Power Research Institute, a utility-funded nonprofit.

The recent growth of utility-scale projects as well as the new expansion of CSP technologies has changed the solar formula, she adds. “There are so many new PV and CSP projects being discussed today, I really can’t keep up.”

Libby describes a race between PV and CSP technologies, both of which have inherent advantages and problems. Currently, PV is winning on market share, with about 80% of operating or under-construction utility-scale power plants. However, that could change.

“If the first utility-scale 100-MW-plus CSP projects are really successful, and we build more of them, and the cost really comes down nicely, CSP will perhaps be more attractive than PV at that point,” Libby says. “But who knows?”

A few years ago, she says, it appeared CSP systems would offer the lowest cost and have the advantage of an economy of scale, similar to a central power system, as well as storage.

Utility-scale CSP with storage goes back decades. The technology got its first big start in the 1980s and ’90s when nine CSP power plants were built in the California desert. The Solar Energy Generating Systems (SEGS) produced 354 MW, making it the largest solar power installation in the world at that time. The company that built the plants morphed into what became BrightSource Energy, Ivanpah’s builder.

Initially, some of the nine facilities in the complex had the ability to provide three hours of thermal energy storage, but in 1999, SEGS caught fire and the storage system was damaged. It was not replaced when the facility was rebuilt and improved, according to DOE. Most of SEGS is still operational today.

“The SEGS plants have been operating reliably, providing steady power for over 20 years,” notes Frank (Tex) Wilkins, an energy consultant who is retired but worked for DOE on experimental solar projects when SEGS was under construction. “Their track record convinced the financial sector that there was little risk with the technology, making it easier for today’s CSP industry to get project financing.”

But, Libby notes, big CSP units have been more difficult to permit and require significant up-front investments. PV systems also have the advantage of being built incrementally, she says, making construction easier to start without a large cash outlay. She notes that a few years back when the recession hit and solar panels plummeted in price, some solar builders switched from proposed CSP installations to PV projects.

Energy analysts say the near future of solar is unclear. “We see a lot of companies doing internal wrangling,” an analyst says. “Should we move forward with another round of projects, or should we wait and see how government policies develop?”

Gibson adds: “Future prospects for solar are good, but without state renewable portfolio standards, the scale of the plants is likely to come down. I think there is a sweet spot for utilities when building new plants at about 15 to 20 MW. PV prices are unlikely to continue to drop, but natural gas prices can go up as well as down, and coal seems too risky for investors. Nuclear is just so expensive. All this gives a boost to solar.”

Gibson and other analysts think PV construction is more likely in the near term, unless storage appears to be a highly valuable attribute, which will drive utilities to CSP.

Solar supporters were heartened by a recent announcement by Xcel Energy, a Colorado utility, to purchase 170 MW of utility-scale PV power without the enticement of federal or state incentives.

“For the first time,” notes Xcel spokesman Mark Stutz, “our analysis determined that utility-scale solar was competitive in price with other sources of electricity, including fossil-fuel-generated electricity, even without a carbon penalty.”

You can return to the main Market News page, or press the Back button on your browser.