Global Clean Energy Markets Exceed $220 Billion by 2016

Global clean-energy markets are poised to quadruple in the next decade, growing from $55.4 billion in revenues in 2006 to more than $226.5 billion by 2016 for four benchmark technologies, according to the sixth annual Clean Energy Trends report. The report was released by clean-tech research and publishing firm Clean Edge, Inc.

As highlighted in the report, “Clean Energy Trends 2007,” a number of factors are contributing to this extensive growth, including an influx of venture capital (VC); a new level of commitment by politicians at regional, state, and federal levels; and significant corporate investments in clean-energy acquisitions and expansion initiatives.

For the second year in a row, the global biofuels market was slightly larger than both solar and wind, reaching $20.5 billion in 2006 and projected to grow to more than $80 billion by 2016. Clean Edge projects solar photovoltaics (modules, system components, and installations) will grow from a $15.6 billion market in 2006 to $69.3 billion by 2016; wind power installations will expand from $17.9 billion in 2006 to $60.8 billion in 2016; and the markets for fuel cells and distributed hydrogen will grow from $1.4 billion in 2006 to $15.6 billion over the next decade.

“At $55 billion, the global market for biofuels, solar, wind, and fuel cells are now considerably larger than the global recorded music industry,” explains Clean Edge co-founder and principal Ron Pernick. “Within a decade we predict these clean-energy markets will exceed $220 billion and that the global annual production of biofuels will increase from around 13 billion gallons last year to 50 billion gallons, solar will jump from 2 GW of production to nearly 20 GW, and wind power will increase from 15 GW to 67 GW. ”

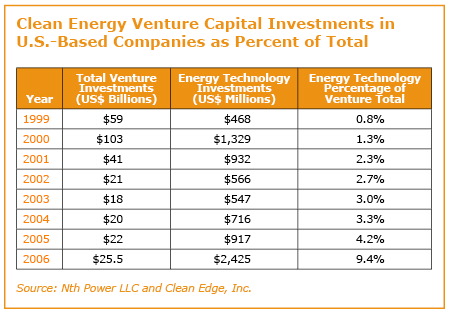

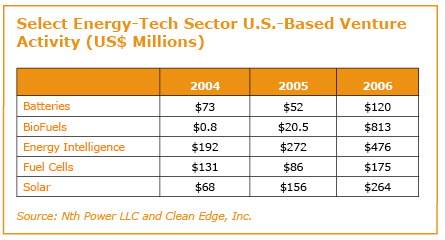

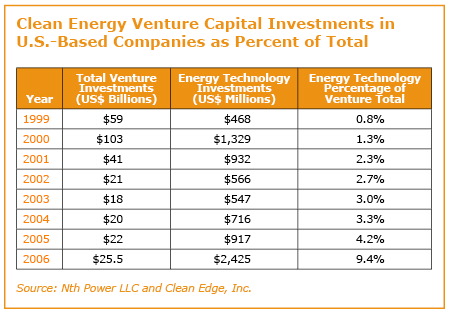

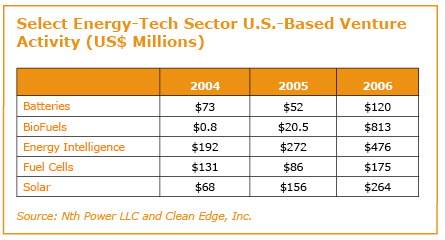

Clean Edge, in collaboration with Nth Power, a leading energy-tech VC firm, also released the firms’ annual energy-tech venture data. This year’s findings show that VC investments in energy-tech start- ups rose 262 percent to $2.4 billion in 2006. These investments, primarily in transportation and fuels, distributed energy, energy intelligence, and power reliability, eclipsed the previous high- water mark set in 2000 for energy-tech investing by more than $1 billion. The figures represent 9.4 percent of total US venture capital investments in 2006.

“Energy tech investing in the U.S. now represents nearly ten percent of the total venture activity,” explains Rodrigo Prudencio, partner, Nth Power. “With a growing number of investors actively seeking energy-tech deals, the capital to fund biofuel and solar expansion was readily available. 2007 will clearly be an indicator of whether the aggressive growth in energy-tech investment can be sustained.”

“Clean Energy Trends 2007” also names five key trends that are shaping the clean-energy landscape this year. They include:

As highlighted in the report, “Clean Energy Trends 2007,” a number of factors are contributing to this extensive growth, including an influx of venture capital (VC); a new level of commitment by politicians at regional, state, and federal levels; and significant corporate investments in clean-energy acquisitions and expansion initiatives.

For the second year in a row, the global biofuels market was slightly larger than both solar and wind, reaching $20.5 billion in 2006 and projected to grow to more than $80 billion by 2016. Clean Edge projects solar photovoltaics (modules, system components, and installations) will grow from a $15.6 billion market in 2006 to $69.3 billion by 2016; wind power installations will expand from $17.9 billion in 2006 to $60.8 billion in 2016; and the markets for fuel cells and distributed hydrogen will grow from $1.4 billion in 2006 to $15.6 billion over the next decade.

“At $55 billion, the global market for biofuels, solar, wind, and fuel cells are now considerably larger than the global recorded music industry,” explains Clean Edge co-founder and principal Ron Pernick. “Within a decade we predict these clean-energy markets will exceed $220 billion and that the global annual production of biofuels will increase from around 13 billion gallons last year to 50 billion gallons, solar will jump from 2 GW of production to nearly 20 GW, and wind power will increase from 15 GW to 67 GW. ”

Clean Edge, in collaboration with Nth Power, a leading energy-tech VC firm, also released the firms’ annual energy-tech venture data. This year’s findings show that VC investments in energy-tech start- ups rose 262 percent to $2.4 billion in 2006. These investments, primarily in transportation and fuels, distributed energy, energy intelligence, and power reliability, eclipsed the previous high- water mark set in 2000 for energy-tech investing by more than $1 billion. The figures represent 9.4 percent of total US venture capital investments in 2006.

“Energy tech investing in the U.S. now represents nearly ten percent of the total venture activity,” explains Rodrigo Prudencio, partner, Nth Power. “With a growing number of investors actively seeking energy-tech deals, the capital to fund biofuel and solar expansion was readily available. 2007 will clearly be an indicator of whether the aggressive growth in energy-tech investment can be sustained.”

“Clean Energy Trends 2007” also names five key trends that are shaping the clean-energy landscape this year. They include:

- Carbon Finally Has a Price…and a Market

- Biorefineries Begin to Close the Loop

- Advanced Battery Makers Take Charge

- Wal-Mart Becomes a Clean-Energy Market Maker

- Utilities Get Enlightened

You can return to the main Market News page, or press the Back button on your browser.