The Natural Rubber Price Entering US$5000 Per Tonne, Are You Ready Now?

As your supplier and prospective supplier, I think I have an obligation to share with you our analysis of the tire price trend for a period of time in the future.

As your supplier and prospective supplier, I think I have an obligation to share with you our analysis of the tire price trend for a period of time in the future.I think an analysis, from a professional point of view, could help you grasp the opportunities for the future.

Currently, natural rubber prices hit 5.000 USD / Metric Ton and Synthetic rubber prices are trading at record levels of 3500 USD /Ton respectively and higher rubber prices were expected in 2011.

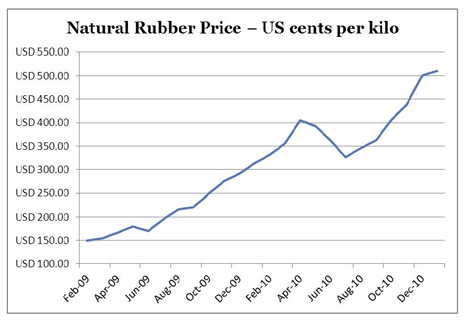

We all know that natural rubber constitutes as much as 50% of the cost of tire production. The natural rubber price increased over 240% from the Feb 2009 (Please refer to the trend chart of natural rubber price as follow).

Extreme weather and aging trees in the key rubber-growing countries of southeastern Asia will reduce natural rubber production to 10.25 million metric tons this year, according to the International Rubber Study Group. Meanwhile, natural rubber consumption will be 10.31 million metric tons.

Looking ahead, projected demand of 11.26 million metric tons in 2011 will outpace anticipated production of 11.0 million metric tons. The bullish natural rubber demand and price outlook is supported by the fact that inventories of the material, used to make gloves, hose, gaskets, and condoms as well as motor vehicle tires, are projected to fall to 67 days of demand in 2011, according to an analysis by Goldman Sachs Group. That’s because of a projected 16.4% rise in world automotive production this year, according to IHS Global Insight, and an 8.5% expansion in 2011.

Since this ‘bullish-phase’ in the natural price will continue to lag behind soaring demand for some months to come, tire makers have had to boost prices to offset the higher cost of their key raw material.

Here is a list of all the announced tire price hikes in the United States this year, not including in-line adjustments.

- American Pacific Industries Inc. (API): up to 8% on Feb. 1; up to 10% on Oct. 27.

- Bridgestone Americas Tire Operations LLC (BATO): up to 5% on Jan. 1; up to 6% (on “certain” passenger and light truck tires) on June 1; up to 8% on Nov. 1.

- Continental Tire the Americas LLC: up to 5% on Jan. 1; up to 6% on June 1.

- Cooper Tire & Rubber Co.: up to 7.5% on June 1; up to 6.5% on Nov. 1.

- Falken Tire Corp.: up to 6% on June 1; up to 8% on Nov. 1.

- Goodyear Tire & Rubber Co.: up to 6% on June 1.

- Hankook Tire America Corp.: up to 5% on Jan. 1; up to 6% on June 1; up to 6.5% on Nov. 1.

- Kumho Tire U.S.A. Inc.: up to 8% on Jan. 1; up to 8% on June 1; up to 6.5% on Nov. 1.

- Michelin North America Inc.: varied (by product line) on Feb. 1; up to 6% on June 1.

- Nankang Rubber Tire Corp. (Tireco Inc.): 6% to 8% on April 20.

- Nexen Tire America Inc.: up to 8% on Jan. 1; 8% on June 1.

- Nokian Tyres Inc.: 3% to 6% on Jan. 11; unannounced price increase in June.

- Pirelli Tire North America: up to 4.5% (except P4 and P5 Touring out of China) on Jan. 1; 4% on July 1; up to 7% on Dec. 1.

- Toyo Tire U.S.A. Corp.: up to 6% on Jan. 1; up to 8% on June 1; up to 6% on Nov. 1.

- Yokohama Tire Corp.: up to 6% (up to 15% on exports from Japan) on Jan. 1; up to 8% on June 1; up to 8% on Dec. 1.

Goodyear and Falken raised prices once and twice, respectively, during 2010. However, both companies (Goodyear up to 6%, Falken up to 7%) raised prices on Dec. 1, 2009, prior to the New Year.

Our final goal is to provide you a reliable basis to assist you to formulate a new flexible marketing strategy. We hope all mentioned above could help you to formulate a new flexible marketing strategy and to respond accurately to the changes of the markets.

You can return to the main Market News page, or press the Back button on your browser.