Water Demand for Energy to Double by 2035

The amount of fresh water consumed for world energy production is on track to double within the next 25 years, the International Energy Agency (IEA) projects.

And even though fracking—high-pressure hydraulic fracturing of underground rock formations for natural gas and oil—might grab headlines, IEA sees its future impact as relatively small.

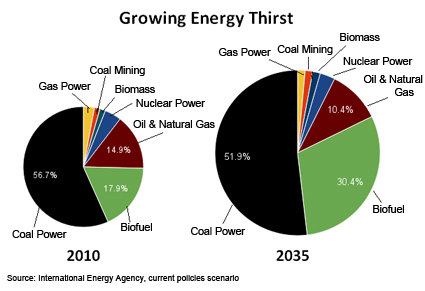

By far the largest strain on future water resources from the energy system, according to IEA’s forecast, would be due to two lesser noted, but profound trends in the energy world: soaring coal-fired electricity, and the ramping up of biofuel production.

If today’s policies remain in place, the IEA calculates that water consumed for energy production would increase from 66 billion cubic meters (bcm) today to 135 bcm annually by 2035.

That’s an amount equal to the residential water use of every person in the United States over three years, or 90 days’ discharge of the Mississippi River. It would be four times the volume of the largest U.S. reservoir, Hoover Dam’s Lake Mead.

More than half of that drain would be from coal-fired power plants and 30 percent attributable to biofuel production, in IEA’s view. The agency estimates oil and natural gas production together would account for 10 percent of global energy-related water demand in 2035.

Not everyone agrees with the IEA’s projections. The biofuel industry argues that the Paris-based agency is both overestimating current water use in the ethanol industry, and ignoring the improvements that it is making to reduce water use. But government agencies and academic researchers in recent years also have compiled data that point to increasingly water-intensive energy production. Such a trend is alarming, given the United Nations’ projection that by 2025, 1.8 billion people will be living in regions with severe water scarcity, and that two-thirds of the world’s population could be living under water-stressed conditions.

“Energy and water are tightly entwined,” says Sandra Postel, director of the Global Water Policy Project, and National Geographic’s Freshwater Fellow. “It takes a great deal of energy to supply water, and a great deal of water to supply energy. With water stress spreading and intensifying around the globe, it’s critical that policymakers not promote water-intensive energy options.”

Power Drunk

The IEA, established after the oil shocks of the 1970s as a policy adviser on energy security, included a warning on water in a special report within its latest World Energy Outlook released late last year. “A more water-constrained future, as population and the global economy grow and climate change looms, will impact energy sector reliability and costs,” the agency said.

National Geographic News obtained from IEA a detailed breakdown of the figures, focusing on the agency’s “current policies” scenario—the direction in which the world is heading based on current laws, regulations, and technology trends.

In the energy realm, IEA sees coal-powered electricity driving the greatest demand for water now and in the future. Coal power is increasing in every region of the world except the United States, and may surpass oil as the world’s main source of energy by 2017.

Steam-driven coal plants always have required large amounts of water, but the industry move to more advanced technologies actually results in greater water consumption, IEA notes. These advanced plants have some environmental advantages: They discharge much less heated water into rivers and other bodies of water, so aquatic ecosystems are protected. But they lose much more water to evaporation in the cooling process.

The same water consumption issues are at play in nuclear plants, which similarly generate steam to drive electric turbines. But there are far fewer nuclear power plants; nuclear energy generates just 13 percent of global electricity demand today, and if current trends hold, its share will fall to about 10 percent by 2035. Coal, on the other hand, is the “backbone fuel for electricity generation,” IEA says, fueling 41 percent of power in a world where electricity demand is on track to grow 90 percent by 2035. Nuclear plants account for just 5 percent of world water consumption for energy today, a share that is on track to fall to 3 percent, IEA forecasts.

If today’s trends hold steady on the number of coal plants coming on line and the cooling technologies being employed, water consumption for coal electricity would jump 84 percent, from 38 to 70 billion cubic meters annually by 2035, IEA says. Coal plants then would be responsible for more than half of all water consumed in energy production.

Coal power producers could cut water consumption through use of “dry cooling” systems, which have minimal water requirements, according to IEA. But the agency notes that such plants cost three or four times more than wet cooling plants. Also, dry cooling plants generate electricity less efficiently.

The surest way to reduce the water required for electricity generation, IEA’s figures indicate, would be to move to alternative fuels. Renewable energy provides the greatest opportunity: Wind and solar photovoltaic power have such minimal water needs they account for less than one percent of water consumption for energy now and in the future, by IEA’s calculations. Natural gas power plants also use less water than coal plants. While providing 23 percent of today’s electricity, gas plants account for just 2 percent of today’s energy water consumption, shares that essentially would hold steady through 2035 under current policies.

The IEA report includes a sobering analysis of the water impact of carbon capture and sequestration (CCS) technology. If the world turns to CCS as a way to cut greenhouse gas emissions from coal plants, IEA’s analysis echoes that of outside researchers who have warned that water consumption will be just as great or worse than in the coal plants of today. “A low-carbon solution is not necessarily a low-water solution,” says Kristen Averyt, associate director for science at the Cooperative Institute for Research in Environmental Sciences at the University of Colorado. However, based on current government policies, IEA forecasts that CCS would account for only 1.3 percent of the world’s coal-fired generation in 2035.

Biofuel Thirst

After coal power, biofuels are on track to cause the largest share of water stress in the energy systems of the future, in IEA’s view. The agency anticipates a 242 percent increase in water consumption for biofuel production by 2035, from 12 billion cubic meters to 41 bcm annually.

The potential drain on water resources is especially striking when considered in the context of how much energy IEA expects biofuels will deliver—an amount that is relatively modest, in part because ethanol generally produces less energy per gallon than petroleum-based fuels. Biofuels like ethanol and biodiesel now account for more than half the water consumed in “primary energy production” (production of fuels, rather than production of electricity), while providing less than 3 percent of the energy that fuels cars, trucks, ships, and aircraft. IEA projects that under current government policies, biofuels’ contribution will edge up to just 5 percent of the world’s (greatly increased) transportation demand by 2035, but fuel processed from plant material will by then be drinking 72 percent of the water in primary energy production.

“Irrigation consumes a lot of water,” says Averyt. Evaporation is the culprit, and there is great concern over losses in this area, even though the water in theory returns to Earth as precipitation. “Just because evaporation happens here, does not mean it will rain here,” says Averyt. Because irrigation is needed most in arid areas, the watering of crops exacerbates the uneven spread of global water supply.

Experts worry that water demand for fuel will sap water needed for food crops as world population is increasing. “Biofuels, in particular, will siphon water away from food production,” says Postel. “How will we then feed 9 billion people?”

But irrigation rates vary widely by region, and even in the same region, farming practices can vary significantly from one year to the next, depending on rainfall. That means there’s a great deal of uncertainty in any estimates of biofuel water-intensity, including IEA’s.

For example, for corn ethanol (favored product of the world’s number one biofuel producer, the United States), IEA estimates of water consumption can range from four gallons to 560 gallons of water for every gallon of corn ethanol produced. At the low end, that’s about on par with some of the gasoline on the market, production of which consumes from one-quarter gallon to four gallons water per gallon of fuel. But at the high end, biofuels are significantly thirstier than the petroleum products they’d be replacing. For sugar cane ethanol (Brazil’s main biofuel), IEA’s estimate spans an even greater range: from 1.1 gallon to 2,772 gallons of water per gallon of fuel.

It’s not entirely clear how much biofuel falls at the higher end of the range. In the United States, only about 18 to 22 percent of U.S. corn production came from irrigated fields, according to the U.S. Department of Agriculture. And the remaining water in ethanol production in the United States—the amount consumed in the milling, distilling, and refining processes—has been cut in half over the past decade through recycling and other techniques, both industry sources and government researchers say. (One industry survey now puts the figure at 2.7 gallons water per gallon of ethanol.) A number of technologies are being tested to further cut water use.

“It absolutely has been a major area of focus and research and development for the industry over the past decade,” says Geoff Cooper, head of research and analysis for the Renewable Fuels Association, the U.S.-based industry trade group. “Our member companies understand that water is one of those resources that we need to be very serious about conserving. Not only is it a matter of sustainability; it’s a matter of cost and economics.”

One potential solution is to shift from surface spraying to pumped irrigation, which requires much less water, says IEA. But the downside is those systems require much more electricity to operate.

Water use also could be cut with advanced biofuels made from non-food, hardy plant material that doesn’t require irrigation, but so-called cellulosic ethanol will not become commercially viable under current government policies, in IEA’s view, until 2025. (If governments enacted policies to sharply curb growth of greenhouse gas emissions, IEA’s scenarios show cellulosic ethanol could take off as soon as 2015.)

Fracking’s Surge

Fracking and other unconventional techniques for producing oil and natural gas also will shape the future of energy, though in IEA’s view, their impact on water consumption will be less than that of biofuels and coal power. Water consumption for natural gas production would increase 86 percent to 2.85 billion cubic meters by 2035, when the world will produce 61 percent more natural gas than it does today, IEA projects. Similarly, water consumption for oil production would slightly outpace oil production itself, growing 36 percent in a world producing 25 percent more oil than today, under IEA’s current policies scenario.

Those global projections may seem modest in light of the local water impact of fracking projects. Natural gas industry sources in the shale gas hot spot of Pennsylvania, for instance, say that about 4 million gallons (15 million liters) of water are required for each fracked well, far more than the 100,000 gallons (378,540 liters) conventional Pennsylvania wells once required.

IEA stresses that its water calculations are based on the entire production process (from “source to carrier”); water demand at frack sites is just one part of a large picture. As with the biofuel industry, the oil and gas industry is working to cut its water footprint, IEA says. “Greater use of water recycling has helped the industry adapt to severe drought in Texas” in the Eagle Ford shale play, said Matthew Frank, IEA energy analyst, in an email.

“The volumes of water used in shale gas production receive a lot of attention (as they are indeed large), but often without comparison to other industrial users,” Frank added. “Other sources of energy can require even greater volumes of water on a per-unit-energy basis, such as some biofuels. The water requirements for thermal power plants dwarf those of oil, gas, and coal production in our projections.”

That said, IEA does see localized stresses to production of fossil fuels due to water scarcity and competition—in North Dakota, in Iraq, in the Canadian oil sands. “These vulnerabilities and impacts are manageable in most cases, but better technology will need to be deployed and energy and water policies better integrated,” the IEA report says. (See related story: “Natural Gas Nation: EIA Sees U.S. Future Shaped by Fracking.”)

Indeed, in Postel’s view, the silver lining in the alarming data is that it provides further support for action to seek alternatives and to reduce energy use altogether. “There is still enormous untapped potential to improve energy efficiency, which would reduce water stress and climate disruption at the same time,” she says. “The win-win of the water-energy nexus is that saving energy saves water.”

You can return to the main Market News page, or press the Back button on your browser.