Will Diving Dollar Force Acceptance of 'Amero' Currency?

FINANCIAL EXPERTS ARE SPEAKING loud and clear. “The dollar is a doomed currency, thanks to Washington,” well-known investor Jim Rogers said on Nov. 25. Peter Schiff, president of Euro Pacific Capital and adviser for Ron Paul’s 2008 GOP primary campaign, took it one step further.

FINANCIAL EXPERTS ARE SPEAKING loud and clear. “The dollar is a doomed currency, thanks to Washington,” well-known investor Jim Rogers said on Nov. 25. Peter Schiff, president of Euro Pacific Capital and adviser for Ron Paul’s 2008 GOP primary campaign, took it one step further. “This is just not a financial crisis. This is an economic collapse. Our entire phony economy is collapsing around us. There is nothing the government can do to stop it. They should just get out of the way and let it happen.”

David Tobin of Mission Capital Advisers agrees, stating on November 24, “The banking system is bankrupt.”

Economic problems couldn’t be more evident. Shockwaves from a burst housing bubble still linger, Detroit’s auto industry is on the verge of collapse, Wall Street investors have lost over $23 trillion in the past few months, socialist-style bailouts became the trend in 2008, while the dollar’s value is plummeting once again. As a result, William Engdahl of Global Research reported on December 15, “In November, U.S. companies cut jobs at the fastest rate in 34 years. Some $1.9 million U.S. jobs have vanished so far in 2008.”

Could this situation deteriorate to such an extent that Americans will actually beg for a new currency to replace the dollar? If globalist planners have their way, such a collapse is precisely what they’re trying to orchestrate.

On Nov. 27, Unfit for Command author Jerome Corsi wrote about billionaire investor Stephen Jarislowsky, who recently told the Canadian House of Commons, “Canada and the United States should both abandon their national dollar currencies and move to a regional North American currency as soon as possible.” Jarislowsky continued, “We have to really start thinking of the model of a continental currency. The idea would be a European Union-type setup with a North American central bank that would issue the new currency and sit over the Bank of Canada and the Federal Reserve in the United States.”

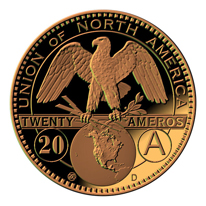

This new currency has popularly been called the “amero.” It was first officially proposed in 1999 by Canadian economist Herbert Grubel, who is a senior member of the “free-trade” oriented Fraser Institute and author of The Case for the Amero. His view on the erosion of national borders is apparent: “Sovereignty is not infinitely valuable.”

In March, 2005, the U.S. came one step closer to this reality when President Bush, Mexico’s Vicente Fox, and Canadian Prime Minister Paul Martin met in Waco, Tex. to announce their plans for a Security and Prosperity Partnership (SSP)—step one in the creation of a North American Union. With illegal immigration virtually unimpeded and threats of false-flag terrorism ever present, the recipe for disaster looms large.

Ben Steil, director of international economics at the Council on Foreign Relations, wrote an article in the May/June 2007 issue of Foreign Affairs entitled The End of National Currency. His primary thesis was unambiguous.

“National currencies and global markets simply do not mix. In order to globalize safely, countries should abandon monetary nationalism and abolish unwanted currencies.”

Setting the stage for such a move are two recent events of monumental importance. First, Bloomberg reported on Dec. 15 that “U.S. policy makers are flooding the world with an extra $8.5 trillion.”

John Taylor, chairman of New York’s FX Concepts Inc., observed, “The dollar will go to new lows as the U.S. attacks its currency.”

These are strong words, prompting many to warn of the second variable, Weimar-style hyperinflation, especially since the Fed is now virtually giving money away for free.

In mid-December, the Fed cut its funds rate to 0.25%, leading Michael Feroli of JP Morgan Chase to predict that the central bank will “cut the overnight lending rate to zero in January, and hold it there throughout the year.”

To make matters even more perilous, no one knows where all the money under our government’s Troubled Asset Relief Program (TARP) is going. According to conservative commentator Saundra McDavid on December 22, “The Associated Press contacted 21 banks which received over $1 billion of federal bailout money, and none of them were able or willing to disclose the use of the funds.”

Or, as JP Morgan spokesman Thomas Kelly so arrogantly put it, “We’ve lent some of it. We’ve not lent some of it. We have not disclosed that to the public. We’re declining to.”

Considering our fiscal climate, could we be teetering on the edge of financial Armageddon? Robert Pastore thinks so. Known as “Father of the North American Union,” he’s spent years planning a merger between Canada, Mexico, and the U.S. Chillingly, in an October 2006 speech, he declared, “A 9-11 crisis might be just the type of catastrophe needed to overcome governmental inertia in advancing the type of economic integration necessary to form a North American community.”

He added, “In a fiscal 9-11 crisis triggered by a dollar collapse, the amero might then look reasonable.”

With economic collapse, chaos would ensue; a scenario not deemed unlikely by Igor Panarin, a professor at Russia’s Ministry of Foreign Affairs. On November 24, he announced that the U.S. could potentially split into six separate regions following a financial crisis.

“The dollar isn’t secured by anything. The country’s foreign debt has grown like an avalanche. This is a pyramid which has to collapse.” He also anticipates that moves are underway to “replace the dollar with a common amero currency as a new monetary unit.”

Is this where Barack Obama enters the picture? Since his mantra for the past two years has been change, publisher Bob Chapman of The International Forecaster fits the final piece to the puzzle. “Creating the amero will be presented to the American public as the administration’s solution for dollar recovery.”

To do so, could an emergency be declared where the U.S. is reorganized under some form of Chapter 11 bankruptcy, with the entire banking industry nationalized, including the Federal Reserve?

In an Oct. 7 column, documentary filmmaker Patrick Henningsen considered the possibility. “The dollar will become basically worthless after the exchange for the Amero, and will have little international value. If you understand who owns the Fed, you will know that U.S. dollars are essentially printed by the same private institutions who print the euro. The amero is about expanding this bank’s operation out of Mexico and Canada, essentially allowing European central banks (and their U.S. Federal Reserve “franchise”) to gain complete control over the entire money supply of North America. The amero will simply bring us one step closer to a global currency; and one step closer to a global government.”

One can’t help but be reminded of Vice President Joe Biden’s words at an Oct. 19 Seattle fundraiser: “Mark my words. It will not be six months before the world tests Barack Obama like they did John Kennedy. We’re going to have an international crisis, a generated crisis, to test the mettle of this guy. And he’s going to need help because it’s not going to be apparent initially; it’s not going to be apparent that we’re right.”

Was he referring to suspending the Constitution, then instituting the amero? Tragically, we’re only one major event away from finding out.

By Victor Thorn

You can return to the main Market News page, or press the Back button on your browser.