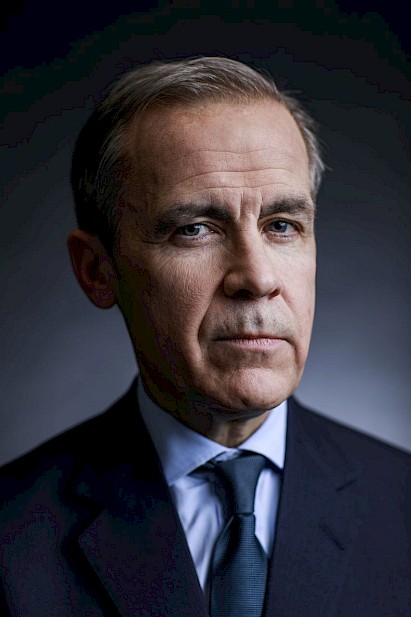

Mark Carney says we're not ready for ‘when things go wrong’

Senior officials in corporate boardrooms and governments need to stop resisting financial reforms that are needed to make the economy more resilient to the climate crisis, Mark Carney says.

Senior officials in corporate boardrooms and governments need to stop resisting financial reforms that are needed to make the economy more resilient to the climate crisis, Mark Carney says.

The former governor of the Bank of Canada and the Bank of England told a Montreal audience of financial regulators and accountants that corporations and governments have “undervalued” the benefits of being transparent about how a changing climate will affect revenues, profits and the economy.

Carney was referring to how officials are pushing back against international disclosure standards, the latest of which are set to be published this summer. The standards would require companies analyze and reveal how a range of different outcomes from climate change could upend their business plans or trash their financial performance.

The cold shoulder given to this type of exercise so far by corporate managers, Carney suggested, was “partly a product of a consistent attitude that unfortunately we’ve had across economies — and I would include governments in this — in that we’ve undervalued resilience relative to efficiency.”

“We haven’t thought about what happens when things go wrong. We haven’t invested in that. We had that in the financial crisis, we had that in the COVID crisis, we had it in energy markets, in geopolitics. We certainly have it in climate. This [exercise] is asking that question.”

Mark Carney: ‘how do you look, as a company, in a 1.5-degree world?’

Carney said the outcome of the exercise, known as climate scenario analysis, was the “least observed” out of all the recommendations made in 2017 by the Task Force on Climate-related Financial Disclosures, a committee linked to the Group of 20 (G20) major economies that Carney helped establish.

He said upcoming climate financial disclosure standards were not yet “adequately understood” by many corporate boards.

“It sounds incredible, but it’s only very recently that it’s become understood that [there should be] board-level responsibility for managing climate-related risks,” said Carney, who also co-chairs a group of financial institutions committed to net-zero emissions.

When The Narwhal reviewed the positions of more than 100 companies and organizations in 2022, it found the majority were opposed to key financial disclosure proposals like climate scenarios.

Oil and gas companies were particularly vocal; none of the submissions to regulators from oil and gas firms The Narwhal reviewed supported making the exercise immediately mandatory.

Yet it’s critical for companies to carry out this kind of strategic planning, Carney added, in order to respond to the clear public demand for climate action.

“[It] helps make the judgement of where the company is going and how it’s going to operate under different scenarios — the most important of which, I’d like to think, is that we as a society do what our citizens are asking us to do, which is address this issue,” he said at the February event.

“How do you look, as a company, in a 1.5-degree world?” he asked, referring to when global average temperatures have risen 1.5 degrees Celsius above pre-industrial levels.

“Is that an opportunity or a risk? Is it something you’re planning for, or you’re not prepared for?”

From surviving to thriving as ‘green, nature-positive, net-zero’

Further action to crack down on fossil fuel pollution is needed to avoid crossing the dangerous threshold of 1.5 degrees of warming, scientists have found. Crossing the 1.5-degree threshold will bring poverty, disease and extreme weather to millions of people.

The new standards would also require businesses to report the carbon pollution generated when the products they produce are used, like when an energy company’s oil is refined into gasoline and used to power cars.

Experts say sustainable finance standards are important not just for large corporations, but because they can help shield vulnerable populations from climate impacts.

Éliane Ubalijoro, a McGill University professor who is the Canada hub director for Future Earth, a network of scientists funded by universities and research groups, said climate change has decreased productivity by 30 per cent for many crops in Africa over the last 50 years, while the continent’s population is expected to double between now and 2050.

The situation can be improved by helping channel funding and information towards smallholder farmers so they can transition to sustainable farming practices, said Ubalijoro, speaking at the summit Carney attended. She said climate disclosure standards can help with that.

“For emerging economies, we know that we need immense funding around [climate] mitigation and adaptation…there’s an incentive for all governments, for all businesses, micro to large, to really adopt standards to allow those [financial] flows to come in,” Ubalijoro said.

“It’s about how do we collectively go from trying to survive climate crisis, to collectively thriving in a green, nature-positive, net-zero world.”

G20 wants ‘globally consistent’ climate financial standards

Businesses have been hesitant to use climate scenarios in Canada because there are multiple, valid versions available for use, argued the Business Council of Canada, a group of chief executives at top Canadian firms.

“Unfortunately we do not yet have a common set of forward-looking financial scenarios that can be used in all disclosures,” said John Dillon, senior vice president for policy and corporate counsel at the council.

The federal government should help develop some baseline climate scenarios, a federal expert panel on sustainable finance said in 2019, to create “a starting point for comparability,”

Ensuring all climate disclosures are “based on the same criteria,” Dillon wrote in an email, “is the best way to ensure that climate disclosure by Canadian companies provides meaningful and practical information to shareholders, governments, regulators and the public.”

Canada and the other G20 nations have been calling for “globally consistent, comparable and reliable” climate disclosure standards in the hope of creating a baseline for world financial markets to help investors shift money away from high-polluting sectors.

Such a shift can destabilize the Canadian economy if it’s done too abruptly or too late, the Bank of Canada and the federal banking regulator have warned. Climate change-driven destabilization will threaten people’s retirement savings and jobs.

New climate rules won’t automatically apply in Canada

Carney told the crowd at the International Financial Reporting Standards Foundation’s inaugural summit that he believed the new climate disclosure standards need to “move from voluntary to mandatory.”

The new standards go into effect in January 2024, and while businesses can voluntarily adopt them, they won’t automatically apply in Canada.

Provincial and territorial securities regulators have the authority to impose mandatory financial disclosures. These regulators co-ordinate their work in a group called the Canadian Securities Administrators.

The administrators group is reviewing the new climate disclosure standards, as part of an ongoing assessment of its own proposal for a climate-related disclosure rule that it first made in October 2021.

The group told The Narwhal it could not predict a date on which new climate disclosure standards could come into force, because a new domestic standards committee expected to review the international standards isn’t fully up and running yet.

Canadian financial regulators are also part of the Madrid-based International Organization of Securities Commissions, which will conduct its own review of the climate standards and make recommendations to its members, the group noted.

The federal Liberal government, which helped pay for the climate financial standards committee to open a Montreal office, has said it is committed to moving towards mandatory climate reporting. Finance Minister Chrystia Freeland’s mandate letter orders her to work with the provinces and territories to “move toward mandatory climate-related financial disclosures.”

The Department of Finance would not say if the minister supported the new climate disclosure standards or if she hoped to see them made mandatory in Canada – only that adoption of the standards and whether to make them mandatory will be a matter for standard-setters and regulators to consider.

Carney has declared his support for the Liberal Party and chairs the advisory board of a Liberal-linked think tank.

The Narwhal asked Jasraj Singh Hallan, the Conservative Party’s finance critic, if he supported making the new climate disclosure standards a requirement for Canadian businesses, but did not immediately hear back before publication.

Ontario Securities Commission watching what the United States will do

One issue that regulators appear to be grappling with is whether the rules should fall equally on companies regardless of size.

Grant Vingoe, CEO of the Ontario Securities Commission, one of the regulators examining new disclosure requirements, told attendees at the summit that the commission was “incredibly supportive of a global baseline” — but also wanted to ensure the standards are “adaptable” and have appropriate timelines for coming into force.

Vingoe said Canada “stands out as being characterized by natural resources companies,” including a large number of smaller companies in the sector, and a “somewhat uniquely, very active public venture capital market.”

“We can cover most of the emitters in Canada through rules that are fully implemented for our most senior [public companies], who are already down this path,” he said.

“But if we are going to have vibrant capital markets, and more entrants from junior [companies] we need to ensure that the rules are well-adapted to that sector.”

Canadian regulators are also considering how closely to align with rules in the United States, given that many Canadian firms are listed in U.S. markets.

The U.S. Securities and Exchange Commission (SEC) proposed a suite of climate financial disclosure standards of its own. The commission’s chairman, however, recently said the body might make adjustments to some of its proposal.

“We’re going to have to make sure that in dealing with the climate disclosure standards, and our desire to endorse them and put them into law, that they’re also not inconsistent with what the SEC is doing, in order to preserve our really privileged position in accessing U.S. capital markets,” said Vingoe.

You can return to the main Market News page, or press the Back button on your browser.