As Coal Sinks, Renewables Soar: Emissions Report Shows Start Of Clean Energy Transition

For the electric power industry, the signs of change are in the air. Power plants are emitting less pollution than in prior years, and renewable power is a bigger part of the energy mix than ever before. That adds up to cleaner air and a more diverse, resilient and lower-carbon electricity system.

For the electric power industry, the signs of change are in the air. Power plants are emitting less pollution than in prior years, and renewable power is a bigger part of the energy mix than ever before. That adds up to cleaner air and a more diverse, resilient and lower-carbon electricity system.The industry is in the midst of a real transition, and a new Ceres report shows that it’s happening even faster than experts predicted.

On a biannual basis, Ceres assesses the environmental performance and progress of the electric power sector by analyzing the air emissions of the nation’s top 100 power producers in collaboration with M.J. Bradley & Associates, the National Resources Defense Council, Entergy, Exelon, Tenaska and Bank of America.

This is the eighth edition of the Benchmarking Air Emissions report, and this year, the findings were particularly significant:

•From 2008 to 2010, sector-wide sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions both fell by over 30 percent.

•Over the same period, carbon dioxide (CO2) emissions fell four percent and preliminary data show another five percent reduction in 2011.

•Non-hydroelectric renewable energy accounted for nearly five percent of U.S. electricity generation in 2011. Including large hydroelectric projects, renewables now provide over 10 percent of our power.

Those results speak volumes. Cutting SO2 and NOx emissions by a third in just a couple years is remarkable, and it reflects that a clean energy transition is within reach. The drop in carbon emissions is also encouraging, but it is important to ensure that the trend continues by continuing to emphasize renewable energy and efficiency. What we did with SO2 and NOx, we can do with CO2.

What are the drivers of this remarkable change? Primarily, power producers are shifting away from coal-fired generation to natural gas-fired plants and even cleaner, zero-emissions renewable energy resources such as wind, solar and geothermal energy. They have also installed emissions controls for the coal plants they are running, as additional Clean Air Act rules are set to go into effect over the next few years.

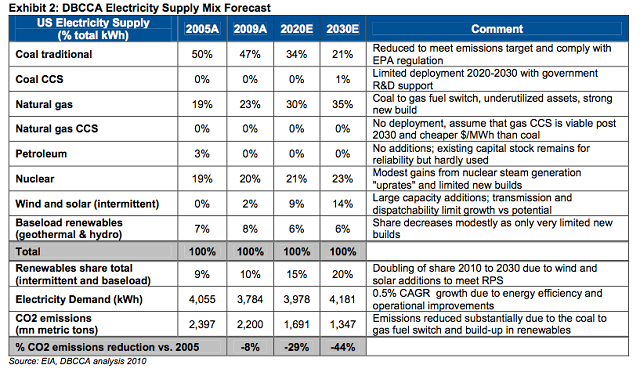

Some experts have been anticipating the coal to gas switch for several years now, but these results show that it’s happening faster than expected. In late 2010, Deutsche Bank’s Natural Gas and Renewables: A Secure Low Carbon Future Energy Plan for the United States report predicted that gas-fired generation would overtake coal between 2020 and 2030:

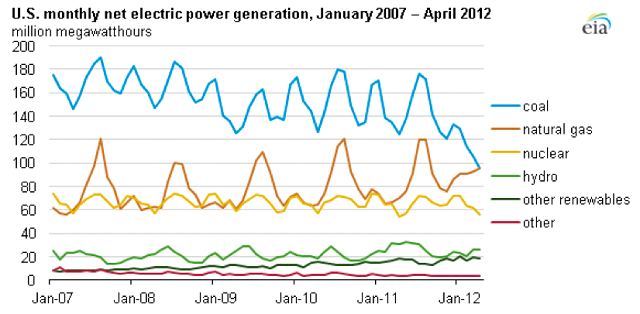

But when you look at the findings of the Benchmarking report and the latest data from the Energy Information Administration, you can see that even Deutsche Bank’s bullish predictions may have been too conservative. The shift has come sooner than projected. In April 2012, coal- and gas-fired generation were equal for the first time ever:

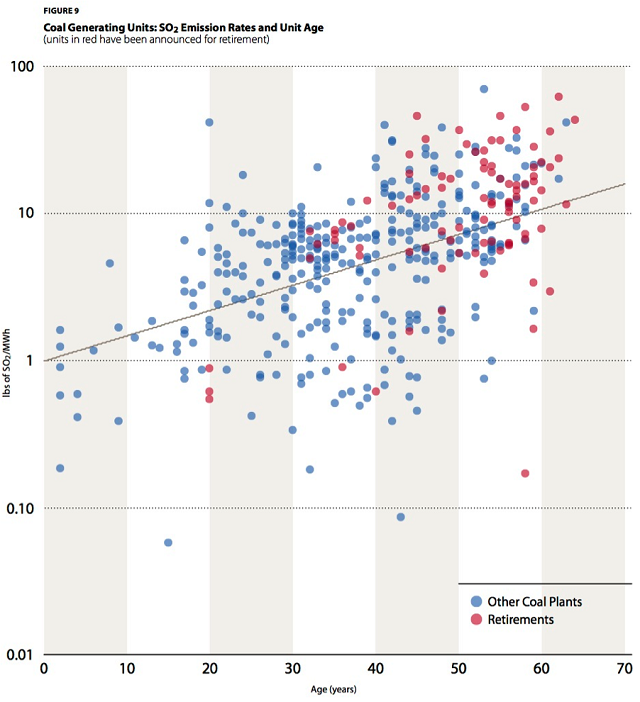

Though we can expect generation sources to fluctuate somewhat with seasonal demand and the price of natural gas, this is still an historic shift for the U.S. grid. As power producers adjust their generating fleets, gas is being swapped for coal in some cases, but in others, coal plants are being retired outright. According to the 2012 Benchmarking Air Emissions report, 12 percent of the nation’s coal-fired generation fleet—about 40 gigawatts of capacity—will be retired. And as the chart below indicates, the plants that are being phased out are largely older, high-emitting generating units:

The majority of the plants being retired are more than 50 years old, and they have some of the highest emissions rates per megawatt of power produced. It’s time to replace them with better, cleaner technologies.

And while utilities typically look to natural gas plants to replace coal, they continue to explore zero-emitting resources. Energy efficiency continues to gain traction and is increasingly being treated as a supply-side resource. From 2010 to 2011, utility energy efficiency budgets increased 26 percent to $6.8 billion, and the nation’s largest electricity market—PJM Interconnection—procured over 900 megawatts of energy efficiency in its latest capacity auction.

These industry-wide trends help to inform the main aim of the Benchmarking Air Emissions report, which is to provide side-by-side comparisons of emissions from power producers across the United States. On a company-by-company basis, the trends are encouraging, but for some, there is still a long way to go to becoming diversified, cleaner power producers.

A good example of these contrasts concerns three of the nation’s largest utilities and their work with energy efficiency programs in Ohio. The state has set strong efficiency goals, with a target of 22.5 percent energy savings by 2025, and these standards affect three large power producers: American Electric Power, Duke Energy and FirstEnergy.

Though they are among the highest-emitting power companies, both Duke Energy and American Electric Power have electric utilities in Ohio that are providing comprehensive energy efficiency programs that are meeting and in some cases exceeding goals. On the other hand, FirstEnergy has been publicly opposing Ohio’s efficiency standards and has delivered sub-par programs thus far. (See this report card for more details on how these utilities stack up.) As each of these heavily coal-burning utilities looks to the future of its generation fleet, they will have to take efficiency and other zero-emissions technologies into account.

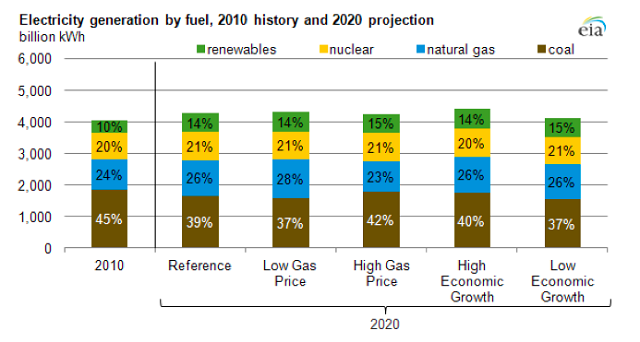

And if the projections are correct, that’s where the biggest growth will be. Just last week, EIA released its new projections for electricity generation over the next several decades. They predict that coal’s share of electricity generation will continue its decline, while renewable energy will see the biggest jump up by 2020:

In my opinion, these projections are still too moderate—but it is encouraging to see the EIA, which tends to use conservative assumptions, predicting that this important shift will continue just as utilities are entering a large-scale build cycle of new generation. The Brattle Group estimates that the electric power sector’s total capital expenditures will be about $100 billion a year through 2030. And as Ceres’s previous reports have shown, renewables and efficiency are among the lowest-risk, lowest-cost resources available.

I’m encouraged by the findings of the 2012 Benchmarking Air Emissions report, but there’s more work to do. The electric power industry is undergoing a seismic shift, and we must ensure that when the dust settles the new energy landscape is better—and cleaner—than ever before.

You can return to the main Market News page, or press the Back button on your browser.