Silicon, Solar Power & Manufacturing: China Continues to Play by Its Own Rules

Much has been talked and written about competition when it comes to manufacturing and international trade in solar photovoltaic (PV) products and technology in the wake of CASM’s filing of dumping and countervailing duty petitions with the Dept. of Commerce and International Trade Commission. Talking about the competitiveness, or lack thereof, of manufacturing solar PV in the US isn’t anywhere near central to the real issue, however. This becomes apparent when examining the vastly different, fundamental nature and structure of the Chinese and US economies.

Much has been talked and written about competition when it comes to manufacturing and international trade in solar photovoltaic (PV) products and technology in the wake of CASM’s filing of dumping and countervailing duty petitions with the Dept. of Commerce and International Trade Commission. Talking about the competitiveness, or lack thereof, of manufacturing solar PV in the US isn’t anywhere near central to the real issue, however. This becomes apparent when examining the vastly different, fundamental nature and structure of the Chinese and US economies.Talking about relative competitiveness of manufacturing in China versus the US is valid enough in theory, but in fact the US and China are playing completely different ball games, or more accurately, playing the same ball game according to wildly different rules. Nowhere can this fundamental clash of economic systems and government policies perhaps be seen more clearly than in the solar PV industry policies and goals set out in China’s latest, recently announced Five-Year Plan.

China’s 12th Five-Year Plan: A Clear, Present Threat to Foreign Competitors

As part of China’s 12th Five-Year Plan, the Ministry of Industry and Information Technology announced the admirable and welcome goal of reducing the cost of solar power to 0.8 yuan (12 US cents) per kilowatt-hour (kWh) by 2015 and 0.6 yuan (9 cents) by 2020.

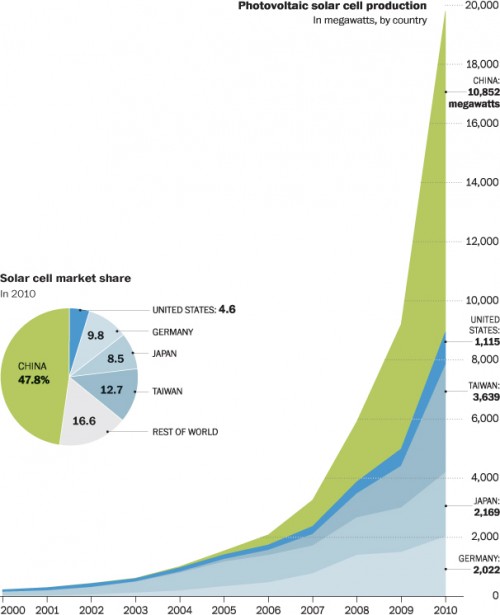

The 12th Five-Year Plan also calls for Chinese manufacturers to significantly increase production of solar PV panels in order to reach 5 gigawatts (5 GW) by 2015, while polysilicon producers will increase their annual production capacity to 50,000 tons.

These market directives come in the wake of solar PV panel prices crashing in the past two years. Leading solar PV companies around the world are posting losses, while less-well-established businesses are going bankrupt. Uncalled for and unsustainable growth in solar PV panel and polysilicon production by Chinese producers have been the main culprits.

Ironically, the extraordinary drop in solar PV and polysilicon prices largely prompted by increasing Chinese production is leading governments in the countries that have led growth in solar power to cut back and reduce, if not eliminate or shelve, subsidies and other incentives — killing the goose that lays the golden eggs, so to speak.

Flaunting International Trade Rules

Is China’s latest Five-Year Plan the response of an open market-driven economy driven by supply and demand? Clearly not. It’s the response of a centralized command-and-control economic system that is fundamentally the polar opposite of those in the US and other major market-driven economies around the world. To pretend otherwise risks future economic growth and well-being of citizens in the US, EU and all other Chinese trade partners.

Regardless of market supply and demand conditions, the Chinese government is intent on continual expansion of “private sector” solar power companies across the supply chain. Could the following ever occur in the US, EU or other countries based on a private sector, market-driven economy?

“The government will also help companies in the solar sector increase annual sales. It aims to have at least one company reaching 100 billion yuan in sales by 2015, and between three and five companies reaching 50 billion yuan by the same date,” according to People’s Daily Online’s report.

Not only that, but despite announced plans to aggressively ramp up domestic solar PV installations, well over 90% of China’s solar PV cells and panels are exported. Tilting the scales even further in favor of domestic companies, “80% of solar equipment and auxiliary materials” are to be produced domestically. Hence, the solar power goals spelled out in China’s latest Five-Year Plan only raise the stakes and increases the pressure on competitors in other WTO member countries.

Subsidizing industries to increase exports to the detriment and harm of industry and businesses in other WTO member countries is specifically prohibited according to WTO rules. So is dumping of products at costs below domestic production. Seeking to enforce these international trade rules to assure something like a level playing field is what CASM’s trade petitions are all about.

Thus far, China’s industrial development and trade policies have focused on knocking out foreign competition in silicon solar PV. The latest Five-Year Plan expands that and puts thin-film solar PV manufacturers under threat. “The plan will bring opportunities for thin-film PV panels,” People’s Daily quoted a unnamed source at Hanergy Holdings Group Co Ltd, a producer of thin-film PV panels.

You can return to the main Market News page, or press the Back button on your browser.