New Energy Finance Cleaning Up 2009 Report Now Available

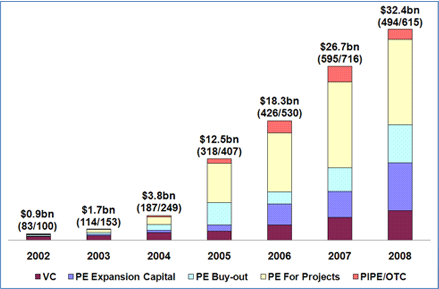

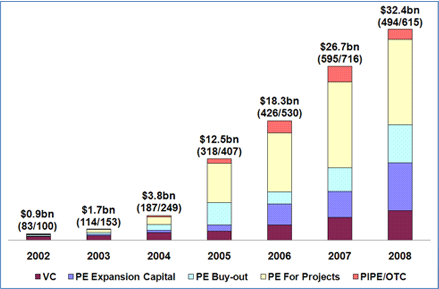

Growth in Private Equity & Venture Capital Investment in Clean Energy Technologies, Companies, & Projects

New Energy Finance is pleased to release the Cleaning Up 2009 report, which provides an in-depth analysis into VC & PE clean energy investment, highlighting the key investment trends of 2008 and offers predictions for 2009 and beyond. While difficult economic conditions led to the contraction of most asset classes in 2008, venture capital and private equity investment held strong with $32.4bn of investment in companies and projects.

To access the full executive summary or get more information, click here.

The Cleaning-Up 2009 report includes:

New Energy Finance is the world’s leading independent provider of subscription-based research to decision-makers in renewable energy, energy efficiency, biofuels, carbon capture and storage, nuclear power and the carbon markets. The company has a staff of more than 130, based in London, Washington DC, New York, Palo Alto, Beijing, New Delhi, Hyderabad, Cape Town, São Paulo and Perth. New Energy Finance’s Insight Services provide deep market analysis to investors in wind, solar, bioenergy, geothermal, carbon capture and storage, energy efficiency, nuclear power and the traditional energy markets. Our Industry Intelligence service provides access to the most comprehensive database of investors and investments in clean energy. The New Energy Finance Briefing is the leading global news and newsletter service focusing on clean energy investment. New Energy Finance is co-publisher of the first global stock-market index of quoted clean energy companies (ticker symbol NEX). The company also undertakes custom research and consultancy and runs senior-level networking events.

New Energy Finance is pleased to release the Cleaning Up 2009 report, which provides an in-depth analysis into VC & PE clean energy investment, highlighting the key investment trends of 2008 and offers predictions for 2009 and beyond. While difficult economic conditions led to the contraction of most asset classes in 2008, venture capital and private equity investment held strong with $32.4bn of investment in companies and projects.

To access the full executive summary or get more information, click here.

The Cleaning-Up 2009 report includes:

- Development-Stage Clean Energy Companies: Of the 1,085 development-stage clean energy companies tracked, see the sectors that are getting funded and what global geographic regions are fostering new companies

- Milestone Deals: An eighteen month overview of select clean energy firm and company fund raises, IPOs, buyouts, M&A and other exits

- Clean Energy Business Incubators: Instrumental in maintaining support for the earliest stages of technological entrepreneurship, learn which regions foster the most early stage technologies and which ones are the most successful

- Private Equity Investment in Companies: PE investment in companies witnessed explosive growth in 2008. Learn which types, regions and sectors grew from 2006 through to 2008 as well as the trends in PIPEs and OTC.

- Private Equity Investment in Projects: Though mid-2008 strong growth fundamentals for clean energy, attractive debt conditions and healthy tax appetites fuelled growth. Find out which of the sectors saw great success and which stagnated.

- Venture Capital & Private Equity Investor Exits: Despite breakthrough quarters for venture and private equity investment, realization of investments lagged. Certain sectors IPO route whereas many

- Global Regions: Which regions are lagging behind? Find out which dominate the international investment landscape in venture and private equity and where competition is emerging.

- US State Investment Spotlight: Five states accounted for 68% of all US private equity investment in new energy companies in 2008. Cleaning Up discusses the factors are driving this domination and the sectors that are reaping the investment dollars.

- Venture Capital & Private Equity Investor Exits: While the momentum behind venture capital and private equity investments continued to build, tough market conditions prevented investors from realizing exits. Learn which sectors were most successful and what routes were most traveled.

- Investment Forecast 2009-2015: Looking past the current turmoil in the market, New Energy Finance forecasts the growth rates in venture and private equity investment through 2015.

New Energy Finance is the world’s leading independent provider of subscription-based research to decision-makers in renewable energy, energy efficiency, biofuels, carbon capture and storage, nuclear power and the carbon markets. The company has a staff of more than 130, based in London, Washington DC, New York, Palo Alto, Beijing, New Delhi, Hyderabad, Cape Town, São Paulo and Perth. New Energy Finance’s Insight Services provide deep market analysis to investors in wind, solar, bioenergy, geothermal, carbon capture and storage, energy efficiency, nuclear power and the traditional energy markets. Our Industry Intelligence service provides access to the most comprehensive database of investors and investments in clean energy. The New Energy Finance Briefing is the leading global news and newsletter service focusing on clean energy investment. New Energy Finance is co-publisher of the first global stock-market index of quoted clean energy companies (ticker symbol NEX). The company also undertakes custom research and consultancy and runs senior-level networking events.

You can return to the main Market News page, or press the Back button on your browser.