Exxon, Once a Skeptic, Sees Profit in Capturing Carbon Emissions

Exxon Mobil Corp. XOM +1.50% says the time has come to turn capturing carbon emissions into a real business, as it faces pressure from activists to become a greener company.

Exxon Mobil Corp. XOM +1.50% says the time has come to turn capturing carbon emissions into a real business, as it faces pressure from activists to become a greener company.

That represents an about-face for the Texas oil giant, which for years has held a pessimistic view of investing heavily to commercialize carbon-capture projects, saying they made little economic sense without massive government incentives.

Exxon, which is counting on carbon capture and storage as a primary way to achieve its targets for reducing greenhouse gas emissions, touted the recent creation of a new business unit to commercialize the technology during its annual analysts day Wednesday, saying political changes and other advances were combining to make it more viable.

“We’ve made enough progress where we are bringing some of the technology to the field now,” Chief Executive Darren Woods said in an interview. “Couple that with governments around the world putting policies in place, investment interest in the space—all of this is coming together.”

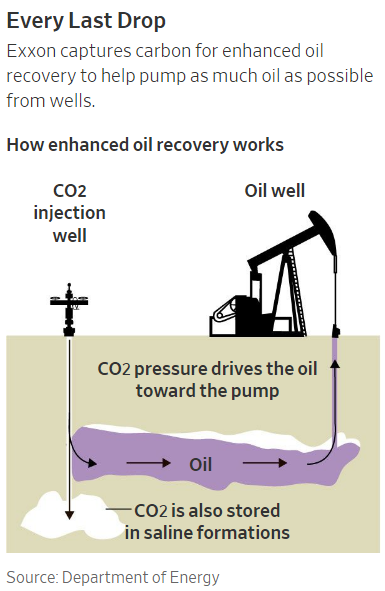

While the Biden administration has expressed support for carbon capture, a process which captures emissions and deposits them underground, many believe huge incentives are needed to spur its deployment, and political hurdles remain. So far, the primary commercial use for captured carbon has been deploying it to squeeze more oil and gas out of the ground.

Exxon said Wednesday that carbon capture will be a $2 trillion market by 2040 and that it is the cheapest way to address emissions, citing a current U.S. tax credit of as much as $50 per metric ton of captured carbon as less expensive than incentives to promote electric vehicles.

Exxon pledged last month to invest $3 billion in its new low-carbon unit through 2025, saying it has 20 projects in the pipeline. Some of the projects Exxon highlighted have been under consideration for years, according to current and former employees, and weren’t previously greenlighted because they were deemed commercially unviable.

For example, managers raised cost concerns about a project to capture carbon from Exxon petrochemical plants along the Gulf of Mexico and inject it into underwater rock formations, the people said.

An Exxon spokesman said costs are an issue in project evaluations but financial considerations are changing as demand, government policies and technologies evolve.

Exxon’s new view comes after it posted a loss of $22 billion last year, its first annual loss in modern history, and is facing pressure from an activist investor and others to step up its low-carbon investments.

Exxon’s new view comes after it posted a loss of $22 billion last year, its first annual loss in modern history, and is facing pressure from an activist investor and others to step up its low-carbon investments.

The activist, Engine No. 1, which is pursuing a proxy fight to nominate four new members to the company’s board, has criticized Exxon carbon-capture plans as an exercise in corporate window dressing.

“There is little, if any, chance that carbon capture will enable Exxon Mobil or any other oil major to avoid transforming its business over the long-term should the pace of global decarbonization accelerate,” it said in a February letter to Exxon’s board.

Exxon has eschewed diversifying into renewable energy, as its big European rivals BP PLC and Royal Dutch Shell PLC have begun to do, and instead invested billions in carbon capture and other technologies to reduce existing fossil fuel emissions.

But most of the company’s carbon capture efforts to date have involved using the greenhouse gas to produce more oil and gas.

Exxon frequently notes that it has captured more than 120 million metric tons of carbon over the last three decades, which it says is 40% of all captured emissions world-wide since 1970. Nearly all of that has come from one project: the Shute Creek Treating Facility in Wyoming, which was constructed in the early 1980s.

The facility processes natural gas, separating out high levels of carbon dioxide and other gases from methane. Exxon doesn’t actually store the carbon, but sells most of it to nearby drillers that use it in a process called enhanced oil recovery, in which carbon is pumped into older oil and gas reservoirs to increase pressure and produce more fossil fuels.

Critics of carbon capture say that enhanced oil recovery negates some of its benefits, since the carbon is used to unlock more sources of carbon emissions.

Exxon has been a skeptical voice within the industry on the near-term prospects of carbon capture, according to government officials, academics and executives from rival companies.

Exxon played a central role in drafting a 2019 Energy Department-sponsored report on carbon capture that determined Congress would need to create an incentive of around $90 to $110 per metric ton of captured carbon to incentivize widespread deployment of the technology.

A current tax credit, known as 45Q, gives companies $35 to $50 per ton, depending on how the carbon is handled. Mr. Woods said Wednesday that 45Q wasn’t sufficient to justify some capture investments.

Some people involved in drafting the report, including executives at some of Exxon’s peers, felt that significant investments in carbon capture could be justified at a far lower priced incentive: less than $70 per ton, according to people familiar with the process.

They argued among other things that technological improvements would more dramatically bring down costs over time. Exxon and some others involved disagreed, these people said, and their view was ultimately reflected in the final report. John Mingé, a former BP executive who led the study, said its conclusions were backed by the steering committee and called it the most comprehensive report on the topic.

In an online presentation on the findings in January 2020, Guy Powell, an Exxon executive who was its point person on the report, said companies would need significant policy changes to confidently invest in large-scale carbon capture projects.

“We did not want to…overpromise what technology could bring and somehow mislead what type of policy incentives would be needed if it doesn’t come,” Mr. Powell said at the time.

Jeffrey Brown, a research fellow at Stanford University who worked on the report and published a dissent, said it used pessimistic assumptions about carbon capture’s future costs that resulted in estimates around 50% higher than past Energy Department studies.

The report constituted “a call to inaction on carbon capture by most of U.S. industry, at least until Congress enacts carbon pricing or capture subsidies far above the hardest greens’ fondest political dreams,” Mr. Brown said in an interview.

You can return to the main Market News page, or press the Back button on your browser.