Electrifying trucking would require a major chunk of the US power grid: ATRI

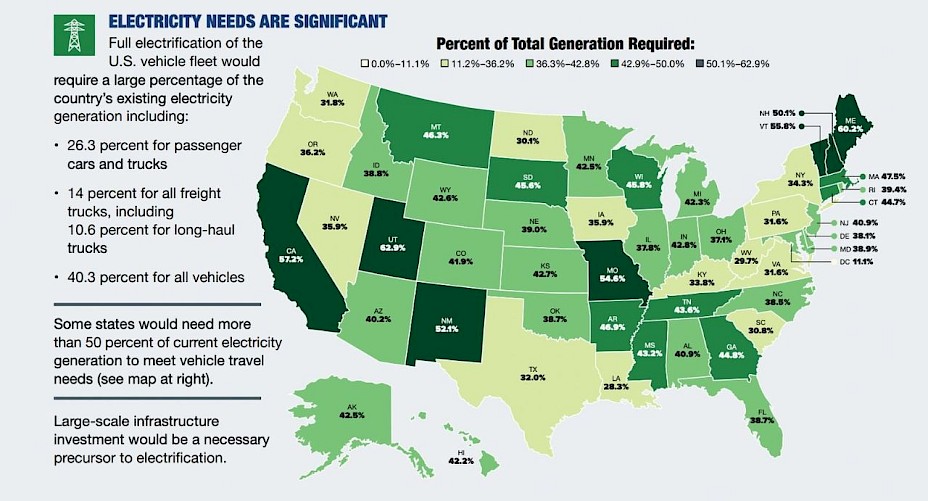

Shifting all vehicles to battery electric vehicles would demand more than 40% of the country’s electricity production, the American Transportation Research Institute said in a report.

Electrifying long-haul truck runs alone on today’s roadways would require about a tenth of the nation’s power generation, according to the American Transportation Research Institute.

Shifting all U.S. vehicles to battery electric would demand more than 40% of the country’s electricity production, ATRI said in a report Tuesday. Installing charging equipment at truck parking stops across the U.S. could cost upwards of $35 billion, based on a per-unit cost of $112,000.

Download ATRI report here » GO.

“ATRI’s research demonstrates that vehicle electrification in the U.S. will be a daunting task that goes well beyond the trucking industry,” ATRI board member Srikanth Padmanabhan, engine business president at Cummins, said in a statement.

Padmanabhan called on utilities, truck parking facilities and OEMs to help the trucking industry tackle the challenge. He recommended “a variety of decarbonization solutions and other powertrain technologies alongside battery electric.”

Near-term, discrete applications exist for BEV trucks, ATRI reported. It said the vehicles available today are suited for local and regional operations, using trucks for short trips in which they return to terminals for nightly charging.

But the nonprofit research group concluded “a completely new charging infrastructure is critical” for increased adoption, including on long-haul routes.

The high cost of BEV trucks is another issue, the report acknowledged. OEMs and others in the vehicle supply chain must produce BEV trucks that meet fleets’ requirements, including the limits of carriers’ balance sheets, ATRI said.

Until public policy requires fleets to order BEVs, though, “carriers themselves will have to decide if the costs and benefits of a BEV truck fit well with their business models,” ATRI said in the report.

“Those decisions will be conditioned on truck costs, shipper/freight requirements, and access to abundant and inexpensive electricity,” the report said. “Issues arise, however, if any one or more of these decision-making inputs is not viable.”

ATRI’s report also delved into the raw material mining requirements for BEV batteries. Beyond requiring new domestic sourcing strategies, electrifying all U.S. vehicles would take between 6 and 35 years of the world’s current raw material production.

The Biden administration has advocated for a bolstering of U.S. supply chains — including for raw materials — to reduce reliance on foreign suppliers. Efforts in the past year have included funding for domestic lithium mining and the end-to-end supply chain, including the processing and manufacturing of EV batteries.

You can return to the main Market News page, or press the Back button on your browser.