Can industry decarbonize steelmaking?

If the steel industry were a country, its carbon dioxide emissions would rank third in the world, below the US and above India. Aside from churning out 1.86 billion metric tons (t) of steel last year, steelmakers generated over 3 billion t of CO2, corresponding to an astonishing 7–9% of all human-made greenhouse gas emissions, according to the World Steel Association. No other industrial material has a greater climate impact.

If the steel industry were a country, its carbon dioxide emissions would rank third in the world, below the US and above India. Aside from churning out 1.86 billion metric tons (t) of steel last year, steelmakers generated over 3 billion t of CO2, corresponding to an astonishing 7–9% of all human-made greenhouse gas emissions, according to the World Steel Association. No other industrial material has a greater climate impact.

With global steel demand expected to rise to 2.5 billion t per year by 2050 (Metals 2020, DOI:10.3390/met10091117), that environmental burden is growing. Yet an analysis of the overall reduction in worldwide carbon emissions needed to limit global warming to a maximum of 2 °C above preindustrial levels—the goal of the 2015 Paris climate agreement—suggests that the steel industry’s annual emissions must fall to about 500 million t of CO2 by 2050 (Metals 2020, DOI: 10.3390/met10070972).

Achieving that target will require the industry to reduce its carbon intensity from about 1.85 t of CO2 per metric ton of steel to just 0.2 t. That will take nothing less than a revolution in steelmaking technology, backed by hundreds of billions of dollars in investments.

At first glance, changing the trajectory of this leviathan business looks like an almost impossible task. Steelmaking has annual sales of $2.5 trillion, according to the World Steel Association, and relies on heavy infrastructure, such as the gigantic blast furnaces that are used to make iron, which can last 20–40 years. “It’s quite difficult to shift a market like steel because there’s so much sunk cost in a blast furnace,” says Michael Lord, an expert adviser to Beyond Zero Emissions, a climate think tank.

Yet a growing number of companies are taking up this daunting challenge, including both established steel majors and disruptive innovators. They are piloting a flurry of technologies that could curb steel’s carbon emissions, largely by using new ways to reduce iron oxides into iron. Some approaches rely on hydrogen from electrolyzers powered by renewable electricity; others use that power directly in electrochemical reactions.

RECIPE FOR REDUCTION

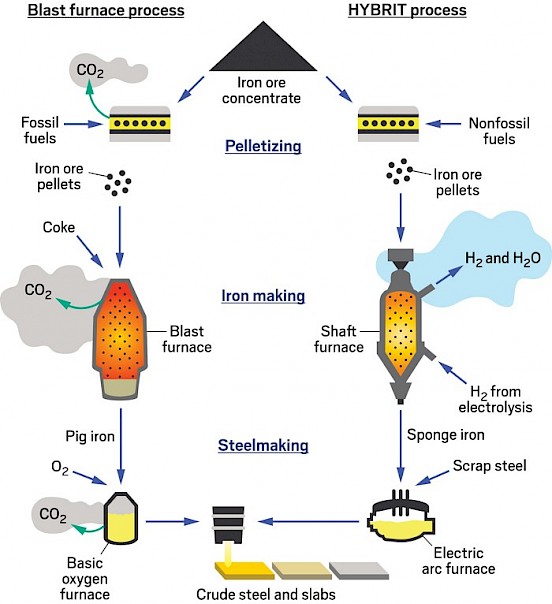

The Hydrogen Breakthrough Ironmaking Technology (HYBRIT) process aims to replace the coke and other fossil fuels used in traditional, blast furnace–based steelmaking and instead relies on hydrogen created with renewable electricity. The process should lower carbon dioxide emissions in all stages of steelmaking, including pelletizing iron ore, reducing iron oxides to iron, and producing crude steel.

Steelmakers have flirted with these methods for decades, but industry insiders say the business case for transformation is now stronger than ever. Advances in chemistry, metallurgy, and engineering have significantly improved the efficiency of these alternative routes to steel. “They’re also associated with renewables, hydrogen, and other technologies that are on a pretty relentless cost-reduction pathway,” says Thomas Koch Blank, senior principal of the Breakthrough Technologies program at RMI, a nonprofit focused on the clean energy transition. “That’s going to fundamentally challenge the structure of the industry.”

Many of the most ambitious approaches are being pursued in Europe, which makes about 10% of the world’s steel. Rising carbon taxes set by the European Union threaten to squeeze companies’ profits if they fail to decarbonize, and this policy is spurring billions of euros of investment in green steel.

This investment could seed change elsewhere. Although some steel companies may be pursuing these projects as a way to burnish their environmental credentials, Lord says, they are also laying the groundwork for a low-carbon future. “I think they’re getting involved so that they’re ready to switch.”

BEYOND COKE

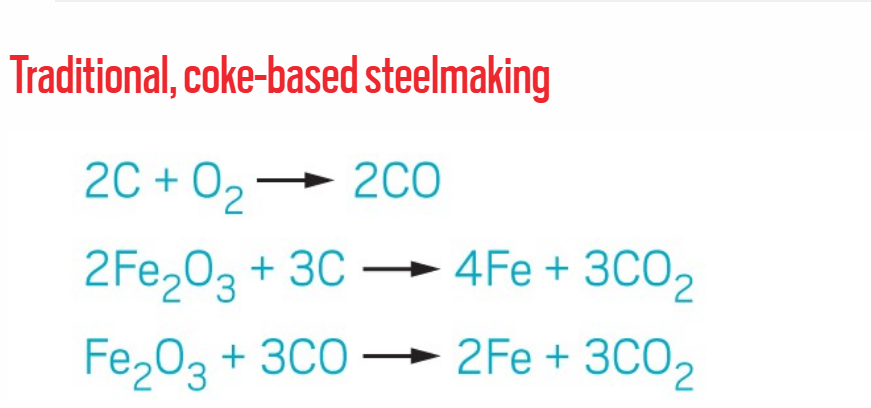

Humans have been extracting iron from its ores since … well, since the dawn of the Iron Age, over 3,000 years ago. Smelting traditionally took place in bloomeries, small furnaces filled with burning charcoal and iron ore containing hematite (Fe2O3) or magnetite (Fe3O4). Bellows forced air through the furnace to make carbon monoxide, which reduced iron oxides to form a solid, porous mass of metal called sponge iron. After knocking off the crust of silicates and other impurities, known as slag, people could hammer the metal into wrought iron. Heating this on a bed of charcoal added roughly 2% carbon, creating an alloy commonly known as steel. For thousands of years, carbon has played these three vital roles in steelmaking: a fuel for heating, a reducing agent, and an alloying agent.

Today, iron is largely made inside blast furnaces running at 2,000 °C or more, where ore, coke, and limestone meet a blast of hot air, creating molten pig iron with a high carbon content—roughly 4–5%. Coke, the crucial carbon source for modern steelmaking, is manufactured by heating crushed coal to drive off tar and gases. The process makes this concentrated source of carbon strong enough to support the huge weight of ore in cavernous furnaces. The world’s largest single blast furnace, at Posco’s Gwangyang steelworks in South Korea, is 110 m high and produces over 5 million t of pig iron per year.

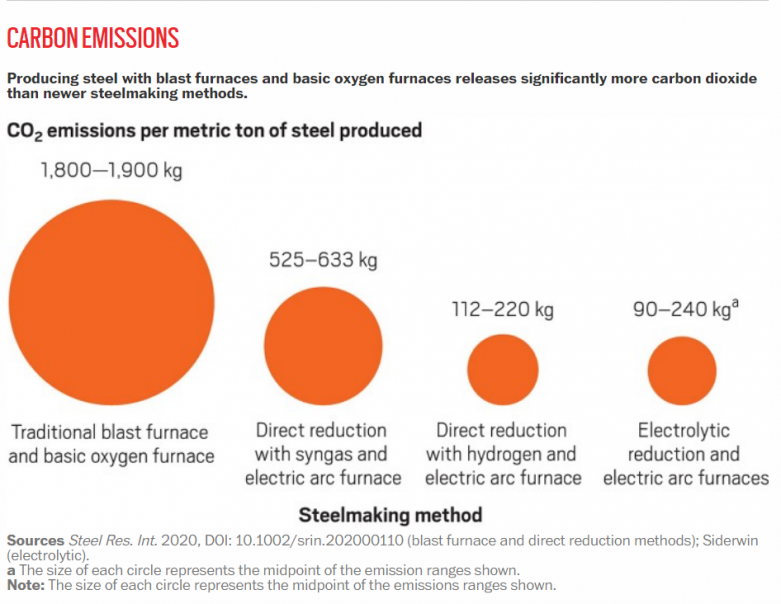

Because of its relatively high carbon content, pig iron is brittle, so it must be processed in a basic oxygen furnace. This furnace delivers pure oxygen through a water-cooled lance, driving off carbon as CO2 along with other impurities to leave crude steel. Secondary refining then fine-tunes the alloy’s metallurgy to make high-grade steel. Roughly three-quarters of the world’s steel is produced through this blast furnace–basic oxygen furnace route. Processing iron ore into pellets and making coke are responsible for about 20% of this route’s CO2 emissions, with the blast furnace itself responsible for about 70%.

Despite huge advances in steelmaking technology, the underlying chemistry has remained essentially unchanged for millennia, and it won’t be easy for the industry to curb its dependence on coke. Some of the largest players in the industry—including the top two producers, ArcelorMittal and China Baowu Steel Group—are planning to retrofit existing furnaces with carbon-capture systems so that CO2 released during steelmaking can be stored underground or used to manufacture chemicals like methanol. But carbon capture is an expensive Band-Aid for an intrinsically unsustainable technology. “Carbon capture fundamentally means doing what you did before, but adding cost,” Koch Blank says. “It’s going to be virtually impossible for that route to be cost competitive.”

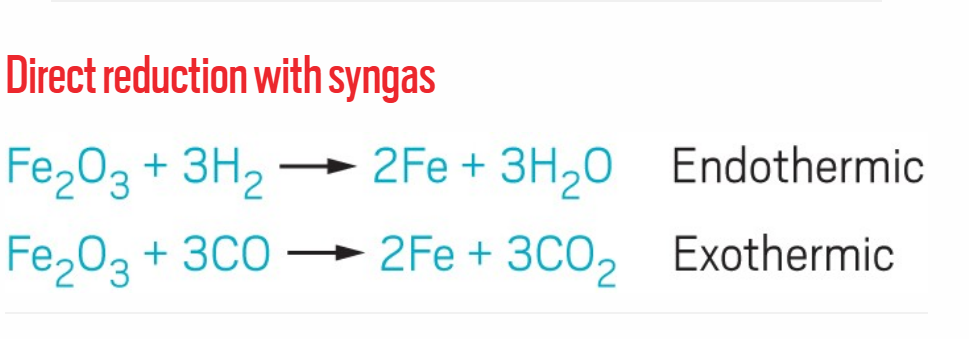

There are already commercial alternatives to coke, however. Well over 100 iron-making furnaces, which mostly rely on processes known as Midrex and HYL-Energiron, instead use natural gas to produce direct reduced iron (DRI), a kind of sponge iron. These plants convert natural gas into syngas, a mixture of hydrogen and CO, both of which reduce solid iron oxide to solid iron inside a shaft furnace at around 1,000 °C. The DRI that emerges several hours later typically contains 1–4% carbon and can be converted into steel in an electric arc furnace, which uses electricity to melt the metal. Carbon and oxygen may also be added in this furnace to remove impurities and adjust the steel’s carbon content. Bolstered by cheap shale gas, a growing number of DRI plants help supply over 100 million t of steel per year, more than 5% of global output, and arc furnaces are already widely used to recycle scrap steel.

Overall, this DRI–arc furnace route has 35–40% lower CO2 emissions than conventional steelmaking (Berg- Huettenmaenn. Monatsh. 2020, DOI: 10.1007/s00501-020-00975-2). Crucially, DRI plants could also act as a stepping-stone to even lower emissions because green hydrogen, made via electrolysis, can be blended into the feed gas to reduce the need for natural gas. Many of the world’s biggest steelmakers plan to transition DRI facilities to use more hydrogen in the mix or build new DRI plants that run almost entirely on green hydrogen.

HYDROGEN HOPE

One of the leading efforts to adopt hydrogen as a reducing agent is in Sweden, where a project called HYBRIT (Hydrogen Breakthrough Ironmaking Technology) is attempting to decarbonize every step of the steelmaking process. HYBRIT is a collaboration between the mining company LKAB, steelmaker SSAB, and energy company Vattenfall that kicked off in 2016. It will rely on cheap and plentiful wind power in northern Sweden to electrolyze water, generating vast amounts of hydrogen.

Last year, HYBRIT finished building a pilot DRI plant in Luleå, Sweden. Until recently, it was running on natural gas, but in May, it started the first trials with hydrogen and will produce about 1 t of DRI per hour during 2-to-4-week campaigns. Over the next 3 years, these trials should answer a range of scientific and technical questions raised by the switch to hydrogen. “We need to find out what are the best operating conditions,” says Martin Pei, SSAB’s chief technology officer.

Syngas’s reduction of iron oxide involves two key reactions. The reduction with CO is exothermic, and that released energy helps drive a parallel endothermic reduction by hydrogen. Switching to a hydrogen-only system significantly changes this thermodynamic balance, so the hydrogen must be preheated before it enters the furnace, which HYBRIT aims to achieve with an electric heating system. Upping the hydrogen content also increases the volume and velocity of gas flowing through the shaft furnace and changes the composition of the DRI (Metals 2020, DOI: 10.3390/met10070922). HYBRIT researchers will study how the composition of this iron compares with DRI made with natural gas and whether it is suitable to pass on to an electric arc furnace.

Meanwhile, HYBRIT is exploring alternative ways to produce the iron ore pellets that feed the DRI plant. This process currently uses fossil fuels, but HYBRIT has tried a bio-oil by-product from papermaking instead, and plans to test hydrogen-based heating to make the pellets.

HYBRIT is already planning a larger demonstration plant in Vitåfors, Sweden, which would reach commercial-scale continuous production of 200 t of DRI per hour. Pei says that this plant should help deliver fossil-free steel—which should have a carbon footprint less than 5% of that of conventional steel—to the market in 2026. SSAB plans to replace all its blast furnaces in Sweden and Finland so that it is entirely fossil-free by 2045.

HYBRIT is already planning a larger demonstration plant in Vitåfors, Sweden, which would reach commercial-scale continuous production of 200 t of DRI per hour. Pei says that this plant should help deliver fossil-free steel—which should have a carbon footprint less than 5% of that of conventional steel—to the market in 2026. SSAB plans to replace all its blast furnaces in Sweden and Finland so that it is entirely fossil-free by 2045.

Back in 2017, HYBRIT estimated that its steel would be 20–30% more expensive than that produced by the traditional coke-based route. But the economic equation has changed since then, thanks in part to the European Union Emissions Trading System. This cap-and-trade system sets ever-tightening regulatory limits on industry’s CO2 emissions while enabling companies that reduce their emissions below this cap to sell spare carbon allowances. In 2017, an allowance to emit a metric ton of CO2 was priced at less than €10 (about $12), but in recent months it has soared above €50 (about $61) in anticipation of the EU further strengthening its emission reduction commitments.

If the cost of green hydrogen fell from today’s $3–$6 per kilogram to $1 per kilogram, today’s carbon price would be enough to make hydrogen-based steelmaking cost competitive with traditional methods, according to BloombergNEF, an energy consultancy. Nel, a Norwegian electrolyzer maker, says it is already targeting a hydrogen cost of $1.50 per kilogram by 2025.

The result is that low-carbon technologies like HYBRIT could soon have a growing commercial advantage over traditional steelmaking. “We believe that in the long run, this will become even more competitive, since we know that emission costs will go up,” Pei says. “Society is really pushing in that direction, and we believe there is a good business case.”

TURNING UP THE HEAT

HYBRIT’s partners are not the only steel companies targeting hydrogen. Swedish start-up H2 Green Steel is planning to build a hydrogen-based DRI plant in Boden, just 30 km from Luleå, and will begin production in 2024. And other companies aim to feed hydrogen directly into traditional coke-fueled blast furnaces, making use of existing infrastructure to achieve more modest emission reductions. In 2019, for example, Thyssenkrupp began trialing this approach at one of its coke-burning blast furnaces in Duisburg, Germany, injecting about 1,000 m³ of hydrogen per hour into the furnace. This approach could eventually reduce blast-furnace CO2 emissions by about 20%.

Austria’s Voestalpine is involved in a more radical project called SuSteel that aims to use hydrogen plasma to reduce iron ore. “The advantage of this concept is that you go in one step from iron ore to crude steel,” says Johannes Schenk of the University of Leoben, one of the project leaders.

SuSteel’s hydrogen plasma smelting reduction technology uses electricity to shred hydrogen gas as it passes through a hollow graphite electrode into a conical reactor. This process creates a stream of hydrogen atoms, ions, and molecules at temperatures over 20,000 °C. The plasma melts and reduces finely ground iron ore to create a pool of liquid steel (Metals 2018, DOI: 10.3390/met8121051). Pelletizing is unnecessary, and the graphite electrode adds just enough carbon to the metal to form crude steel, so the metal can avoid a trip through an electric arc furnace and proceed directly to secondary steel refining. SuSteel’s pilot plant at Donawitz, Austria, will start running in the summer and eventually produce 50–100 kg of steel per batch.

One constraint shared by most hydrogen-based methods is that they need to be fed with hematite because magnetite is far less porous and so has a much slower reduction rate inside a shaft furnace (Steel Res. Int. 2019, DOI: 10.1002/srin.201900108). That means steelmakers that rely on magnetite ore must first oxidize it to hematite before it can be reduced in a furnace.

An approach called flash ironmaking technology (FIT) promises to avoid this redox roller coaster because it is well suited to reducing purified magnetite. FIT uses oxygen to partially burn a stream of natural gas or hydrogen inside a reactor, creating a gas mixture that reduces a cascade of iron ore particles less than 100 μm wide (Metals 2021, DOI: 10.3390/met11020332). Thanks to their small size, these particles can be reduced much faster than iron ore pellets, says Hong Yong Sohn of the University of Utah, who developed FIT. The reaction is so fast, Sohn says, that “even in a large industrial-sized reactor, the maximum reaction time is maybe 10 s.”

Up to 70% of iron and steel produced in the US starts from a low-grade magnetite ore called taconite, and the existing purification process produces fine particles that can go directly into a FIT reactor. In 2017, Sohn’s team built a 2 m high reactor that can make about 10 kg of iron per hour, and the researchers calculate that running the system on green hydrogen could offer up to 96% lower CO2 emissions than a blast furnace. Sohn is now looking for an industrial partner to build a FIT reactor at a larger scale and estimates that a 35 m high FIT reactor could produce 1 million t of iron per year.

POWER PLAY

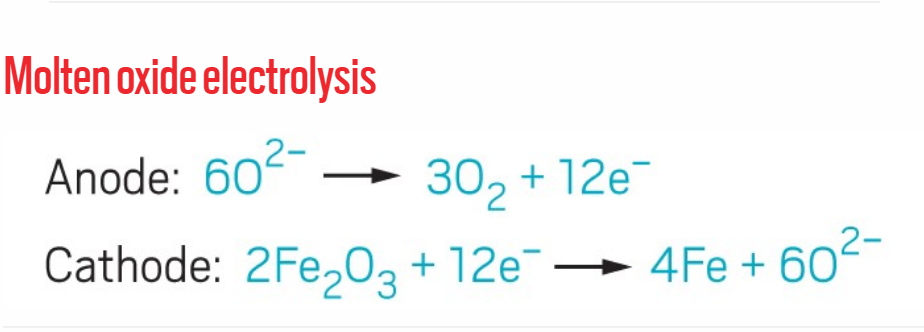

Despite improvements in the efficiency of electrolyzers, some scientists argue that it could be more economical to skip the hydrogen and use renewable electricity itself to reduce iron oxides. Massachusetts Institute of Technology spinout Boston Metal, for example, is pioneering a process called molten oxide electrolysis. “Our goal is to make steel that is no more expensive than steel made by the conventional route,” says Donald R. Sadoway of MIT, who cofounded the company in 2012.

The electrochemical process happens inside a squat, 2 m wide steel vessel lined with alumina-based bricks, with an anode poking down through the top and a horizontal cathode on the base. Inside the vessel, iron oxides are dissolved in a mixture of molten metal oxides such as silica, magnesia, and quicklime, all heated to about 1,600 °C by an electric current. At the cathode, this current reduces iron ions to form a pool of liquid iron that can be sent to an electric arc furnace. The energy-intensive step of pelletizing the ore is unnecessary, and Sadoway says the reduction process is more energy efficient than hydrogen-based routes.

A key breakthrough behind this technology came in 2013, when Sadoway developed a 90:10 chromium-iron alloy anode that could withstand the extreme conditions inside the reactor without corroding or reacting with oxygen or the molten electrolyte (Nature 2013, DOI: 10.1038/nature12134). During the process, the alloy forms a thin oxide coating that protects the underlying metal but still allows electron transfer.

One challenge is that the electrochemical reaction releases copious amounts of oxygen at the anode, which reduces the conductivity of the melt. “If you landed from Mars and saw this thing, you’d say this is an oxygen-producing facility,” Sadoway says. The company has developed engineering solutions to remove this oxygen as quickly as possible. Boston Metal has also tailored the mixture of metal oxides to ensure that it melts at a reasonable temperature, remains stable, and is not too viscous, so that oxygen can escape from the mix (J. Electrochem. Soc. 2014, DOI: 10.1149/2.0451501jes). In January, Boston Metal raised $50 million in investment funding, and it plans to have its first demonstration plant running by 2025. “There are fantastic challenges in front of us, but the electrochemistry is sound,” Sadoway says.

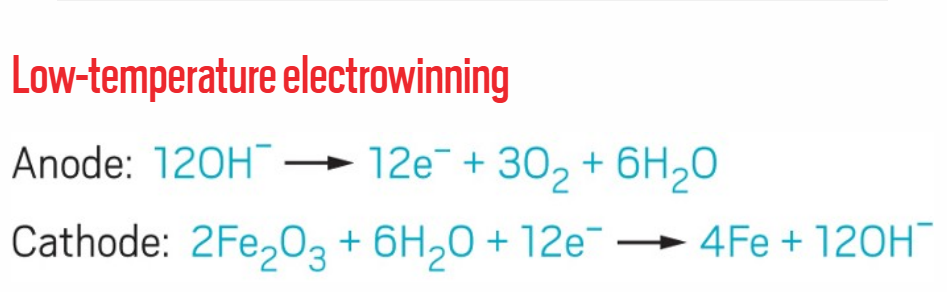

Other research groups are pursuing a low-temperature electrochemical process called electrowinning. In France, a project called Siderwin is building a 3 m long pilot plant that will host finely milled hematite ore particles suspended in a highly alkaline aqueous sodium hydroxide solution at about 110 °C. When a current passes through the electrolyte, iron metal grows on the surface of the cathode, while oxygen gas is liberated at the anode. The iron plate is then removed and fed into an electric furnace to make steel.

Thanks to the low-temperature conditions, the process uses 31% less energy than traditional steelmaking and reduces CO2 emissions by 87%, according to the Siderwin team. Compared with hydrogen-based routes, electrowinning also relies on less infrastructure, says Hervé Lavelaine de Maubeuge, a researcher at ArcelorMittal who coordinates the Siderwin project. “There is a long journey to industrial scale, but theoretically we have a strong advantage in terms of capital costs,” he says. Siderwin’s pilot plant should be operational later this year, producing 100 kg of iron in every 2-day shift.

READY FOR REVOLUTION?

Despite the promise of new steelmaking technologies, they currently operate on a scale that is eclipsed by traditional blast furnaces. And although the prices of renewable electricity and green hydrogen are falling fast, the capital costs of setting up new plants—and shuttering old ones—are still a major barrier to change across the industry. Beyond Zero Emissions’ Lord and RMI’s Koch Blank agree that most steel companies are not yet committing the level of investments in new technologies needed to completely decarbonize by 2050.

Meanwhile, an industry-wide shift to these technologies would require eye-watering quantities of solar and wind power. Researchers at K1-Met, a research center in Linz, Austria, that is involved in green hydrogen and steel projects, calculate that if hydrogen-based DRI replaced all of Europe’s current steel production, the industry’s electricity demand would increase at least fivefold, to 400–500 TW h per year. That additional demand is equal to about 18% of total current EU electricity consumption and would require an additional 50,000 wind turbines (Steel Res. Int. 2020, DOI: 10.1002/srin.202000110). Large-scale hydrogen-based steel production would also need enormous amounts of electrolyzer capacity. The largest electrolyzers currently operate at about 20 MW, but a DRI plant making 2 million t of iron per year would need about 1 GW of hydrogen-generating capacity.

Yet Koch Blank points out that the industry has managed similar revolutions in the past. During the 1960s and 1970s, the basic oxygen furnace largely replaced its predecessor, the open-hearth furnace, because it offered much lower capital costs and required far fewer workers. “It took about 20 years to replace literally every steel asset in the world with a new technology,” he says.

Environmental legislation could help tip the balance in the newcomers’ favor. The EU has committed to at least a 55% reduction in CO2 emissions by 2030 relative to 1990 levels, and the bloc is considering a carbon tax on imports such as steel, which could help domestic low-carbon technologies stay competitive.

In the US, the Buy Clean California Act of 2017 requires state-funded building projects to use construction materials that meet certain carbon-intensity limits, which should give low-carbon manufacturers an advantage. Those limits come into effect in July, and they mandate that hot-rolled steel, for example—which is used in construction beams—must have a carbon intensity below 1.38 t of CO2 per metric ton of steel, less than the global average carbon intensity of the metal today. Similar green public procurement programs operate in countries like Japan, South Korea, and South Africa. Perhaps the biggest policy questions are in China, which produces about half the world’s steel. Although reports earlier this year suggested that the government plans a 30% cut in steelmaking emissions by 2030, the road map to achieve this target is unclear.

Other trends in steelmaking should help lower the material’s carbon footprint. Recycling currently provides about 30% of the world’s fresh steel, but that is expected to reach 50% by 2050, which would open up more opportunities for renewable-powered electric arc furnaces to produce steel (Metals 2020, DOI: 10.3390/met10091117). Meanwhile, metallurgists are developing stronger, lighter steel alloys that could help meet demand with less metal.

Alongside changes in technology and regulations, international supply chains may also need to adapt. “It would make more sense to locate the bulk of green steel production in places where it’s a lot easier to produce renewable energy,” Lord says. And while thermal technologies benefit from economies of scale, electrochemical methods may be better suited to smaller steelmaking units located close to customers, Koch Blank says.

For now, it’s still unclear which of these technologies will emerge as winners. “Hydrogen-based direct reduction is arguably further ahead in commercialization, but I think it’s largely up for grabs,” Koch Blank says. In the next few years, though, the pilot plants now springing up around the world could provide an answer.

You can return to the main Market News page, or press the Back button on your browser.