UK and US banks among biggest backers of Russian ‘carbon bombs’, data shows

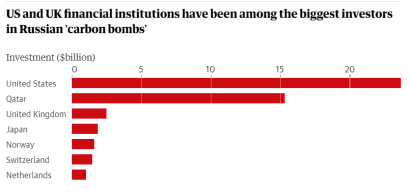

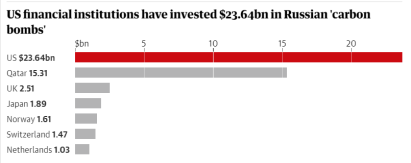

US and UK financial institutions have been among the leading investors in Russian “carbon bomb” fossil fuel projects, according to a new database of holdings from recent years.

US and UK financial institutions have been among the leading investors in Russian “carbon bomb” fossil fuel projects, according to a new database of holdings from recent years.

Campaigners in Ukraine said these institutions must immediately end such investments, to limit the funding of Russia’s invasion of Ukraine and to avoid climate breakdown.

Carbon bombs are fossil-fuel extraction projects identified by researchers to contain at least 1bn tonnes of climate-heating CO2, triple the UK’s annual emissions. Russia is a hotspot, with 40 carbon bombs, 19 of them operated or developed by Russian companies backed by foreign finance. The companies are Gazprom, Novatek, Lukoil, Rosneft oil company and Tatneft.

The database, produced by the Leave it in the Ground Initiative (Lingo), found more than 400 foreign financial institutions had provided $130bn (£109bn) of support to the Russian companies – $52bn in investment and $84bn in credit. The data was released on Wednesday, Ukraine’s independence day and six months since the start of the Russian invasion.

Financial institutions in the US hold almost half the foreign investment in Russian carbon bomb companies, with 154 institutions holding $23.6bn. The largest combination of investment and credit – $10bn – was provided by JPMorgan Chase, which other analyses have also identified as a leading funder of fossil fuels.

Financial institutions in the US hold almost half the foreign investment in Russian carbon bomb companies, with 154 institutions holding $23.6bn. The largest combination of investment and credit – $10bn – was provided by JPMorgan Chase, which other analyses have also identified as a leading funder of fossil fuels.

The biggest single investment in the Russian carbon bomb companies was the $15.3bn in Rosneft held by the Qatar Investment Authority, Qatar’s sovereign wealth fund.

The UK was third in the list of investing nations, with 32 financial institutions holding $2.5bn in investments. HSBC had the largest investment and credit total, at $308m. Financial groups in Japan, Norway, Switzerland and the Netherlands also held significant investments, while Chinese and Italian institutions provided $45bn in credit between them.

“Putin’s war is funded through money from fossil fuels and these fossil fuels are causing climate breakdown as we speak,” said Svitlana Romanko, director of the Ukrainian NGO Razom We Stand, which is calling for an immediate end to all foreign investment in Russian fossil fuel companies and a permanent embargo on Russian oil, gas and coal. “Investing in Russian carbon bombs is the worst thing you can do today.”

Kjell Kühne, at Lingo, said: “This [war] has made really clear that, when you don’t care who you’re doing business with, it does translate into human suffering and lives lost. It’s also clear we should not be investing in new fossil fuel projects, as the International Energy Agency has confirmed. Anybody involved in these projects should be really questioning what they’re doing.”

The Lingo researchers said some financial institutions may have reduced their support for the Russian companies since the war started, but that many seemed to have adopted a wait-and-see approach. The researchers hope the database will enable campaigners to challenge the 400 institutions over their investments.

The foreign financial support is largely for big oil and gas projects in Russia, including in Siberia and the Arctic. Coal projects are mainly supported by domestic investors, the researchers said. The database only includes financial support for the Russian fossil fuel companies and not for foreign oil and gas companies that work in Russia, or the services companies that support them.

In May, the Guardian revealed that world’s biggest fossil fuel firms were quietly planning huge oil and gas projects that would drive the climate past internationally agreed temperature limits, with catastrophic global impacts. The plans included 195 carbon bombs identified by Kühne and his colleagues, 60% of which have already started pumping. “We have identified the carbon bombs, now we have to defuse them,” he said.

A spokeswoman for HSBC said: “HSBC Asset Management has suspended dealings in its Russia-only funds which include the Russian oil and gas companies referenced and [is] no longer investing further in funds whose objectives included investing in Russian securities. In these funds, exposure to Russian equities has generally been reduced or exited.”

JPMorgan Chase and the Qatar Investment Authority have also been contacted for comment.

You can return to the main Market News page, or press the Back button on your browser.