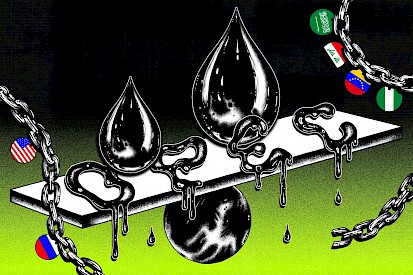

Can OPEC rescue the planet?

“In less than 100 years,” Mohammad Reza Pahlavi, the shah of Iran, told The New Republic in 1973, “this oil business will be finished.” Today, we face a different type of reckoning. Oil won’t run out anytime soon. But time could.

“In less than 100 years,” Mohammad Reza Pahlavi, the shah of Iran, told The New Republic in 1973, “this oil business will be finished.” Today, we face a different type of reckoning. Oil won’t run out anytime soon. But time could.

According to the U.N. Environment Program, the world is now on track to produce 50 percent more fossil fuels than would be consistent with capping global warming at a disastrous 2 degrees Celsius—and 120 percent more than the limits required to keep warming to a barely more tolerable 1.5 degrees Celsius. In order to avert catastrophe, fossil fuel production must decline rapidly over the coming decade. Instead, it’s on track to rise by 2 percent annually. The international body charged with handling climate change—the United Nations, via its Framework Convention on Climate Change (UNFCCC)—is mostly toothless. Its crowning achievement, the 2015 Paris agreement, doesn’t mention fossil fuels or a mechanism for regulating them. Indeed, the only body that has ever successfully regulated oil production as a matter of international relations is the one American politicians have spent decades demonizing: the Organization of the Petroleum Exporting Countries, or OPEC.

Reckoning with the full scale of the climate challenge and the energy revolution needed to meet it requires one kind of magical thinking or another. In one common story of the future, clean energy will explode to outcompete fossil fuels on a free and open market—in a seamless transition involving little to no direct constraints on the polluters. In another, new technologies will simply suck all the excess carbon from the air. For many, a muscular and cooperative multilateralism sounds more unrealistic than either of these two pipe dreams. Yet a world order that can compel countries and companies to ditch fossil fuels is no less outlandish than hopes that energy markets will deliver climate salvation. The United States can help build that world order. But to do so, it needs to do what both Richard Nixon and the late shah would have found unthinkable. The United States should join OPEC.

OPEC may not sound like a likely ally. In 2018, its most influential member, Saudi Arabia—a repressive, theocratic monarchy and prolific buyer of U.S. arms, employing armies of slave labor—joined the Trump administration in blocking the UNFCCC from formally integrating into its negotiations the findings of the Intergovernmental Panel on Climate Change’s special report on the grave differences between worlds warmed by 1.5 and 2 degrees. It was one in a long line of moves from Saudi Arabia to sabotage U.N. climate talks.

America’s longstanding bipartisan animosity to OPEC could also make collaboration a heavy lift. One Fox Business opinion headline in January neatly captured the GOP’s pushback to any and all challenges to domestic fuel production: Biden’s climate plan, it all but shouted, would “make OPEC great again.”

OPEC scares U.S. politicians and the fossil fuel companies that fund them, with good reason. The history of oil is a history of imperialism—and the history of OPEC is a history of a once unfathomable victory against imperialism.

Companies such as BP, Royal Dutch Shell, and the old Standard Oil empire—today splintered off into the likes of Chevron and ExxonMobil—acquired tremendous reserves by seeking concession arrangements in what’s known today as the global south. Concessions lasting several decades entitled Western businessmen to tap into vast pools of oil, usually in exchange for paltry payments to host governments and some infrastructure for extracting and transporting the fuel. For much of the twentieth century, this handful of companies headquartered in the United States and the U.K.—the “Seven Sisters,” as an Italian executive dubbed them—maintained a cartel over the world’s oil market. Their stranglehold on global oil supplies rested in part on the Texas Railroad Commission’s proration system, which set production quotas on wells throughout the state. Such controls helped the Seven Sisters to manipulate the posted price of oil, which did more to determine the profits shared between corporations and host countries than prices at the pump; the posted price was the basis for calculating the taxes that cartel members paid to producer governments. A decision made in Houston, then, could throw public budgets in Caracas or Dubai into chaos. And thus a new producers’ cartel was born: When Exxon opted to raise the posted price in August 1960, anti-imperialist interests in Venezuela, Saudi Arabia, Iran, Iraq, and Kuwait convened an emergency meeting in Baghdad and formed the Organization of Petroleum Exporting Countries. Before long, the collective bargaining adopted among OPEC’s member states gave way to outright nationalizations, most famously in the case of the Arabian-American Oil Company, or Aramco. “OPEC was born in order to safeguard the fiscal income of the countries that formed it,” said Giuliano Garavini, author of an expansive history titled The Rise and Fall of OPEC in the Twentieth Century. “It was a way to say to the companies, ‘From this moment on you will not be able to decide the amount of money our governments will take because this is too important for state building.’”

OPEC emerged amid a wave of decolonization and attempts to create a more democratic and representative international system. Between the founding of the United Nations in 1945 and OPEC’s formation in 1960, U.N. membership ballooned from 51 to 99 countries, as former colonies won independence. New global alliances such as the New International Economic Order, seeking equitable North-South trade relations, and the Non-Aligned Movement—for “the national independence, sovereignty, territorial integrity and security” of countries beyond the two poles of the Cold War—brought together leaders with vastly different political leanings united in their opposition to imperialism. Those who convened in Belgrade and Bandung, two of the many forums where anti-colonial leaders gathered through the 1960s and 1970s, sought to chart a path to development not defined by either the First World (the United States and NATO) or the Second, the USSR.

But OPEC wouldn’t become a household name in the United States until the 1973 oil crisis. To discourage Western importers from siding with Israel in the Arab-Israeli War, Gulf producers moved to cut supplies by 5 percent. Meanwhile, but unrelatedly, Gulf OPEC members boosted the posted price of oil by 70 percent, sending a massive shock wave through global oil markets that coincided with a dramatic increase in what OPEC member states made off each barrel. The inflation scares and geopolitical angst bred by the 1973 price hikes sent U.S. policymakers into hysterics. “I know what would have happened in the nineteenth century. But we can’t do it,” Secretary of State Henry Kissinger said in a meeting, apparently alluding to an armed attack. “The idea that a Bedouin kingdom could hold up Western Europe and the United States would have been absolutely inconceivable.” Western politicians panicked, envisioning both a dramatic rupture in the geopolitical power grid, and new brands of domestic unrest as American strikers and political radicals expressed solidarity with anti-imperialist struggles abroad. The newsletter of the Students for a Democratic Society, New Left Notes, had already gestured at that possibility in 1969, describing a strike at Shell refineries in Curaçao, a colonial possession where Dutch troops were sent in to quell the rebellion. “When the workers at Shell Curaçao strike, they are striking for all working people. Their enemies in struggle in Curaçao are the same as in Martinez, or in Vancouver, British Columbia, where a strike against the Imperial Shell refinery has been going on since May 23rd,” one dispatch argued.

As Americans lined up by license plate number to fill their tanks at higher prices, the Nixon administration erected an elaborate series of price controls and planning measures to spur domestic production. This marked the debut of the objective that would become the mission of every White House energy policy since: energy independence, defined against a not-so-subtly racialized other. “Our neck is stretched over the fence and OPEC has a knife,” Jimmy Carter would say in 1979.

The United States may have thrown the biggest tantrum, but countries in the global south faced the most calamitous fallout from higher oil prices and the rolling debt crisis that accompanied them. And Kissinger’s diplomatic corps exploited this imbalance to keep the global south firmly in its place, pitting Southern importers and exporters against one another while uniting the North. In 1974, he also led the charge to convene a league of oil-consuming countries to provide a counterweight to OPEC called the International Energy Agency (IEA). With characteristic ingenuity, he opted to site its headquarters in Paris to obscure its U.S. roots. “We will say all the appropriate platitudes about this not being a confrontation with producers,” Kissinger told a meeting of senior staff that year. “The fact to the matter is that the only way the consumers can protect themselves against what is a revolution in international finance, in international economics, is to share a common perception and organize it.”

The years since OPEC’s emergence in the 1970s have seen its power diminish and its members fracture. After decades of American politicians demonizing the insidious global reach and market-shaping power of the trading bloc, OPEC is now weak in many of the same ways that other multilateral institutions are. If it can even be called a cartel any longer, OPEC is a far less influential one than that maintained by the Seven Sisters and the Texas Railroad Commission, which oversaw prorationing. It has little ability to enforce its mandates. Its sway over the world’s energy landscape stems largely from the House of Saud’s ability to turn the spigots of its vast reserves on and off, as well as its more recent collaborations with Russia—another notoriously directionless and waning oil-producing state.

Yet even as a shadow of its former self, OPEC still possesses the power to upend American energy markets. The United States has seen the bulk of its domestic oil production shift to costly unconventional drilling—on offshore rigs, in the Arctic, and through fracking. That makes U.S.-produced oil vulnerable to even modest price drops, which can render tens of billions of dollars’ worth of projects unprofitable, and leave tens of thousands out of work. In 2014, OPEC’s “Thanksgiving Surprise” decision to maintain existing oil flows helped tank independent oil and gas companies in the United States that had been riding high on the shale revolution. Combined with Covid-19, a price war between Saudi Arabia and Russia helped send prices of West Texas Intermediate (WTI) crude—an international fuel price benchmark—into double-digit negatives last spring. With global oil markets still distressingly volatile, OPEC’s Joint Ministerial Monitoring Committee has been meeting monthly to manage production levels and stabilize prices. In December, it reported near total compliance among the 23 member nations of OPEC+, a consortium of OPEC-collaborating countries.

This is where one can begin to see the potential for the great oil-producing cartel-that-was to move us toward post–fossil fuel world order. A review of the trading bloc’s record makes it clear that OPEC has helped bring monumental change to the fundamental operations of the oil industry. The Seven Sisters companies controlled some 85 percent of oil reserves in the lead-up to 1973. Today, state-owned oil companies within and without OPEC control 65 percent of them. For all its weakness, OPEC remains the most successful and infamous vestige of a moment where the world system could have been more equal. Now, under the fast-accelerating pressures of the climate crisis, we need both a more rigorously regulated model of energy extraction and a more equitable global low-carbon economy. What organization is better positioned to oversee such changes than the one that has already upended global energy production?

Consider in this light the shifting fortunes of the oil industry itself. Yes, much of the next decade’s excess oil production will come from politically influential, U.S.-based multinational corporations with familiar names like Chevron and Exxon. Yet 55 percent of oil and gas production comes from state-owned national oil companies. A February report from the Natural Resource Governance Institute found that such firms are poised to invest $1.9 trillion in fossil fuels over the next decade. Private and public oil companies are laboring under similar delusions: that fossil fuel extraction can continue on indefinitely and profitably.

Reality will hit hard. An estimated $400 billion of the projected new fossil fuel investments by state-owned producers could be stranded as demand for oil continues to decline. The U.K.-based think tank Carbon Tracker found that keeping to a low-carbon pathway—where there’s a 50 percent chance of capping warming at 1.65 degrees Celsius—could cut worldwide oil and gas revenue in half in the next two decades, coming in up to $13 trillion below industry expectations.

Different petrostates will absorb the blow in different ways. Texas, for example, is a relatively diversified economy where taxes on oil and gas account for 8 percent of general revenue—still, the impact will be tremendous. Some OPEC members are better insulated than others. Saudi Arabia has a small population that can fall back on its $400 billion sovereign wealth fund—a resource that exists to smaller degrees in Brunei, Kuwait, and the United Arab Emirates as well. In Nigeria, however, oil and gas revenue makes up 45 percent of government revenue and could face a 69 percent shortfall. For Iraq, where oil accounts for 89 percent of government revenue, disruption will likely mean catastrophe. Twenty percent of the world’s proven oil reserves and a little less than 10 percent of proven gas reserves are housed across 76 countries that possess high debt-servicing requirements, according to the Jubilee Debt Campaign. Already, a fifth of Congo’s oil revenue is funneled straight into debt service. Carbon Tracker finds that four of the five most heavily indebted petrostates would be most exposed to a shortfall in fossil fuel revenue.

“For producer countries, there are going to be big trade-offs, particularly among those that are highly dependent on oil and gas with large populations,” said Andrew Grant, Carbon Tracker’s head of Climate, Energy and Industry Research and co-author of the report. Investments in oil and gas extraction have historically been able to attract foreign investors and a quick injection of dollars to host governments facing punishing debt repayment terms. But oil demand is already beginning to taper off in ways that cause growing concern even among major oil producers. Last year, BP announced that it would stop exploration in new countries. “We can see the energy transition coming,” Grant added. “It’s really a matter of when rather than if this shift happens.”

There are myriad reasons even for OPEC states to want a swift transition. Nnimmo Bassey, director of the Health of Mother Earth Foundation (HOMEF), who serves on the steering committee of Oilwatch International, described oil’s impact on Nigeria with one word: “ecocide.” His home country recorded 1,300 oil spills in 2018 and 2019, contaminating water and soil. Exact figures are tough to come by, because the practice is so loosely regulated, but Bassey estimates that drillers in Nigeria each year flare off as much as $2 billion worth of gas, produced as a byproduct of oil extraction. Private companies like Shell, operating in agreement with the Nigerian National Petroleum Corporation, haven’t built infrastructure to capture it and so burn it into the air. Officially, Nigeria has outlawed flaring since 1984, but the practice continues, Bassey explained, because “the penalty for flaring gas is so minuscule. It’s cheaper to flare the gas than do anything with it.” It’s estimated that flaring produces more greenhouse gas emissions than all other sources in sub-Saharan Africa. It’s also linked to skin and respiratory ailments, cancer and blood disorders, and acid rain, which erodes steel roofs and threatens agriculture.

Bassey contends that reckoning with the toxic legacy of the imperial age is the only way forward. “Climate change requires keeping fossil fuels in the ground. There’s got to be justice in the scenario. There’s got to be total accountability from those who created the problem in the first place,” he told me, referring to the colonial Seven Sisters and their governments as having incurred an “ecological debt” that needs to be repaid.

Countries that stand to lose the most in an unjust transition away from fossil fuels are at particular risk from global warming, with little capacity to adapt to changes already underway. The 1 percent of the planet now considered too hot to be habitable by humans stretches through several oil-producing countries in the Middle East and sub-Saharan Africa. By 2070, those unbearably hot patches could extend over nearly 20 percent of the earth’s surface, engulfing several countries on track to keep drilling for decades to come.

Determining just what countries can keep producing depends on what kinds of assets already exist. Saudi Arabia and Iraq, for instance, can readily access their reserves, thanks to their existing infrastructure. That’s not the case for countries with emerging oil sectors like Uganda and Senegal, where Total and BP (respectively) are eyeing expansions that could run afoul of both climate goals and basic profitability. That makes easy-to-access oil in the Gulf a better bet than the shale patch in West Texas, where production costs per barrel can be $40 higher or more. But U.S. lawmakers and their industry donors aren’t going to like the notion that drilling should continue in the Ghawar oil field long after it stops in the Permian Basin.

And here is where OPEC again comes in. Only so many fossil fuels can be exploited if the world is to avoid catastrophic warming—and that places a limit on the amount of revenue they can yield. As countries vie for shares of the carbon budget—the amount of carbon dioxide that can be safely spewed before crossing the warming thresholds outlined by the Paris agreement—they’re also competing over the rents from the resources under their feet.

As demand for oil begins to falter, the terms of that unmanaged transition fall to the market, including vulture funds eager to swoop in on distressed assets in the public and private sectors. Depending on the circumstances, falling oil revenue can also produce outright chaos. “If you think Texas or Alaska have a problem, Venezuela is there to tell you what happens when an OPEC country goes from producing three million barrels of oil a day to 1.3 million,” said Garavini. Between January and June of last year, oil production had declined by 96 percent. U.S. sanctions were a major factor in that collapse. “Emigration from Venezuela is even bigger than from Syria,” Garavini said. “There’s hyperinflation, a collapse of basic infrastructure, and pollution without any kind of control of its oil sites. Basically it’s a war scenario.”

The early days of the Biden administration have seen modest improvements over the Obama era where curbing fossil fuels is concerned. But the Biden agenda is also consistent with decades of continued fossil fuel expansion here in the United States. As of this writing, the vast majority of domestic drilling taking place on private lands remains unaffected by new rules governing production. The administration’s stance on U.S. fuel exports and commitments on climate finance is undefined, with no firm adherence yet to the Green Climate Fund or other mitigation, adaptation, or loss and damage pools. The White House hasn’t signaled much interest in pushing for sovereign debt relief, either. International climate envoy John Kerry has pledged to restore U.S. climate leadership on the world stage. Yet the idea of Kerry riding in on a private jet and with a century of foreign-policy baggage to lecture OPEC members and smaller, less developed producers about turning off fossil fuels while our shale sector hums along doesn’t inspire much confidence.

An alternative approach—prioritizing energy multilateralism over “energy dominance,” to cite Donald Trump’s prime oil objective—would recognize that the global order built in the mid–twentieth century is poorly equipped to tackle the twenty-first century’s biggest challenges. “The world has been shaped for the whole neoliberal era around a very U.S.-driven Washington Consensus: what trade agreements look like and what our agricultural policies look like and what rules around intellectual property look like, and the structure of [Investor-State Dispute Settlement] systems,” Sivan Kartha, senior scientist at the Stockholm Environmental Institute and a co-author on the Production Gap Report, told me. The United States joining OPEC would be an important symbolic step toward reckoning with the history that has brought us to this point—and a signal to other oil producers that the world’s most powerful government is willing to do more than lecture others from afar.

The potential power of OPEC as a climate policymaking body comes less from cutting production directly—although that, too, is possible—than from offering a forum for petrostates to communicate about the existential crisis facing each and every one of them. Without such coordination, independent oil and gas drillers in the United States will compete with major oil producers financing offshore rigs in Guyana and low-cost producers in the Middle East as they are today—a race to burn through the carbon budget as fast as possible. A world in which OPEC cooperatively agrees to phase out all oil production seems unlikely—yet a timely, managed decline would entail deciding how remaining oil rents should be distributed, and which countries can keep producing the longest. That’s more attractive—and just—than a free-for-all race to the bottom. The climate crisis demands energy interdependence: likely, the United States importing more oil from lower-cost and lower-carbon polluters while it transitions to clean energy, and agreeing to rein in its own drillers’ ability to flood the world with exports harvested from methane-spewing wells.

America joining OPEC could make the institution a place for candid discussions—backed by real monetary commitments—about how to keep the world from crashing out of the fossil age. “You’re going to have a few people who are going to say, ‘Fuck you, I’m going to keep producing,’” said political scientist Paasha Mahdavi, author of Power Grab: Political Survival Through Extractive Resource Nationalization. Perhaps OPEC’s greatest value, he said, has been in creating a place for energy ministers to come together and share strategies and information. A managed decline demands such discussions.

Several topics beyond production itself call for urgent attention: For example, energy analysts at OpenOil have proposed that international creditors either pay or forgive the debt of countries that agree to keep undeveloped fossil fuel reserves buried. A revived OPEC should take up a conversation on widespread debt relief, and any number of other measures that can help ease the energy transition for states that have, out of postcolonial necessity, built their economies almost entirely around oil and gas.

Ultimately, much more than OPEC will have to change course in order to accommodate a warmer world. The group may not be the place where the nations of the world decide to keep oil in the ground or remake the global order. Yet it’s hard to imagine that either change can happen without its members. Ironically, the Trump administration may have taken baby steps toward future U.S. involvement in such talks when it met with OPEC and Russia last spring. “There was never a U.S. president that I know of that has not followed the line that OPEC is a disgrace,” Garavini told me, noting that Trump used similar rhetoric before prices crashed in April. “Dialogue on petroleum with OPEC…. That’s new.” For his part, OPEC Secretary General Mohammed Barkindo has expressed an eagerness to work with the new administration. “We believe that we have established very mutually beneficial productive relationships with the industry in the United States,” he told CNBC in January of this year. “And I think we have no option but to continue to strengthen this relationship under President Biden.”

Once the most valuable company on Earth, Exxon was booted from the Dow late last year. Demand for the technology metals required for electric vehicles and smart homes is growing by the day. New energy powerhouses built around substances like lithium and cobalt could well be poised to displace the oil petrostates and private empires. The oil industry’s core products will remain important for a long time to come. But a haphazard and too-slow transition from fossil fuels is already restructuring the global economy. The question now is how quickly oil will fade, and how many people and governments it will take down with it.

You can return to the main Market News page, or press the Back button on your browser.