More Drilling Won't Lower Gas Prices

In an introductory economics class, the first thing the teacher sketches out on the blackboard is a strikingly simplistic graph: two curves making a swooping “X” between the two axes—the economic model of supply and demand. The basic underlying principle is simple: The point at which the supply curve and the demand curve meet will determine the price of the commodity. Increasing supply when demand remains constant will cause prices to fall.

In an introductory economics class, the first thing the teacher sketches out on the blackboard is a strikingly simplistic graph: two curves making a swooping “X” between the two axes—the economic model of supply and demand. The basic underlying principle is simple: The point at which the supply curve and the demand curve meet will determine the price of the commodity. Increasing supply when demand remains constant will cause prices to fall.This fundamental concept is widely understood by anyone who has sat through those Econ 101 lectures, and anyone who’s ever noticed a parking lot near a major sports venue jack up its prices on game day can easily relate. The concept is also the driving force behind the 2012 conservative reincarnation of Michael Steele and Sarah Palin’s favorite 2008 campaign slogan: “drill, baby, drill.”

If the solution were so simple, then the problem of rising gasoline prices wouldn’t exist—we’re already drilling like crazy in the United States. And yet prices have continued to spike. As my colleague Daniel J. Weiss explains, the reasons for the recent price increase are myriad and include political instability in the Persian Gulf, the influence of financial speculators, and increasing worldwide demand as economies recover.

Yet many conservatives are dusting off their old bumper stickers and touting more drilling as the sole solution to high prices at the pump. One Republican presidential contender, former Speaker of the House Newt Gingrich, is on the campaign trail promising that if elected he’ll get the price of gasoline back to a nationwide average of $2.50 per gallon. Yet even in a 29-minute infomercial-style speech, he couldn’t find the time to address any of the reasons why more drilling will not lead to lower prices.

Gingrich simply trumpets the misguided talking points of building the Keystone XL pipeline, tapping shale oil in the upper Midwest, and of course opening more areas to offshore drilling. He then leaves it to his audience to make the assumption that supply-side economics will work its voodoo magic, and presto-change-o, we’ll all be able to drive Hummers and have enough cash left over to put a latte in every cupholder.

By contrast, President Barack Obama delivered an address on energy last Thursday in which he made the less politically expedient but actually realistic proclamation that “there is no silver bullet” that will solve our energy problem. He further suggested anyone who pitches the idea that drilling alone will lower gas prices “doesn’t know what they’re talking about or just isn’t telling you the truth.”

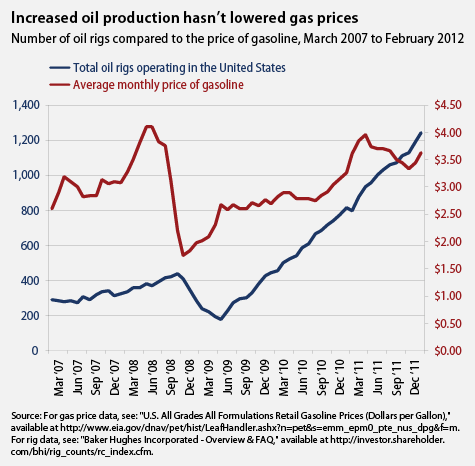

If increasing oil drilling lowered gas prices, we’d know it already. When President Obama took office in 2009, there were fewer than 400 drilling rigs operating in the United States, a number that dwindled to fewer than 200 by April 2009. Since then, even as his administration conducted a wholesale review of drilling regulations in the aftermath of the worst offshore oil spill in the nation’s history—the BP Deepwater Horizon oil catastrophe in the Gulf of Mexico—the number of oil rigs operating in the United States has quadrupled. But that massive influx of supply has done nothing to reduce the price we pay to top up our tanks.

As fundamental as the law of supply and demand might be to macroeconomic theory, the on-the-ground reality is that more drilling will not lower gas prices. Here’s why:

It hasn’t worked yet. There are currently more oil rigs operating on U.S. lands and waters than in the rest of the world combined, production is at an eight-year high, and the most recent “Short-Term Energy Outlook” from the Energy Information Administration projects production to continue growing at least through 2013 based on current activity. By the end of President Obama’s recently issued five-year drilling plan, fully 75 percent of our undiscovered, technically recoverable offshore reserves will be open to drilling. All that additional activity hasn’t stemmed the recent gas price spike.

If oil companies wanted to increase production, they could. In March 2011 the Department of the Interior released a report revealing two-thirds of oil-and-gas companies’ offshore leases and more than half of their onshore leases are not being produced.

Pumping oil takes time. Opening new offshore areas will take seven years to produce any new oil, and the Arctic National Wildlife Refuge will take 10 years to produce a single drop of oil. Even if more production would lower prices, it wouldn’t happen tomorrow. And the Energy Information Administration finds that even if we wave the green flag for our entire exclusive economic zone, it will do nothing more than reduce the cost of gasoline by two cents, and not until 2030.

You can’t put crude oil in your tank. Ultimately, gasoline supply is constrained not by oil production but by refining capacity. More than half of the nation’s refineries are controlled by five companies, and last spring, as gas prices surged close to $4 per gallon, the Los Angeles Times reported domestic refineries were “operating at about 81 percent of their production capacity,” and that exports of refined products such as gasoline were increasing because foreign buyers were “willing to pay a premium.” Take one look at gas prices in Europe and you’ll understand why.

Supply is global too. As U.S. production increased, other oil-producing countries actually reduced their output to ensure the price didn’t fluctuate. Remember, there are two ways to make money—increase volume, or increase price. Countries such as Saudi Arabia, whose reserves are reportedly on the decline, have every motive to ration their golden geese’s eggs.

There’s no doubt high gas prices are bad for economic recovery and growth. So if your freshman year economics professor was right about the whole supply-and-demand thing, when the increased supply of one particular thing doesn’t lower prices, then we should look to diversify our source of that thing while also reducing demand for it. This is a large part of President Obama’s answer to high gas prices.

Under the Obama administration the United States has put in place new fuel economy standards that will require cars sold in this country to average 55 miles per gallon by 2025. That helps answer the demand side of the equation. The administration is also incentivizing the development of renewable sources of energy that will reduce our dependence on fossil fuels. Diversifying sources of energy will result in greater supply and drive energy prices down. Similarly, we are investing in alternative, domestically produced liquid fuels that may prove capable of supplementing or even replacing traditional gasoline to reduce prices at the pump specifically.

More domestic oil and gas drilling will turn our public lands and oceans into pincushions, pave the way for the next BP Deepwater Horizon disaster, line Big Oil’s pockets with escalating profits, and increase the 25 percent share of planet-stifling greenhouse gas emissions that come from domestic fossil-fuel production.

Albert Einstein, among others, is credited with observing that the definition of insanity is “continuing to do the same thing over and over, and then expecting different results.” Perhaps Einstein wasn’t an economics professor, but he was still a pretty bright guy.

You can return to the main Market News page, or press the Back button on your browser.