BC's Carbon Tax - An Environmental and Economic Success Story

British Columbia’s pioneering carbon tax has been remarkably effective in reducing fuel use, with no apparent adverse impact on the province’s economy. This conclusion comes from a new study by Sustainable Prosperity soon to be published in the upcoming issue of Canadian Public Policy.

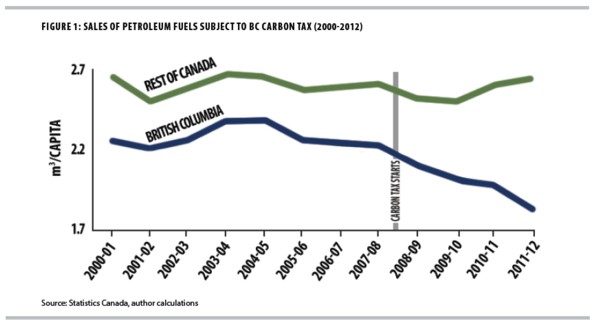

British Columbia’s pioneering carbon tax has been remarkably effective in reducing fuel use, with no apparent adverse impact on the province’s economy. This conclusion comes from a new study by Sustainable Prosperity soon to be published in the upcoming issue of Canadian Public Policy.The study’s key findings suggest that since the carbon tax took effect (July 1, 2008), BC’s fuel consumption has fallen by 17.4% per capita (and fell by 18.8% relative to the rest of Canada). These reductions occurred across all the fuel types covered by the tax, not just vehicle fuel.

In terms of economic impact, the study findings suggest BC’s GDP kept pace with the rest of Canada’s over that time, and the tax shift enabled BC to have Canada’s lowest income tax rates (as of 2012).

Overall, concludes the study, the tax shift has benefited all taxpayers in that cuts to income and other taxes have exceeded carbon tax revenues by $500 million from 2008-12.

BC brought in North America’s first carbon tax in July 2008 and imposed a price on the use of carbon-based fuels. The tax was a central component of BC’s climate change strategy, which aims to reduce GHG emissions by 33 percent below 2007 levels by 2020.

The carbon tax was designed to be “revenue neutral”, meaning that all revenues were to be used to reduce other taxes, mainly through cuts to income taxes (personal and corporate), as well as targeted tax relief for vulnerable households and communities - resulting in no overall increase in taxation.

The tax was initially set at $10 per tonne of carbon dioxide equivalent (CO2e), but the price was designed to rise by $5 per year thereafter until it reached $30 per tonne (roughly 7 cents per litre of gas) in 2012.

The Sustainable Prosperity study notes that when the carbon tax was brought in, there were predictions that it would harm BC’s economy. Now, four years later, the data show that BC’s economy has slightly outperformed the rest of the country over the period that the carbon tax has been in place.

So too, notes the study, the ultimate goal of BC’s carbon tax is to reduce GHG emissions, by taxing the fossil fuels that cause them. Data on GHG emissions is available only through to 2011, so changes in fuel use (available through 2012) were used as the most current indicator of the tax’s effects.

To get a fuller picture on GHG reductions the study compared GHG emissions in BC to emissions in the rest of Canada, counting only those sources that are subject to the BC carbon tax. From 2008 to 2011, BC’s per capita GHG emissions associated with carbon taxed fuels declined by 10.0 percent, which the report’s authors describe as a substantial reduction.

During this period, BC’s reductions outpaced those in the rest of Canada by almost 9 percent. These GHG reductions were similar to those seen in fuel use during this same 2008-11 time period.

The study concludes that on the basis of available evidence, BC’s carbon tax has been a highly effective policy to date, contributing both to a significant reduction in fossil fuel use per capita, with no evidence of overall adverse economic impacts. However, it cautions, further economic analysis is needed to reach more firm conclusions about these effects and their causality.

Research conducted by GLOBE Advisors confirms many of the Sustainable Prosperity conclusions, in particular that the carbon tax has helped various stakeholder groups from government, First Nations, educational institutions, and in the private sector to rethink the way they operate and to consider investing in clean technologies or to adopt more environmentally-friendly or lower carbon intensive practices.

The GLOBE Advisors research also suggests that while having a carbon tax provides positive benefits to the province, sustained leadership from both the public and private sector is required to meet the continuing challenge of further reducing the province’s carbon footprint and growing BC’s clean economy.

This is particularly so given that the carbon tax could be more than carbon neutral, revenue neutral, but could also be used to provide measurable, performance-based improvements for all BC residents and businesses.

The Sustainable Prosperity study notes that the BC experience to date is consistent with the results witnessed in seven European countries that brought in carbon tax shifts in the 1990s, notes the study. In those countries, the tax shifts caused estimated GHG emission reductions ranging from 2 to 7 percent (over a decade or more), according to a major empirical study funded by the EU.

It cautions that BC’s carbon tax shift is only 4 years old, so it is too early to draw firm conclusions. But its GHG reductions are trending in the same direction as those seen in European countries with more than 15 years of date. However, it points out, BC’s reductions to date appear to be even greater, which is consistent with the fact that its carbon tax rate is now higher and more comprehensive than in most European countries.

Stewart Elgie, Professor of law and economics at University of Ottawa, and the study’s lead author, said “BC’s experience shows that it is possible to have both a healthier environment and a strong economy – by taxing pollution and lowering income taxes.”

Canada’s premiers are meeting from July 24-26 to discuss a proposed Canadian Energy Strategy which includes “a more integrated approach to climate change,” Elgie added. “I hope that BC’s success will inspire Canada’s premiers to show leadership on a national approach to pricing carbon pollution.”

His point is well taken. As reported recently in the Globe and Mail, studies undertaken by Environics Research and more recently the Environics Institute shows that a majority (59 per cent) of Canadians outside of B.C. would support the introduction of a B.C. style carbon tax in their own province, a proportion that has been slowly building over the past four years.

Majority support for such a tax was expressed in all provinces except Alberta (at 43 per cent), and is most widespread in Quebec (67 per cent), followed by Manitoba (59 per cent), Saskatchewan (58 per cent), Ontario (58 per cent) and Atlantic Canada (54 per cent).

You can return to the main Market News page, or press the Back button on your browser.